Zapper App Review: How U.S. Crypto Users Track DeFi & Staking

Managing crypto today feels less like holding coins and more like juggling moving parts. One wallet here, a staking pool there, and a DeFi position you forgot about last month. That’s where portfolio tracking tools step in—and Zapper is one of the most talked-about names in this space.

This Zapper app review takes a deep look at how the Zapper DeFi app helps U.S. crypto users track DeFi positions, staking rewards, NFTs, and multi-chain portfolios in one clean dashboard. If you want clarity without complexity, this guide breaks everything down—step by step.

Table Of Content

What Is the Zapper App?

Official link to Download App :

For Android User- Zapper App

For IOS users- Zapper App

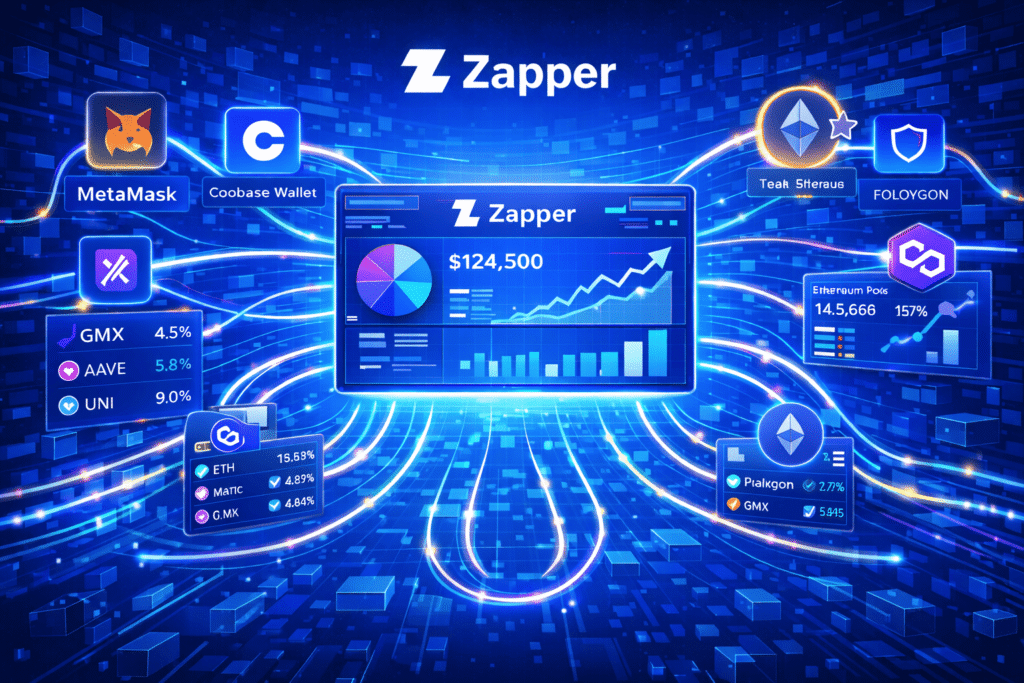

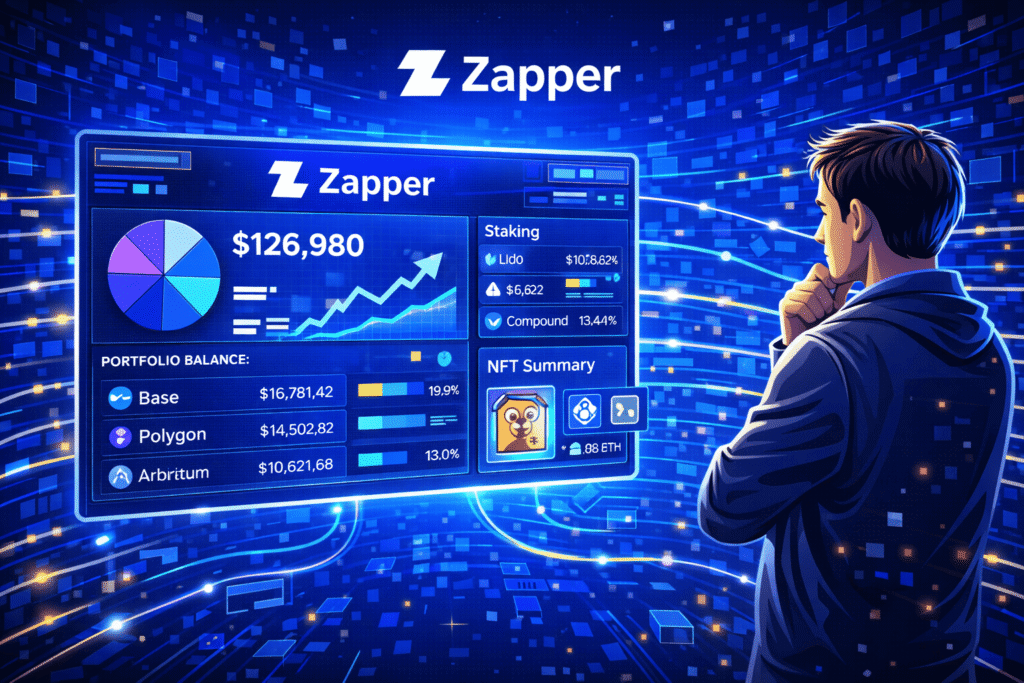

At its core, Zapper is a DeFi portfolio tracker designed to give you a single, real-time view of everything happening across your wallets. Instead of manually checking multiple blockchains, DeFi apps, and staking dashboards, Zapper pulls that data into one place.

Think of Zapper like a financial GPS for Web3. You don’t need to know every road or protocol—it shows you where your assets are, what they’re doing, and how they’re performing.

The Zapper app USA users rely on works entirely through wallet connections. That means no account creation, no KYC, and no need to hand over private keys. You simply connect wallets like MetaMask, Coinbase Wallet, or WalletConnect-supported options, and Zapper reads the data directly from the blockchain.

Zapper doesn’t custody funds. It doesn’t move assets unless you approve a transaction through your wallet. This makes it closer to a dashboard than an exchange—an important distinction for security-conscious users.

Over time, Zapper has evolved beyond basic tracking. It now supports:

