How to Stake Solana on Coinbase (Step-by-Step)

By Abhishek Chandravanshi

Staking Solana on Coinbase is one of the easiest ways to earn passive income with crypto. If you’re holding SOL and want to make your tokens work for you, this guide walks you through everything—from buying Solana to staking it directly on Coinbase. Whether you’re new to staking or just looking for a streamlined solution, Coinbase offers a user-friendly way to participate in the Solana network and earn staking rewards with minimal effort.

What is Solana Staking?

Solana staking allows SOL holders to earn rewards by helping secure the Solana blockchain. By delegating your SOL to a validator, you contribute to network consensus and are rewarded with a percentage of the transaction fees and inflationary rewards. On centralized platforms like Coinbase, the process is simplified—they handle delegation and validator selection for you.

💡 Want to compare Solana’s staking rewards with others? Visit our Live Staking APY Rates page.

- What is Solana staking?

- Is staking SOL on Coinbase safe?

- How to stake Solana on Coinbase: Step-by-step

- Staking rewards and fees on Coinbase

- Pros and cons of using Coinbase for SOL staking

- Alternatives to Coinbase for staking Solana

- FAQs

Why Stake Solana on Coinbase?

Staking SOL through Coinbase is ideal for beginners. You don’t need to worry about technical steps like choosing a validator or running a wallet. Everything is managed by Coinbase, and you’ll still receive competitive rewards for your staked tokens.

Key Benefits:

- Automatic staking with eligible balances

- No manual delegation required

- Coinbase handles validator operations

- Rewards paid directly to your account

- Easy tracking of your staking balance

📊 Use our Crypto Staking Calculator to estimate how much you could earn by staking SOL or any other supported token.

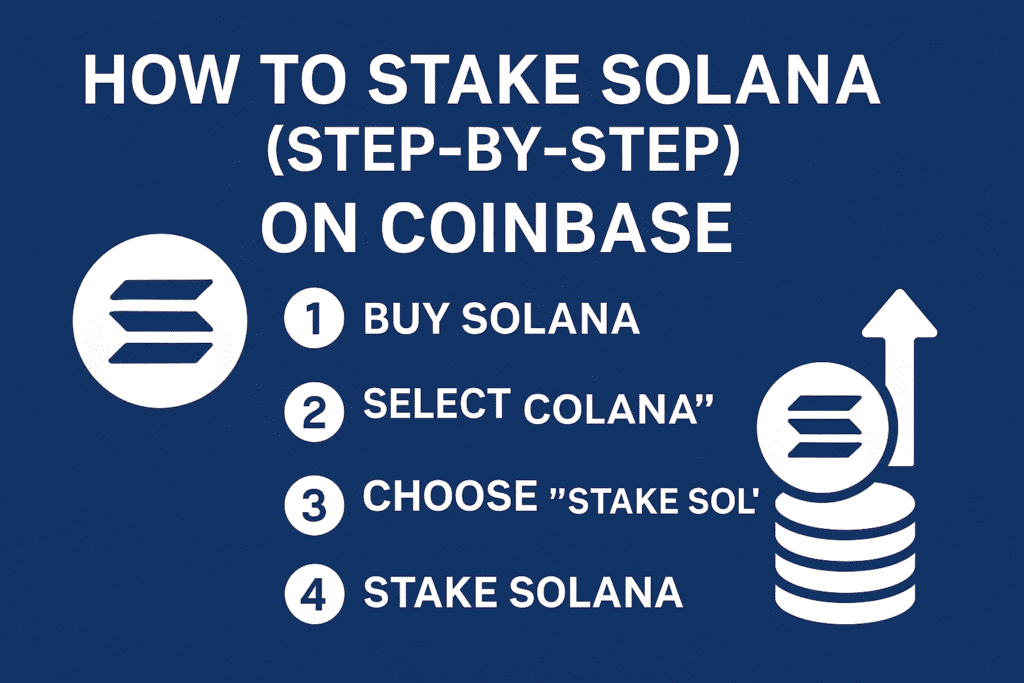

How to Stake Solana on Coinbase (Step-by-Step)

Let’s break it down so you can get started easily.

Step 1: Create or Log into Your Coinbase Account

Go to coinbase.com and create an account if you don’t already have one. You’ll need to verify your identity, which may include uploading your ID and providing personal details for KYC compliance.

Step 2: Fund Your Account

You can fund your account using:

- Bank transfer (ACH in the U.S.)

- Debit card

- PayPal (available in select regions)

- Transferring crypto from another wallet or exchange

Step 3: Buy Solana (SOL)

Once your account is funded:

- Search for “Solana” or use the ticker SOL.

