Which Crypto Exchange gives the Best Staking Rewards?

By expert

Looking to earn passive income from your crypto holdings? Staking has emerged as one of the most effective ways to grow your digital assets without trading or lending. The key to maximizing your staking rewards lies in choosing the right platform. In this comprehensive guide, we’ll explore which crypto exchange gives the best staking rewards, what to consider when comparing platforms, and how you can optimize your earnings in 2025.

Use our Live APY Staking Rates Tracker to get real-time staking yields across major platforms like Binance, Kraken, Nexo, and more.

What Is Crypto Staking?

Crypto staking is the act of locking your crypto assets to support a blockchain network’s operations—usually in Proof-of-Stake (PoS) systems—in return for rewards. You earn interest (often called APY, or annual percentage yield) on your staked coins, similar to a traditional savings account but with much higher returns.

Popular staking coins include:

- Ethereum (ETH)

- Solana (SOL)

- Polkadot (DOT)

- Cardano (ADA)

For a deeper dive, visit our Crypto Staking FAQs.

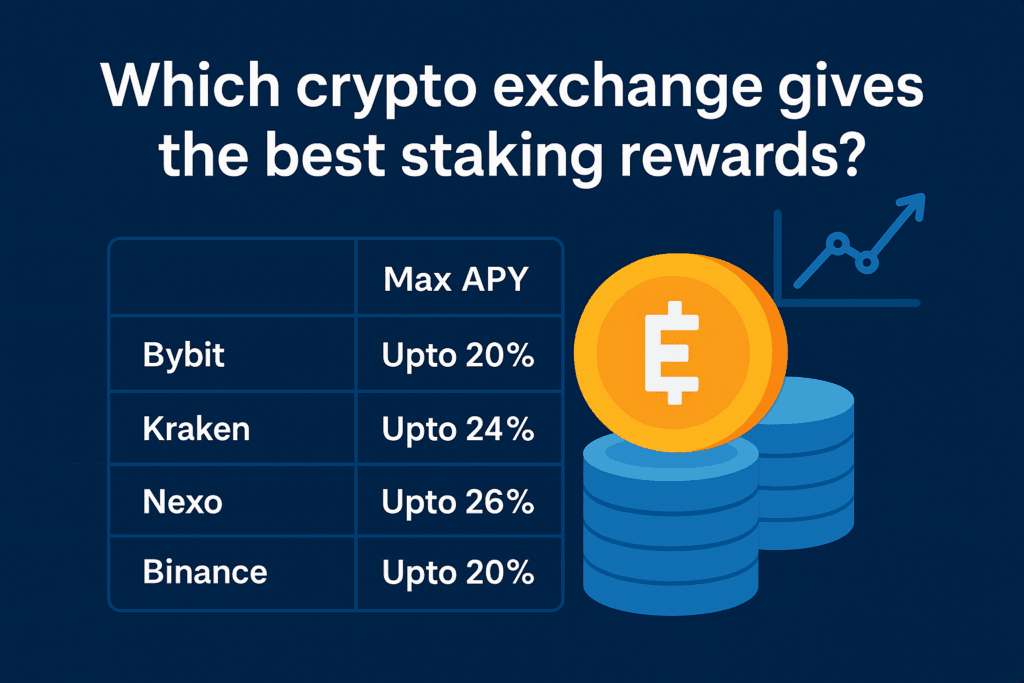

Which Crypto Exchange Gives the Best Staking Rewards in 2025?

The question many investors ask is: Which platform will give me the highest and safest return on my staked crypto? We analyzed the top centralized exchanges and their APY offerings across major tokens.

Top Exchanges with High Staking Rewards:

| Exchange | Max APY | Notable Coins | Type |

|---|---|---|---|

| Nexo | Up to 26% | ETH, DOT, MATIC | Flexible, daily compounding |

| Kraken | Up to 24% | ETH, ADA, SOL | Bonded & flexible options |

| Bybit | Up to 20% | ETH, APT, ARB | Locked & flexible terms |

| Binance | Up to 20% | 100+ coins | Fixed terms, auto-invest |

| KuCoin | Up to 30% | SOL, ATOM, BNB | Flexible & fixed lockups |

To see the most updated APY rates, visit our Live Staking Rewards Page.

Key Factors to Consider When Choosing a Staking Platform

Before locking your assets into a platform, consider these important factors:

1. Reward Frequency

Some platforms distribute rewards daily (e.g., Nexo), while others operate on weekly or bonded cycles (e.g., Kraken).

2. Security

Look for exchanges with robust security features, insurance policies, and a strong reputation. Binance and Kraken are known for their industry-leading security practices.

3. Lock-up Periods

Flexible staking allows you to withdraw anytime, while locked staking may offer higher APY in exchange for commitment.

4. Token Availability

Choose an exchange that supports the tokens you hold or are interested in. Binance offers one of the largest token selections.

Use our Crypto Staking Calculator to estimate how much you can earn based on different platforms and lock-up periods.

Centralized vs. Decentralized Staking

There are two primary ways to stake crypto:

Centralized Exchanges

These include Binance, Kraken, and Nexo. They are user-friendly and often handle all technical details for you. However, your assets are held in custody by the platform.

Decentralized Platforms

Protocols like Lido and Rocket Pool allow you to stake directly from your wallet, giving you more control. However, they can be complex for beginners and may involve higher risk.

Which is better? For beginners and intermediate users, centralized platforms offer better UX and support. For advanced users, DeFi platforms may offer slightly higher APYs but with increased risk.

Featured Snippet Answer for SEO

Q: Which crypto exchange gives the best staking rewards? A: In 2025, Nexo currently offers the highest staking rewards among centralized exchanges, with up to 26% APY on select assets. Kraken follows closely with up to 24%, offering both flexible and bonded options. Binance and KuCoin also provide competitive rates depending on token and lock-up term.

FAQs – Crypto Staking on Exchanges

Q1: Is staking crypto safe on exchanges? Yes, provided you use reputable exchanges with strong security measures like Binance, Kraken, and Nexo.

Q2: Can I withdraw staked crypto anytime? This depends on whether the staking option is flexible or locked. Flexible options allow instant withdrawal, while locked terms require a waiting period.

Q3: Which exchange offers the best ETH staking rewards? As of now, Nexo and Kraken offer highly competitive ETH staking rates, reaching up to 26% and 24% APY, respectively.

Q4: How do staking rewards compare to DeFi yields? DeFi platforms can offer slightly higher yields but come with higher risks and more complex processes.

Final Thoughts

When it comes to determining which crypto exchange gives the best staking rewards, the answer depends on your goals:

- For highest APY: Choose Nexo or KuCoin

- For trusted reputation: Go with Kraken or Binance

- For flexible withdrawals: Try Nexo or Bybit

To stay ahead, always monitor the latest rates using our Live APY Tracker and use our staking calculator to model your potential earnings.

Start staking smart in 2025 and let your crypto work for you.

What are your top priorities when choosing a staking exchange—APY, flexibility, or platform reputation? Let us know in the comments below!