- DeFi positions

- Staking and yield farming

- NFTs

- Token swaps

- App and protocol discovery

For anyone active across multiple chains, Zapper aims to act as the best DeFi tracking app for clarity without overwhelm.

How Zapper Works for U.S. Crypto Users

Zapper works by reading public blockchain data tied to your wallet address. Once you connect a wallet, the app automatically scans supported blockchains and DeFi protocols to detect balances, positions, and historical activity.

For U.S. crypto users, this approach has a few major advantages.

No Exchange Dependence

Many Americans use a mix of centralized exchanges and DeFi apps. Zapper focuses on the self-custody side—wallets, smart contracts, and on-chain activity. This makes it a strong complement to popular U.S. crypto apps, especially for users expanding beyond basic buying and selling.

Multi-Wallet Support

If you use multiple wallets for different strategies—long-term holds, staking, or experimentation—Zapper lets you track them all in one interface. You can label wallets, group them, or view them individually without switching apps.

Real-Time Portfolio Updates

Zapper updates positions as blocks are confirmed. Token balances, liquidity pool values, and staking rewards adjust automatically based on on-chain data. While no tracker is perfect, this real-time visibility helps users spot changes quickly.

DeFi Without the Guesswork

Instead of opening five tabs to figure out where funds are deployed, Zapper shows:

- Which protocol holds your assets

- What type of position it is (staking, LP, vault)

- Estimated value and yield

This clarity is especially helpful when markets move fast or gas fees spike.

Zapper also fits naturally into broader adoption trends highlighted across popular U.S. crypto apps, as users shift from passive holding to active on-chain participation.

