Hyperdex Crypto Trading App Review (2025): Features, Fees & Performance Explained

🔍 Introduction to Hyperdex Crypto Trading App Review

What is Hyperdex?

Hyperdex is not just another crypto app—it’s a DeFi-powered investment platform designed for anyone who wants to earn passive income from crypto without juggling 10 wallets or manually managing yield farms. It simplifies complex strategies and wraps them into what they call Investment Cubes—smart-contract-driven portfolios tailored for different risk appetites.

Think of it like having a mini hedge fund in your pocket—but without the high fees or Wall Street gatekeepers.

Why It’s Gaining Buzz in 2025

The crypto space in 2025 is flooded with platforms, but few deliver reliable returns and a user-friendly experience. Hyperdex stands out because it bridges advanced DeFi tools with simplicity. It’s kind of like how Robinhood made stock trading feel easy—Hyperdex is doing that for decentralized finance.

Its strong community, growing user base, and consistently high-yielding strategies have made it a buzzword among crypto influencers and YouTubers this year.

🚀 Getting Started with Hyperdex

Easy Account Setup

Getting started on Hyperdex is refreshingly straightforward. No more awkward passport photos or uploading a selfie holding a sign. Just connect your Web3 wallet—like MetaMask, Trust Wallet, or even Ledger—and boom, you’re in.

If you’re using fiat (like transferring from your bank), then yes, KYC might pop up via the third-party ramp. But if you’re crypto-native? You’re good to go in under a minute.

Supported Countries & KYC Requirements

Since Hyperdex operates on decentralized rails, there’s no central entity to demand your identity. It’s open to nearly every country—including the U.S.—unless local laws restrict smart contract usage. This makes it a fantastic choice for users tired of CEX limitations.

That said, always double-check your country’s crypto policies just to be safe.

Official Website – Hyperdex

✨ Key Features of Hyperdex

Modular Investment Cubes

This is the core of Hyperdex—and honestly, it’s what makes the platform so cool. These “Cubes” are pre-configured smart investment strategies:

- Fixed Income Cube: Ideal for stable, predictable earnings. It spreads funds across yield farms, stablecoin lending, and staking platforms.

- Algo Trading Cube: Uses AI-powered bots to trade volatile tokens and rebalance based on market movements.

- Race Cube: A gamified investment pool where different strategies compete for the highest yield, and users bet on which will win.

Each cube shows:

- Estimated APY

- Risk level

- Past performance

So you can make informed decisions without being a DeFi expert.

DeFi Made Simple

What makes Hyperdex magical is how it automates everything under the hood. You don’t need to manage LP tokens, adjust farming pairs, or even touch yield aggregators. Hyperdex does it all for you—seamlessly and securely.

AI-Powered Portfolio Management

Their built-in AI isn’t just for show. It monitors market volatility, sentiment, token performance, and then dynamically shifts funds inside your cubes to optimize returns while managing risk.

In short? It’s like a financial advisor who doesn’t sleep.

Real-Time Analytics Dashboard

Hyperdex’s dashboard is a thing of beauty. You can see:

- Cube performance over time

- Live APY updates

- Token exposure

- Historical charts

It’s both beginner-friendly and power-user ready.

📱 Hyperdex User Interface and Experience

Mobile vs Web Interface

Both their mobile app and web platform are designed for clarity. Everything is snappy, colorful, and intuitive—no lag, no crashes. The mobile app in particular feels like a polished fintech product, not a clunky DeFi dApp.

You can monitor investments, switch cubes, or claim rewards from your phone in under 3 taps.

User-Friendly Design for Beginners

Hyperdex avoids confusing crypto terms. Instead of “APY via auto-compounding vaults,” it just says “You’re earning 11% a year here.” This makes it easy for someone completely new to DeFi to feel confident.

Even better? Every cube comes with a “Learn More” section to break down strategy, risks, and benefits.

👉 Atomic Wallet Review 2025: 5 Hidden Features Every Crypto Trader Must Know

🔐 Security and Privacy on Hyperdex

Wallet Integration

You never give up custody of your assets. Hyperdex connects to your wallet, and your funds interact only with vetted smart contracts. You stay in control—always.

No private keys are ever stored or accessed.

2FA, Encryption & Smart Contract Audits

Hyperdex takes security seriously:

- Audits: All core contracts are regularly audited by Trail of Bits and Hacken.

- Open Source: Contracts are published on GitHub and verified on-chain.

- 2FA: Optional 2FA if using a linked email for notifications or fiat ramps.

It’s as secure as any DeFi platform can get—and far safer than most CEXs.

