RhinoFi Crypto Trading Review: Features, Pros & Cons Explained

🔍 Introduction to RhinoFi Crypto Trading Review

Crypto trading has come a long way—from clunky exchanges with long wait times to sleek platforms offering instant swaps and yield opportunities. But let’s be honest: most platforms still struggle with one big thing — Ethereum gas fees.

Enter RhinoFi, the decentralized trading hub that wants to eliminate all that friction. Built on Layer 2 tech and with a strong focus on cross-chain DeFi access, RhinoFi is aiming to be more than just another DEX. It wants to be your one-stop portal to the multichain world of DeFi.

So, is it legit? Is it easy to use? Is it actually gas-free?

Let’s break it all down.

🚀 What is RhinoFi?

At its core, RhinoFi is a Layer 2 decentralized exchange (DEX) that makes crypto trading cheaper, faster, and more accessible. Instead of trading directly on Ethereum (which can be slow and expensive), you do it on a Layer 2 solution called StarkEx, which batches transactions off-chain and settles them on-chain.

That means:

- Lower fees (almost zero)

- Faster trades

- Same security as Ethereum

In short, it’s like taking the express lane on a crowded highway.

Official Website – RhinoFi

🔄 Evolution from DeversiFi to RhinoFi

If you’ve been in crypto for a while, you might remember DeversiFi. That was RhinoFi’s old name.

Originally, DeversiFi focused on creating a private, high-speed DEX. But as the crypto ecosystem evolved, so did the platform. It rebranded to RhinoFi to reflect its new mission: becoming a truly multichain DeFi gateway where users can move, trade, and earn across multiple blockchains — without using bridges or paying crazy fees.

Think of it as DeFi’s version of an airport hub, letting you go from one chain to another without the security lines or delays.

📈 Why It’s Gaining Popularity in 2025

In 2025, with mainstream DeFi adoption rising and Ethereum still struggling with congestion, RhinoFi is perfectly positioned. It’s winning hearts for a few key reasons:

- Zero gas fees on trades

- Cross-chain access without bridges

- One-click earning and swapping

- No need to register or KYC

- Privacy and self-custody by default

This combination of freedom, speed, and simplicity makes it appealing for both newbies and power users alike.

🔧 Key Features of RhinoFi

Let’s get into the juicy stuff — the features that actually make RhinoFi special.

🧠 Layer 2 Scaling with StarkEx

Layer 2 is the future of Ethereum, and RhinoFi was one of the early adopters of StarkEx — a zero-knowledge rollup solution by StarkWare. Instead of each trade being a standalone transaction on Ethereum (which clogs the network), StarkEx bundles thousands of trades together, proving them all at once with cryptographic accuracy.

This gives you:

- Lightning-speed trades

- Near-zero fees

- Same level of decentralization and safety

You basically get Ethereum-level security, minus the Ethereum-level headache.

💨 Gasless Trading – Is It Real?

Yes, it’s 100% real. Unlike Uniswap or SushiSwap, where every trade burns gas, trading on RhinoFi is completely gas-free on Layer 2.

You’ll still pay a tiny swap fee, but you won’t burn $10–$50 just to press ‘swap’.

This is a game-changer, especially if you’re making small or frequent trades.

🌉 Cross-Chain Swaps Without Bridges

Here’s where it gets magical.

RhinoFi allows you to swap tokens across blockchains like Ethereum, Polygon, Arbitrum, Optimism, and more — all without needing a bridge or switching wallets.

Normally, you’d have to:

- Use a bridge (risky + time-consuming)

- Manually switch networks in your wallet

- Approve transactions again (and again)

With RhinoFi, it’s just select → confirm → done. It handles all the backend stuff for you.

👉 Hyperdex Crypto Trading App Review (2025): Features, Fees & Performance Explained

🔗 Wallet Connect & Compatibility

RhinoFi plays nice with:

- MetaMask

- Trust Wallet

- WalletConnect-enabled wallets

- Hardware wallets like Ledger

No logins. No sign-ups. Just connect and go.