Supported Blockchains, Layer-2s & DeFi Protocols

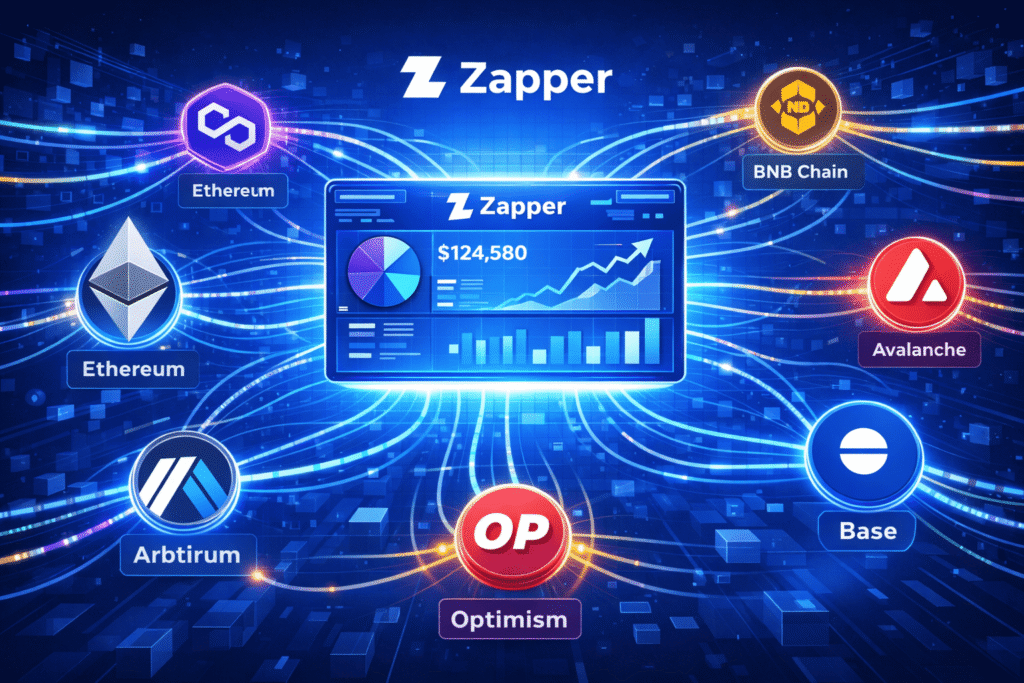

One of the biggest reasons Zapper stands out as a best DeFi tracking app is how wide its coverage is. Crypto today isn’t just about Ethereum anymore. Assets are spread across Layer-1 chains, Layer-2 networks, and dozens of DeFi protocols. Zapper is built for this reality.

Major Blockchains Supported

Zapper supports most of the blockchains actively used by DeFi participants, including:

- Ethereum

- Polygon

- Binance Smart Chain (BNB Chain)

- Avalanche

- Optimism

- Arbitrum

- Base

For U.S. crypto users, this matters because many newer DeFi apps are launching on Layer-2s like Arbitrum and Base to reduce gas fees. Zapper automatically detects positions across these networks without requiring manual switching.

Layer-2 Friendly by Design

Layer-2s can feel confusing at first. Funds move between chains, bridges are involved, and tracking becomes messy fast. Zapper simplifies this by showing all chains side by side in one dashboard.

Instead of thinking, “Where did my ETH go?”, you see:

- Which network it’s on

- Which protocol is using it

- What it’s earning

This makes Zapper especially useful for users exploring newer ecosystems tied to DeFi staking and yield strategies across chains.

DeFi Protocol Coverage

Zapper tracks hundreds of DeFi protocols, including:

- Decentralized exchanges (DEXs)

- Lending platforms

- Yield farms

- Liquid staking protocols

- Vault-based strategies

When explaining how Zapper fits into the broader DeFi landscape, it helps to see it as a map, not the destination. If you want to explore the wider ecosystem of platforms themselves, this DeFi staking overview gives helpful context on where Zapper pulls its data from.

Zapper doesn’t replace DeFi apps—it connects them visually.

Key Features of the Zapper App

Zapper’s features are designed around one idea: reduce friction. Instead of forcing users to learn every protocol interface, Zapper abstracts complexity into a clean, readable layout.

Let’s break down the core features that make the Zapper portfolio tracker so popular.

Easy Wallet Connect

Connecting a wallet to Zapper takes less than a minute.

There’s no signup, no email, and no password. You simply:

- Visit Zapper

- Choose your wallet

- Approve the connection

Zapper uses read-only access by default. It can see balances and positions but can’t move funds unless you explicitly approve a transaction. This design supports Zapper’s reputation as a safe DeFi tracking app.

For users managing multiple wallets, this feels like plugging several USB drives into one screen instead of opening each file separately.

Clear Portfolio View

Once connected, the dashboard becomes the star of the experience.

Zapper shows:

- Total portfolio value

- Asset allocation by chain

- DeFi positions by protocol

- Token balances

- NFTs (if enabled)

Everything updates dynamically. When token prices change or rewards accrue, values adjust automatically.

Instead of rows of raw numbers, Zapper presents data visually—charts, breakdowns, and summaries that make sense even during market volatility.

Simple Transactions

Zapper doesn’t just show data—it lets you act on it.

From within the app, users can:

- Swap tokens

- Enter or exit DeFi positions

- Move assets between supported protocols

All transactions still route through your wallet for approval, keeping you in control. Zapper acts like a control panel, not a custodian.

