Pros and Cons of Staking on Centralized Exchanges

By Abhishek Chandravanshi

Introduction: Why Centralized Crypto Staking Is Popular

In 2025, staking crypto has become one of the most common ways to earn passive income from digital assets. With Ethereum, Solana, and other Proof-of-Stake (PoS) coins offering consistent yields, many investors are turning to centralized exchanges (CEXs) like Kraken, Binance, and Coinbase to simplify the staking process.

But just how safe is staking through a centralized platform? Are you better off using a wallet or a DeFi protocol? In this article, we explore the pros and cons of staking on centralized exchanges, helping you make an informed decision about your crypto strategy.

✅ What is staking on centralized exchanges?

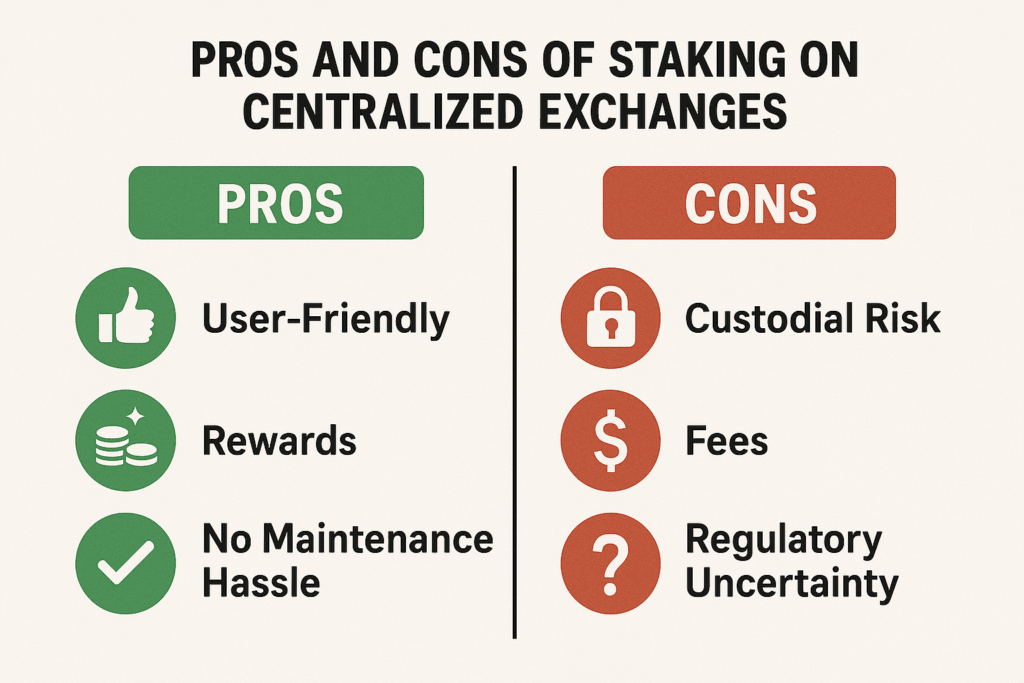

🔍 Pros: User-friendly, automatic rewards, ease of access

⚠️ Cons: Custodial risk, platform fees, regulatory issues

🤔 Is it worth staking on exchanges in 2025?

📌 Alternatives: DeFi staking, liquid staking tokens

❓ FAQs about staking on centralized platforms

What Is Staking on Centralized Exchanges?

Staking on centralized exchanges refers to the process of delegating your crypto assets to a platform like Binance, Kraken, or Coinbase, which then stakes them on your behalf. In return, you earn staking rewards—usually paid out in the same crypto you deposited.

These platforms handle everything behind the scenes: setting up validators, claiming rewards, and even slashing penalties in some cases.

✅ The Pros of Staking on Centralized Exchanges

1. User-Friendly and Accessible

Most centralized exchanges have intuitive dashboards that let you stake in just a few clicks. There’s no need to set up your own validator node or manage complex wallet setups.

- One-click staking via the app or web

- Auto-restaking options

- Great for beginners

This convenience makes it ideal for those just entering the crypto space.

2. No Technical Hassle

Running a validator or delegating through your own wallet comes with responsibilities—uptime, private key security, software upgrades, and more. With centralized platforms, these headaches vanish.

They handle:

- Validator node maintenance

- Reward calculations

- Network upgrades

3. Consistent Rewards

Top platforms offer competitive yields, often around or above the network’s base rate. Some even offer promotional APYs for new tokens or staking events.

🔗 Explore More: Highest Paying Staking Exchanges Right Now

You can stake Ethereum, Solana, Cardano, and dozens of other assets in a single dashboard—no network-switching required.

4. Fiat On-Ramps and Liquidity

Unlike staking through DeFi or wallets, centralized exchanges give you access to fiat conversion, instant crypto swaps, and fast withdrawals. That means your staking earnings are much easier to cash out.