💰 Earn Yield Through DeFi Opportunities

You can stake, farm, and earn with just a few clicks. RhinoFi pulls in DeFi opportunities from different protocols and chains, so you can earn without switching platforms or using multiple tools.

It’s like having a DeFi toolkit built right into your trading terminal.

💱 Supported Assets & Trading Pairs

🔥 Popular Tokens on RhinoFi

Here’s a quick look at what you can trade:

- ETH, DAI, USDC, USDT

- MATIC, OP, ARB

- SUSHI, SNX, and other DeFi tokens

More assets are added regularly, especially from Layer 2 ecosystems.

💧 Adding and Removing Liquidity

Want to become a liquidity provider? RhinoFi lets you supply liquidity to pools and earn fees, similar to Uniswap. However, it’s still expanding its LP options, so it’s not as deep as some older DEXs.

💸 Stablecoins, ETH, and Beyond

RhinoFi supports most major stablecoins, making it ideal for:

- Trading with low volatility

- Yield farming

- Onboarding new users who want to avoid big price swings

🛡️ Security & Trustworthiness

🔒 Is RhinoFi Safe to Use?

As of 2025, RhinoFi has not been hacked — and that’s saying something in crypto.

It inherits Ethereum’s base-layer security and leverages zk-rollups for extra safety, which many believe are the future of secure DeFi.

🧪 Audits, Bug Bounties, and Transparency

The platform has undergone multiple smart contract audits and publishes open-source code. They also run a bug bounty program with incentives for white-hat hackers to find vulnerabilities.

Transparency and user safety are baked into its DNA.

📱 User Experience and Interface

💻 Web App Interface

RhinoFi’s web interface is super clean and intuitive. Even if you’re new to crypto, you can navigate, trade, and earn in minutes.

The dashboard includes:

- Token balances

- Swap interface

- Yield tab

- Wallet info

- Transaction history

📲 Mobile Accessibility

While there’s no dedicated mobile app yet, the mobile web version is fast, responsive, and fully functional.

You can trade and stake on the go — just keep your wallet connected.

👶 Beginner-Friendly or Not?

RhinoFi hits a sweet spot — simple enough for beginners, but powerful enough for serious DeFi users.

No steep learning curve. No unnecessary steps.

💵 Fees and Cost Structure

🚫 Gas Fees – Are They Really Zero?

Yes, trading on RhinoFi’s L2 environment costs zero gas. You only pay if you’re withdrawing to Ethereum Layer 1, and even then, it’s cheaper than using a bridge manually.

💰 Swap Fees and Protocol Charges

- Trading fees are around 0.2% per swap

- No deposit/withdrawal fees on Layer 2

- Bridging to L1 may cost network gas (Ethereum, Polygon, etc.)