This is especially helpful for users who want to manage positions quickly without navigating multiple DeFi UIs.

Multi-Chain Support

Multi-chain support isn’t just a feature—it’s a necessity.

Zapper automatically detects which chain an asset lives on and groups data accordingly. You don’t need to toggle networks manually or remember where funds were deployed weeks ago.

For active DeFi users, this feels like switching from paper maps to GPS navigation.

NFT and App Explorer

Zapper also includes tools for discovery.

The App Explorer highlights trending DeFi protocols, making it easier to find new opportunities without endless scrolling on social media.

The NFT view displays NFTs held across supported wallets, showing floor prices and collection data. While not as deep as dedicated NFT tools, it’s useful for portfolio awareness.

Together, these features turn Zapper into more than a tracker—it becomes a window into the wider Web3 ecosystem.

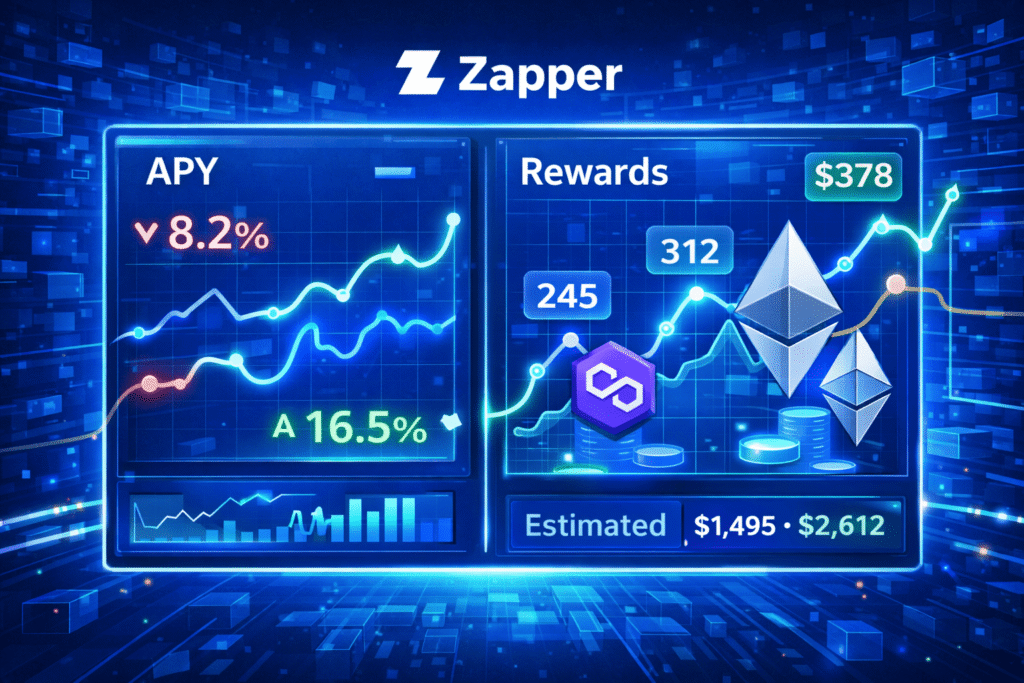

How Accurate Is Zapper for Tracking Staking Rewards & APY?

Accuracy is where most DeFi tracking apps either earn trust or lose it. Zapper does a solid job here, but it’s important to understand how the numbers are calculated and where small gaps can appear.

Zapper doesn’t guess. It pulls data directly from smart contracts and blockchain explorers. When you stake tokens, provide liquidity, or deposit into a yield vault, Zapper reads those contracts and displays the balances and rewards tied to your wallet address.

How Zapper Calculates Staking Rewards

Zapper tracks:

- Principal deposited

- Tokens earned so far

- Current token price

- Estimated APY (when available)

The APY you see is usually sourced from the protocol itself. That means if a staking platform updates rewards dynamically, Zapper reflects those changes in near real time.

However, DeFi APYs are often variable. Rates can change hourly based on:

- Total value locked (TVL)

- Network usage

- Token emissions

So if you see APY fluctuate, that’s not a Zapper issue—it’s DeFi behaving as designed.

Where Small Differences Can Appear

Sometimes users notice slight mismatches between:

- Zapper’s displayed rewards

- The protocol’s native dashboard

This usually happens due to:

- Pending rewards not yet claimed

- Price oracle updates

- Compounding mechanics

Zapper focuses on visibility, not perfect precision to the decimal. For decision-making, that level of accuracy is more than enough.