- Click “Buy” and select the amount.

- Confirm the purchase.

Now, you hold SOL in your Coinbase portfolio.

🧠 Not sure if SOL is the right pick? Read our blog on Top Liquid Staking Tokens including Solana, Lido, and Rocket Pool.

Step 4: Enable Staking (Optional)

Coinbase automatically stakes SOL for eligible users, but here’s how to manually check:

- Navigate to your Assets tab.

- Click on Solana (SOL).

- Tap or click “Stake SOL” if available.

- Read the terms and confirm staking.

You’ll now begin earning rewards automatically, as long as your SOL remains in your Coinbase wallet.

How Long Until You Start Earning SOL Rewards?

You typically start earning rewards after a brief warm-up period (about 2-3 days). Coinbase stakes your SOL in batch cycles, and you’ll receive rewards distributed directly into your account every 3-5 days, depending on network conditions.

How Much Can You Earn Staking Solana on Coinbase?

Staking rewards vary based on the network’s inflation rate and Coinbase’s validator performance. As of May 2025:

| Metric | Details |

|---|---|

| Estimated APY | ~5.1% |

| Minimum Balance | No strict minimum (but rewards scale with amount) |

| Payout Frequency | Every few days |

| Lockup Period | None (you can sell or send anytime) |

| Coinbase Fee | ~25% of staking rewards |

Note: Coinbase retains a portion of staking rewards as a service fee, which is standard across many centralized exchanges.

Want better yields? Check out our guide on the Highest Paying Staking Exchanges (May 2025).

Pros and Cons of Staking SOL on Coinbase

✅ Pros:

- Extremely beginner-friendly

- No need for self-custody wallets

- No lock-up or unbonding period

- Rewards auto-compounded

- Transparent reporting in the app

❌ Cons:

- High commission (25%)

- You don’t choose the validator

- Custodial control (not your keys, not your coins)

- Not available in all regions

For power users or decentralization advocates, you may want to consider self-staking through wallets like Phantom or using platforms like Marinade or Lido on Solana.

Alternatives to Coinbase for Solana Staking

If you want higher rewards or full control over your SOL, consider these options:

1. Phantom Wallet + Solana Validator

Use the Phantom browser extension wallet to delegate to a validator of your choice. This method gives you full control, and you can compare validator performance manually.

2. Marinade Finance

Marinade is a liquid staking protocol for Solana. Stake SOL and receive mSOL, a liquid token you can use across DeFi platforms.

3. Lido for Solana

Lido also supports SOL liquid staking. Stake SOL and get stSOL in return.

Is Staking SOL on Coinbase Safe?

Yes, Coinbase is a regulated exchange and one of the most trusted platforms in the world. However, you are trusting a third party to manage your private keys and staking process. If Coinbase is ever compromised or halts withdrawals (as seen with some exchanges in past cycles), your assets could be temporarily inaccessible.

Always weigh convenience versus custody.

Tips to Maximize Your Staking Returns

- Stake Larger Amounts – Rewards scale with your stake.

- Avoid Frequent Transfers – Unstaking happens automatically when you sell or send your SOL, which interrupts rewards.

- Watch for Fees – Coinbase takes a significant cut. Monitor your net APY.

- Use a Staking Calculator – Estimate your monthly income from staking with our staking calculator.

Final Thoughts

If you’re looking for a fast, low-maintenance way to earn passive income with Solana, staking on Coinbase is a great starting point. You don’t need technical knowledge, and there’s no lock-up. However, for better returns and decentralization, consider alternatives like Phantom, Marinade, or Lido.

Solana continues to be a strong contender in the smart contract space with blazing-fast speeds and low fees—making it an attractive asset to stake, especially in a bull market.

Frequently Asked Questions (FAQs)

How do I start staking Solana on Coinbase?

Just hold SOL in your Coinbase account. If staking is supported in your region, you’ll automatically be enrolled.

Is there a lock-up period when staking SOL on Coinbase?

No, you can sell or transfer your SOL at any time.

How much does Coinbase take from staking rewards?

Coinbase typically takes a 25% commission from the staking rewards.

Can I stake SOL in Coinbase Wallet (non-custodial)?

No, staking is currently only supported on Coinbase.com, not the Coinbase Wallet app.

What happens if I sell my staked SOL?

Your SOL is unstaked automatically, and you stop earning rewards immediately.

Need help choosing between centralized vs decentralized staking options? Check out our detailed guide: Pros and Cons of Staking on Centralized Exchanges.

What’s your experience staking Solana on Coinbase—have you found it rewarding or are you considering other platforms?