✅ Pros of Using RhinoFi

- No gas fees for most transactions

- True cross-chain swaps with no bridges

- Fast, secure, decentralized

- No KYC or account setup

- Integrated DeFi earning tools

❌ Cons of Using RhinoFi

- No native mobile app yet

- Some token pairs have limited liquidity

- Yield options aren’t as deep as Yearn or Aave

- Not designed for NFT trading

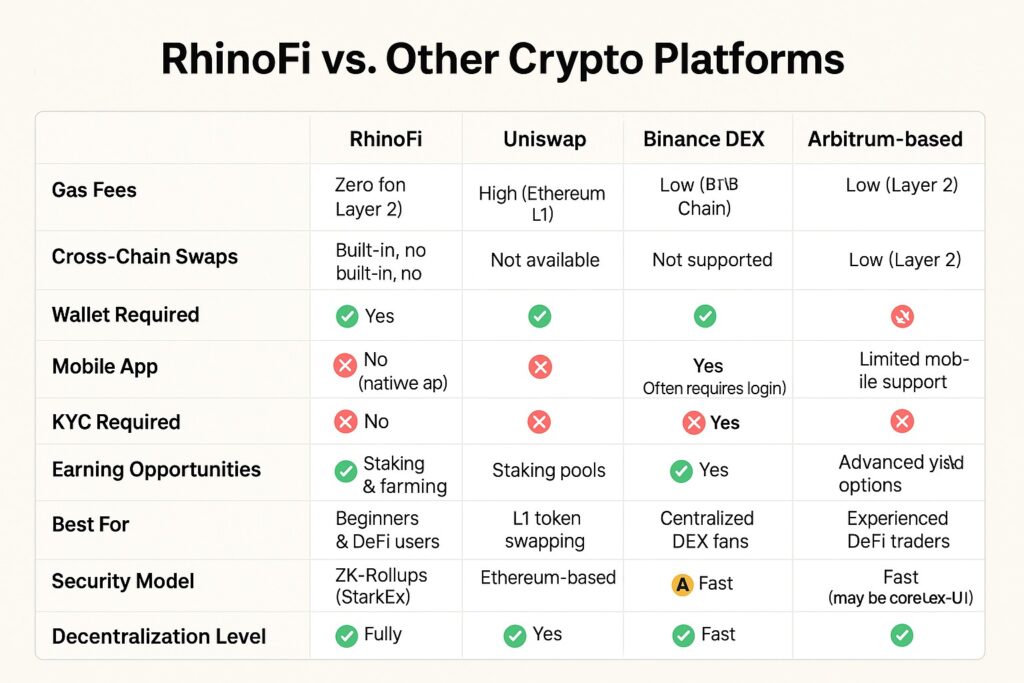

🤼 RhinoFi vs. Other Crypto Platforms

RhinoFi vs. Uniswap

Uniswap is the OG DEX, but it relies on Ethereum L1, so expect gas costs.

RhinoFi? Fast and gas-free — ideal for retail users.

RhinoFi vs. Binance DEX

Binance DEX is fast but requires registration and has custodial risks. RhinoFi is non-custodial, and your funds stay in your wallet.

RhinoFi vs. Arbitrum-based DEXs

Arbitrum DEXs like GMX are great for leverage trading, but RhinoFi is better for everyday DeFi tasks like swapping, yield farming, and cross-chain access.

🛠️ How to Get Started with RhinoFi

1. Connect Your Wallet

Head to app.rhino.fi, click “Connect Wallet”, and choose from MetaMask, WalletConnect, Ledger, etc.

2. Make Your First Trade

Pick a token to swap, set the amount, confirm, and you’re done. It’s as easy as ordering food online.

3. Explore Yield Opportunities

Want to earn passive income? Go to the “Earn” tab and stake your assets. You’ll see available APRs and durations.

🎯 Who Should Use RhinoFi?

RhinoFi is perfect for:

- First-timers in DeFi

- Cross-chain explorers

- Users annoyed by high gas fees

- Yield hunters looking for safe options

🗣️ Real User Reviews & Community Feedback

Users love RhinoFi’s:

- Speed

- No gas policy

- Cross-chain wizardry

Common requests? A mobile app and more token support. But overall, the vibe is positive and optimistic.

🧠 Final Verdict: Is RhinoFi Worth Trying in 2025?

If you’re even slightly into DeFi, you owe it to yourself to check out RhinoFi. It’s not hype — it’s actually solving real problems with elegant, user-first solutions.

With more chains being added and yield options expanding, 2025 might just be the year RhinoFi goes mainstream.

🧾 Conclusion

RhinoFi is like the Tesla of DeFi — fast, futuristic, and boundary-pushing. Whether you’re just getting started or you’ve been in crypto for years, it’s designed to make your life easier.

Gas fees? Gone. Bridges? Obsolete. Confusing UI? Not here.

❓ FAQs

1. Is RhinoFi available in the U.S.?

Yes, RhinoFi is fully decentralized and doesn’t restrict access based on geography.

2. Does RhinoFi require KYC?

No KYC, no sign-ups. It’s just you and your wallet.

3. Can I swap Bitcoin on RhinoFi?

Not native BTC, but you can swap Wrapped Bitcoin (WBTC) and other ERC-20 representations.

4. Is RhinoFi better than MetaMask?

MetaMask is a wallet. RhinoFi is a trading and earning platform. You can use them together for a full experience.

5. How does RhinoFi make money?

Via small trading fees and by offering integrated yield services — no shady stuff.

Please don’t forget to leave a review.

One Comment