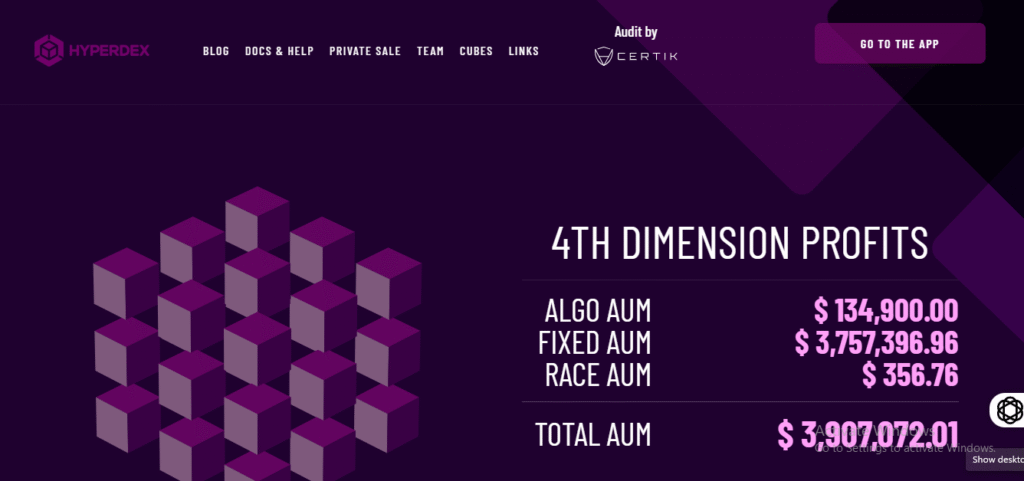

📈 Performance Metrics in 2025

APY Returns on Investment Cubes

Current (May 2025) average annual returns:

- Fixed Income Cube: 9.3%–10.8%

- Algo Trading Cube: 14.5%–17.9%

- Race Cube: Varies wildly, with some winners posting 22–28% in strong market cycles.

Returns fluctuate based on underlying protocol performance and market trends, but Hyperdex maintains strong, consistent yields.

Comparison with Other Trading Apps

Compared to:

- Coinbase Earn: Lower yields (typically 3–5%)

- Kraken Staking: Higher security, but limited flexibility

- Binance Earn: Comparable yields but custodial and riskier on withdrawal restrictions

Hyperdex wins on decentralization, returns, and usability—especially for passive investors.

🛠️ Trading Options and Tools

Automated Strategies vs Manual Trading

You can either:

- Choose a cube and let Hyperdex automate it, or

- Manually tweak allocations, adjust exposure, and monitor cube rebalancing yourself.

It’s great for beginners and pros alike.

Cross-Chain Swaps & Liquidity Pools

Hyperdex supports:

- Ethereum

- Polygon

- BNB Smart Chain

Cross-chain liquidity pools let you swap or stake assets across ecosystems without jumping through bridges manually.

This is especially useful when yields vary between chains.

💰 Fees and Pricing

Trading Fees Breakdown

- Performance Fee: 5%–15% of profits only (not your deposit!)

- No entry or exit fee on standard cubes (unless you withdraw early)

- Gas fees: Paid by you, but optimized for low-cost routes

Hidden Costs to Watch Out For

- Cube exit fees if withdrawing before a cycle ends

- Chain-specific gas spikes

- Bridging fees if using non-native assets

How Hyperdex Compares to Competitors on Fees

Unlike platforms that charge a fee for every click, Hyperdex keeps it simple:

- You pay when you earn

- No monthly subscription fees

- Transparent cost structure

It’s ideal for budget-conscious crypto users.

🧑🤝🧑 Community & Support

Active Telegram & Discord Channels

Hyperdex has a thriving global community:

- Strategy discussions

- Feature requests

- Early-access test invites

- Developer AMAs

Join their Discord and you’ll see over 70K active members sharing insights.

In-App Customer Support Quality

There’s a built-in support bot and live human reps. Most queries are resolved within 10–15 minutes.

That’s rare in DeFi, where many platforms ghost you.

✅ Pros and Cons of Using Hyperdex

Pros:

- High APYs without micromanagement

- Transparent performance

- Beginner and expert-friendly

- Audited and non-custodial

Cons:

- Not great for frequent traders

- Exit fees for early withdrawals

- Requires basic Web3 wallet knowledge

🧑💼 Who Should Use Hyperdex?

Hyperdex is ideal if you:

- Want to earn passive income

- Prefer DeFi without complexity

- Are exploring diversification without micromanaging wallets

- Need a reliable alternative to CEXs

📅 Future Roadmap & Upcoming Features

Coming soon:

- NFT-based reward systems

- Real-world assets (RWA) like tokenized gold and bonds

- Direct fiat onboarding for U.S. residents

- Premium AI cubes with adaptive volatility tracking

It’s only getting better from here.

📝 Final Verdict: Is Hyperdex Worth It in 2025?

If you’ve been hunting for a smart, safe, and stress-free way to earn in crypto—Hyperdex might just be the answer. It combines intelligent automation, transparent design, and solid returns, making it a standout choice in 2025’s crowded DeFi landscape.

For long-term holders, side-income seekers, and even part-time degens—it’s 100% worth trying.

📌 Conclusion

In a world overflowing with crypto platforms, Hyperdex carves its own niche. It empowers regular users to tap into pro-level DeFi strategies, minus the confusion. You stay in control, your assets stay in your wallet, and your money works smarter.

Whether you’re testing the waters or diving deep into passive income, Hyperdex is a rare combo of usability, trust, and potential.

❓ FAQs

Is Hyperdex safe for beginners?

Yes, Hyperdex is extremely beginner-friendly and designed for anyone with basic wallet access. Its smart contracts are audited and assets stay in your control.

Can you withdraw funds anytime?

Yes, but certain cubes may charge a small fee if you exit before a cycle ends. Read the fine print inside each cube.

Does Hyperdex support staking?

Indirectly—yes. Some cubes use staking as part of their underlying yield strategies, though Hyperdex handles it for you.

What’s the minimum to start investing?

You can start with as little as $10 in most cubes, making it ideal for those testing the waters.

How does Hyperdex differ from Robinhood or Binance?

It’s non-custodial, DeFi-native, and offers automated investment strategies—not just spot trading. You own your keys and the yield is algorithmic, not just token-based.

Please don’t forget to leave a review.

3 Comments