Understanding the basics of staking safety helps here, especially when evaluating whether yield numbers are sustainable or inflated by short-term incentives.

Is Zapper Reliable for Long-Term Tracking?

For long-term holders and stakers, Zapper is reliable for:

- Tracking trends over time

- Monitoring reward growth

- Spotting underperforming positions

It may not replace protocol-native dashboards for ultra-detailed analytics, but as a portfolio-level view, it performs consistently well.

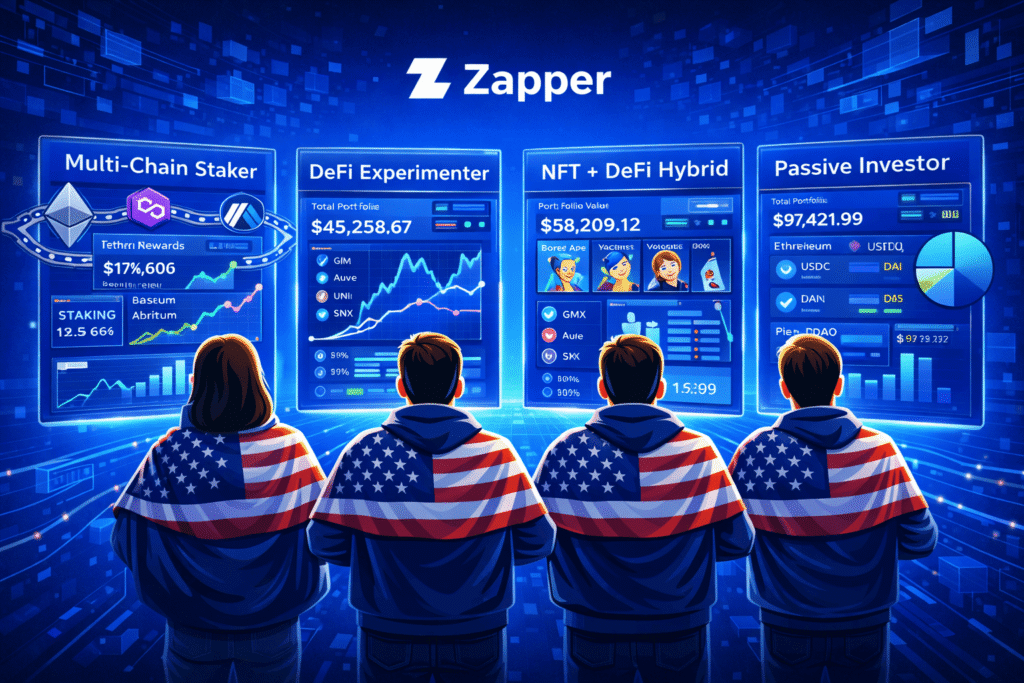

Real-World Zapper Portfolio Examples (U.S. Use Cases)

To understand Zapper’s real value, it helps to see how different types of U.S. crypto users actually use it.

Example 1: The Multi-Chain Staker

Imagine a user staking:

- ETH via liquid staking

- Stablecoins in a lending protocol

- Tokens on Arbitrum for higher yield

Without Zapper, this requires checking three or four different dashboards. With Zapper, all positions appear in one view, showing:

- Total capital deployed

- Chain distribution

- Estimated rewards

This makes it easier to rebalance or exit positions when market conditions change.

Example 2: The DeFi Experimenter

Some users constantly test new protocols with small amounts. Over time, these “test positions” add up and get forgotten.

Zapper surfaces:

- Dormant positions

- Dust balances

- Unclaimed rewards

It’s like cleaning out an old wallet and finding spare change—except that change can sometimes be worth more than expected.

Example 3: The NFT + DeFi Hybrid User

Many U.S. crypto users now hold both NFTs and DeFi positions. Zapper lets them:

- Track NFT floor values

- See how NFTs fit into total net worth

- Avoid overexposure to one asset type

This combined view helps users think in terms of portfolio strategy, not just individual assets.

Example 4: The Passive Investor

Not everyone wants to trade daily. Some users simply stake, hold, and check in occasionally.

For them, Zapper acts like a monthly statement:

- “Here’s what you own”

- “Here’s what it’s earning”

- “Here’s where it lives”

No noise. No pressure.

Benefits of Using Zapper for DeFi & Staking

Zapper’s real strength isn’t any single feature. It’s how everything comes together to make DeFi feel manageable instead of overwhelming. For many users, that alone is the biggest benefit.