Some exchanges even offer:

- Flexible staking (withdraw anytime)

- Staking+ trading, where your assets earn yield even while posted as margin

⚠️ The Cons of Staking on Centralized Exchanges

1. Custodial Risk

This is the biggest drawback. When you stake through a centralized platform, you don’t control your private keys.

“Not your keys, not your coins.”

If the platform is hacked, freezes withdrawals, or declares bankruptcy (think: FTX collapse), your assets could be at risk.

2. Platform Fees Eat Into Rewards

Centralized exchanges often charge staking commissions, taking a cut (usually 5%–20%) of your earned rewards. While that might sound small, over time, it significantly impacts your yield.

You’re essentially paying for convenience.

🔗 Compare Platforms: Kraken vs Coinbase: Best Staking APY for U.S. Users

3. Regulatory Uncertainty

U.S. regulators have been scrutinizing staking services on exchanges. In 2023, Kraken had to shut down its staking program for U.S. users after an SEC lawsuit.

In 2025, it’s still unclear whether centralized staking services will survive in heavily regulated regions. If you’re in the U.S., staking availability may be:

- Limited to institutional users

- Offered through third-party custodians

- Subject to tax complications

🔗 Read More: IRS Rules for Crypto Staking Income (Explained Simply)

4. Limited Control and Flexibility

On-chain staking lets you choose validators, change delegation, or participate in governance. Centralized platforms abstract these details, giving you less control.

You may not know:

- Where your assets are staked

- Who’s validating on your behalf

- How slashing is handled

Real-World Example: Ethereum Staking on Coinbase vs Lido

Let’s take ETH staking as a case study.

On Coinbase, ETH is staked automatically, and you receive cbETH, a liquid staking token, but Coinbase takes a 25% commission on rewards.

On Lido, you can stake ETH in a non-custodial way and receive stETH. Lido’s fee is ~10%, but you hold your stETH in your own wallet, giving you more control.

🔗 Full Comparison: Top Liquid Staking Tokens (Lido, Rocket Pool) in U.S.

Is It Worth Staking on Centralized Exchanges in 2025?

The answer depends on your goals:

| User Type | Recommended Staking Method |

|---|---|

| New/inexperienced | Centralized exchange (ease of use) |

| Security-focused | Hardware wallet + native staking |

| Yield maximizer | DeFi or liquid staking tokens |

| U.S. resident | Check availability and compliance first |

If convenience is key and you’re using a reputable exchange, centralized staking can be a good choice. Just know what you’re giving up in terms of control and risk.

Alternatives to Centralized Staking

1. Liquid Staking Protocols

Platforms like Lido, Rocket Pool, and Frax let you stake ETH and receive a token in return (stETH, rETH) that remains liquid and usable across DeFi.

- Non-custodial

- Decentralized validator network

- DeFi composability

🔗 Learn more: How Restaking Is Changing Crypto Staking in 2025

2. Native Staking via Wallets

You can stake directly from wallets like Keplr (for Cosmos) or Phantom (for Solana).

- No third-party risk

- Choose your validator

- Full reward control

Downside: It requires technical knowledge and may expose you to slashing risks if your validator behaves poorly.

Final Verdict: Balancing Convenience with Custody

Staking on centralized exchanges is easy, fast, and beginner-friendly, but it comes at a cost—both financially and in terms of security.

If you’re just getting started or don’t want the hassle of managing your own keys, centralized platforms are a fine choice. However, if you’re looking to maximize yield and reduce third-party risk, you may want to explore non-custodial or DeFi staking options.

FAQs About Staking on Centralized Exchanges

❓ Is staking on centralized exchanges safe?

It depends on the platform. Reputable exchanges like Kraken or Coinbase are relatively safe but still come with custodial risks.

❓ Do centralized exchanges take a cut of my staking rewards?

Yes. Most platforms charge a commission fee, typically between 5–25% of your earned rewards.

❓ Can I lose money staking on an exchange?

Yes, especially if the exchange is hacked, goes bankrupt, or if your staked asset drops in value.

❓ What happens if I unstake early?

It depends on the exchange. Some offer flexible staking, while others have lockup periods with early withdrawal penalties.

❓ What are better alternatives to CEX staking?

Liquid staking protocols (like Lido or Rocket Pool) and native staking via wallets offer more control and transparency.

Conclusion

The pros and cons of staking on centralized exchanges boil down to one trade-off: convenience vs control.

If you’re okay with letting a trusted platform manage your staking and take a fee, then staking on a CEX is a great passive income option. But if you want full autonomy over your assets and yields, consider staking via wallets or DeFi platforms instead.

🔗 Browse more staking guides on CryptoTrendd.com

2 Comments