Let’s break down why the Zapper DeFi app has become a daily tool for tracking and managing on-chain activity.

One-Stop View

The biggest pain point in DeFi is fragmentation. Assets are scattered across chains, protocols, and wallets.

Zapper solves this by acting like a master dashboard. Instead of asking:

- “Which wallet did I use?”

- “Which chain is this on?”

- “Which protocol is holding my funds?”

You see everything in one place.

This “single pane of glass” approach helps users make smarter decisions faster. When markets move quickly, clarity becomes a competitive advantage.

Easy Staking Entry

Staking can feel intimidating at first. Different protocols, variable yields, and unfamiliar interfaces create friction.

Zapper lowers that barrier by:

- Showing staking options clearly

- Explaining positions in plain language

- Letting users interact through one familiar interface

You still control the assets, but the experience feels simplified—like using a universal remote instead of five different ones.

Track Earnings Simply

Watching rewards grow is motivating. Zapper makes that easy by displaying:

- Earned rewards

- Estimated APY

- Value changes over time

Instead of calculating returns manually, you get instant feedback. This encourages better portfolio habits, like reviewing positions regularly and reallocating underperforming assets.

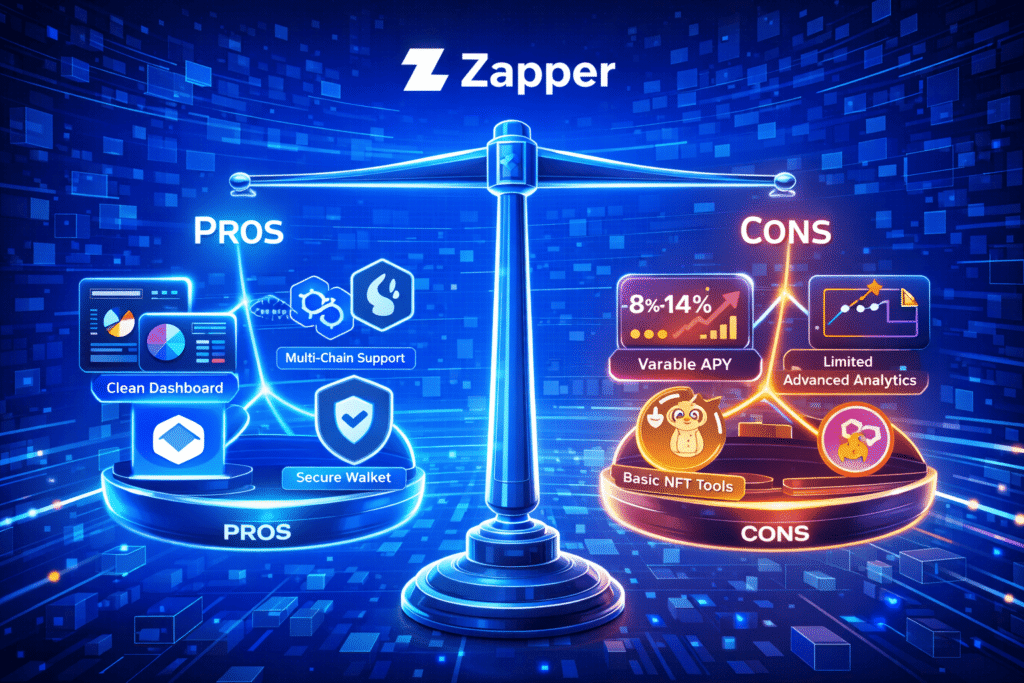

Zapper App Pros, Cons & Limitations

No app is perfect, and Zapper is no exception. Understanding both sides helps set realistic expectations.

Pros

- Clean, intuitive interface

- Strong multi-chain support

- No custody of funds

- Read-only wallet connections

- Works well for both beginners and advanced users

Zapper strikes a rare balance between simplicity and power.

Cons

- APY estimates can vary slightly from protocol dashboards

- Limited control over advanced DeFi strategies

- NFT analytics are basic compared to specialized tools

Limitations to Keep in Mind

Zapper doesn’t replace deep protocol analytics. If you’re optimizing yield at a granular level, you’ll still need native dashboards. Zapper is best used as a command center, not a microscope.

Zapper Security & Privacy Review

Security matters more than features in DeFi. Zapper takes a conservative approach here, which is a good thing.

Non-Custodial by Design

Zapper never holds your funds. Assets remain in your wallet or smart contracts. This drastically reduces risk compared to custodial platforms.

Wallet Permissions

Most interactions start as read-only. When a transaction is required, your wallet prompts you for approval. Zapper can’t move funds on its own.

Privacy Considerations

Zapper doesn’t require:

- Email addresses

- Passwords

- Personal identification

Your on-chain activity is already public. Zapper simply organizes it in a readable format.

For users evaluating whether Zapper qualifies as a safe DeFi tracking app, the answer is yes—when used as intended.

Zapper vs Other DeFi Tracking Apps

Zapper isn’t the only DeFi portfolio tracker on the market. But it does approach the problem differently than many alternatives. To understand where it stands, it helps to compare it against similar tools.

Zapper vs Zerion

Zerion is Zapper’s closest competitor and often the first comparison users make. Both apps aim to simplify DeFi tracking, but their strengths differ.

Zerion focuses heavily on:

- A polished mobile-first experience

- Token swaps and DeFi actions

- A more “exchange-like” interface

Zapper, on the other hand, leans into:

- Deeper protocol visibility

- Broader multi-chain portfolio views

- Clearer breakdowns of staking and LP positions

For users who prioritize portfolio clarity across many protocols, Zapper often feels more informative. For users who trade frequently and want fast execution, Zerion can feel smoother.

A deeper comparison of Zerion as a Web3 dashboard helps highlight why some users prefer one over the other depending on their strategy.

Zapper vs Manual Tracking

Some users still rely on spreadsheets or bookmarks. While this offers control, it quickly becomes outdated.

Zapper wins here by:

- Updating automatically

- Reducing human error

- Saving time

Zapper vs Exchange Dashboards

Exchange dashboards only show assets held on that platform. Zapper covers what exchanges can’t—self-custody, DeFi, NFTs, and multi-chain exposure.

This makes Zapper more suitable as a long-term portfolio tracker rather than a trading terminal.

How to Use Zapper App Step-by-Step

One reason the Zapper portfolio tracker has grown so popular is how easy it is to get started. You don’t need technical expertise or prior DeFi experience.

Here’s a simple walkthrough.

Step 1: Visit Zapper

Open the Zapper website using a secure browser. There’s no download required unless you prefer a mobile wallet connection.

The homepage immediately prompts you to connect a wallet—no signup screens or friction.

Step 2: Connect Wallet

Choose your wallet provider:

- MetaMask

- Coinbase Wallet

- WalletConnect-compatible wallets

Approve the connection. By default, Zapper requests read-only access, meaning it can view balances but not move funds.

Step 3: View Dashboard

Once connected, the dashboard loads automatically.

You’ll see:

- Total portfolio value

- Asset allocation by chain

- DeFi positions by protocol

- Tokens and NFTs

This is where most users spend their time. It’s the “home base” for monitoring everything at a glance.

Step 4: Swap or Manage

From the dashboard, you can:

- Swap tokens

- Enter or exit DeFi positions

- Claim rewards (when supported)

Each action requires wallet approval, keeping you in control.

Step 5: Explore More

Use the App Explorer to discover new protocols or monitor trending DeFi activity. This feature helps users stay informed without chasing social media hype.

How Crypto Entrepreneurs & Full-Time Traders Use Zapper

For serious market participants, Zapper isn’t just a convenience tool—it’s part of their daily workflow.

Many crypto entrepreneurs operate across multiple wallets, chains, and protocols at once. Some manage personal capital, DAO treasuries, test wallets, and long-term cold storage simultaneously. Zapper allows them to monitor all of this from one interface without exposing private keys or centralizing funds.

Instead of logging into each protocol separately, they use Zapper to:

- Track capital efficiency across chains

- Identify idle assets

- Monitor risk exposure during market volatility

For full-time traders, Zapper acts like a “macro view.” Trading apps handle execution, but Zapper shows the big picture. This separation helps avoid emotional decisions driven by short-term price action.

It’s no surprise that many successful crypto entrepreneurs rely on tools like Zapper to stay organized while scaling their on-chain activity.

Zapper Pricing, Fees & Monetization Model

Zapper is free to use.

There are no subscription fees, no premium tiers, and no hidden charges for portfolio tracking. This alone makes it appealing compared to analytics platforms that lock insights behind paywalls.

So how does Zapper make money?

Primarily through:

- Protocol partnerships

- Optional transaction routing fees

- Discovery placements inside the app

Importantly, users are never forced into paid actions. You can use Zapper purely as a tracker without spending a cent.

Using Zapper with U.S. Crypto Tax Tools

Crypto taxes are a reality for U.S. users, especially when dealing with DeFi, staking, and yield farming.

Zapper doesn’t replace tax software—but it makes tax reporting much easier.

How Zapper Helps with Taxes

Zapper:

- Organizes transaction history

- Identifies DeFi activity clearly

- Shows reward inflows over time

This makes it easier to export wallet data into U.S.-compatible crypto tax tools.

Instead of guessing where rewards came from, users can cross-check positions and timestamps. This clarity matters, especially for staking income and yield-based earnings.

For users serious about compliance, combining Zapper with proper reporting tools is far better than relying on raw wallet explorers alone.

Who Should & Shouldn’t Use Zapper?

Zapper isn’t for everyone—and that’s okay.

Zapper Is Ideal For:

- DeFi users with multi-chain exposure

- Stakers tracking long-term rewards

- NFT + DeFi hybrid portfolios

- Users who value clarity over complexity

Zapper May Not Be Ideal For:

- High-frequency traders needing execution speed

- Users who only hold assets on centralized exchanges

- Those seeking deep protocol-level analytics

If you interact with DeFi even occasionally, Zapper quickly proves its value.

Final Verdict: Is Zapper Worth It for U.S. Crypto Users?

Yes—Zapper is absolutely worth using for U.S. crypto users involved in DeFi and staking.

It doesn’t try to be everything. Instead, it excels at one core mission: making on-chain portfolios understandable.

Zapper shines because it:

- Respects self-custody

- Simplifies complexity

- Supports modern multi-chain behavior

While it won’t replace exchanges or tax software, it fits perfectly between them—acting as a reliable, neutral dashboard for Web3 activity.

For anyone serious about tracking DeFi positions without losing sleep, Zapper earns its place.

Frequently Asked Questions

Before we wrap up, here are answers to some of the most common questions U.S. crypto users ask about the Zapper DeFi app. These quick explanations clear up concerns around accuracy, security, taxes, and how Zapper compares to other DeFi tracking tools.

Is Zapper accurate for staking rewards?

Zapper pulls data directly from smart contracts and protocols. While minor timing differences can occur, it’s reliable for tracking staking rewards and trends.

Is Zapper safe for large portfolios?

Yes. Zapper is non-custodial and uses read-only wallet connections by default, making it suitable even for large portfolios.

Can Zapper track Base & Arbitrum staking?

Yes. Zapper supports major Layer-2 networks including Base and Arbitrum, and tracks supported staking and DeFi protocols on them.

Does Zapper help with U.S. crypto taxes?

Indirectly, yes. Zapper organizes on-chain activity clearly, making it easier to use alongside U.S. crypto tax tools.

Is Zapper better than Zerion for DeFi tracking?

It depends on your needs. Zapper excels at portfolio visibility and protocol breakdowns, while Zerion may feel better for frequent traders. Many users try both.

Final Takeaway

If DeFi feels scattered, confusing, or hard to track—Zapper brings order to the chaos.

For U.S. crypto users who value control, transparency, and simplicity, the Zapper portfolio tracker stands out as one of the most practical tools in Web3 today.

🔗 Related Guides on CryptoTrendd

If you want to explore DeFi tracking, staking safety, and the tools most U.S. crypto users rely on, these in-depth guides pair perfectly with this Zapper review:

- Zerion – A detailed breakdown of Zapper’s closest competitor and why many Web3 users compare the two for DeFi portfolio tracking.

- Staking safety – Learn how crypto staking really works, the risks involved, and how to protect your funds before chasing high APYs.

- DeFi staking – An overview of the best DeFi staking platforms and how tools like Zapper fit into the broader staking ecosystem.

- U.S. crypto apps – See which crypto apps are most commonly used by Americans and how Zapper complements them.

- Crypto entrepreneurs – Discover how top crypto entrepreneurs manage multi-chain portfolios, DeFi exposure, and risk using advanced tools.

✍️ About the Author

Abhishek Chandravanshi is a crypto enthusiast and founder of CryptoTrendd.com, where he dives deep into crypto trading apps, DeFi tools, and the strategies of successful crypto entrepreneurs. With a focus on helping U.S. crypto users simplify complex on-chain activities, Abhishek reviews platforms like Zapper to show how investors can track staking rewards, NFTs, and multi-chain portfolios efficiently