Is Cash App Safe for Crypto? Full Review 2025

If you’re thinking about buying Bitcoin in 2025, Cash App is probably one of the first names that comes to mind. It’s fast, simple, and built for people who prefer handling money from their phones instead of complicated trading dashboards. And with crypto adoption growing, more users want tools that feel modern and easy—not something overwhelming.

Many traders today want trustworthy information before investing. 👉 Learn more about our mission to empower modern traders

Table Of Content

What Is Cash App Crypto?

Official link to Download App :

For Android Users – Cash App

For IOS – Cash App

Cash App started as a simple peer-to-peer money app, but today it’s also one of the most popular platforms for buying Bitcoin in the U.S. The app lets you buy, sell, send, and receive BTC with just a few taps. It’s built for mobile-first users who prefer quick access, clean design, and no-friction trading.

This is also why modern traders tend to compare it with other mobile-focused platforms like Coinbase, BitGlide, and Robinhood. Mobile-first tools have become essential for people who want speed and convenience. For more comparisons, check out the best crypto trading apps in the USA or the latest crypto apps dominating 2025.

Cash App focuses on simplicity, which makes it very different from advanced exchanges. You won’t find complicated charts, futures trading, or altcoins here. Instead, it provides a clean experience that’s easy to understand even if you’re not a technical expert.

For users who want to explore what modern crypto apps offer—simple UI, clean dashboards, or automation tools—here are the key features modern crypto apps offer.

Is Cash App Safe for Crypto?

Short answer: Yes, Cash App is generally safe for buying and holding Bitcoin, and its security is stronger than many people expect. However, just like any platform, it has limits you need to understand.

Cash App uses standard industry protections such as encryption, identity verification, fraud monitoring, and two-factor security. It also works under strict U.S. regulatory rules because it’s owned by Block, Inc. (the company founded by Jack Dorsey). Many users feel safer with Cash App because it’s not a random startup—it’s a publicly listed company with years of financial management experience.

But here’s the important part:

Cash App is safe for basic Bitcoin usage—not advanced crypto trading.

It doesn’t offer private keys, multiple coins, staking, or deep trading tools. If you want those features, platforms like Coinbase, Robinhood & BitGlide may fit better. See the full Coinbase, Robinhood & BitGlide comparison.

Cash App focuses on simplicity over flexibility, which is great for beginners but limited for active traders.

If you’re researching the best beginner-friendly tools, here are updated guides:

Cash App Security Features

Cash App has multiple layers of protection designed to keep your financial and crypto data secure. These protections work together like a security system for your digital wallet. Here’s how each layer works:

Data Encryption

Cash App encrypts all data that moves between your device and its servers. That means transaction details, wallet information, and login data stay secure even if someone tries to intercept the connection. Think of encryption like sending a locked box instead of an open envelope.

Security Lock

This feature adds an extra step before sending money or Bitcoin. You can require a PIN or biometric scan (fingerprint/Face ID) before any crypto movement. Even if someone gets into your phone, they can’t move your BTC without your approval.

Fraud Detection

Cash App uses automated monitoring tools to detect unusual patterns. Sudden big withdrawals, suspicious transfers, or rapid login attempts may trigger extra verification. This is similar to how banks stop unusual card transactions.

Extra Protections

Cash App also includes optional features such as:

- Two-factor authentication (2FA)

- Device recognition

- Login alerts

- Automatic logout timers

If you want a deeper look into risk management and safety practices, check out these helpful resources:

These links help you compare Cash App’s security with other top platforms in 2025.

Cash App’s Regulatory Status, Licensing & U.S. Compliance

Cash App follows some of the strictest financial rules in the U.S. because it operates as part of Block, Inc. This means it must comply with federal and state regulations to offer money transfers and Bitcoin services.

Cash App holds:

- Money transmitter licenses in many U.S. states

- FinCEN registration (Financial Crimes Enforcement Network)

- AML/KYC compliance frameworks

- Identity verification requirements for crypto features

These rules ensure that users buying Bitcoin aren’t dealing with an unregulated, offshore exchange. All crypto activity must follow U.S. reporting laws.

This level of compliance is important because many new crypto apps disappear quickly or operate outside U.S. jurisdiction. Cash App avoids those risks because it’s part of a major publicly traded company that faces regular audits.

For users evaluating apps based on regulation, UI, or reliability, see:

- Why Zerion is the No.1 Web3 trading app for UX

- honest reviews of top crypto trading apps

- which crypto trading app is best for U.S. investors

How Cash App Stores Your Bitcoin

Cash App uses a mix of hot and cold storage to keep user Bitcoin secure. Hot storage is connected to the internet, making it accessible for fast transactions. Cold storage is kept offline, protected from hacking attempts.

Cash App’s system works like this:

- A small amount of BTC stays in hot wallets to support daily transfers.

- Most user assets remain in cold wallets, stored securely offline.

- Internal controls limit who inside the company can access these wallets.

Cash App does not give private keys to users. Instead, it manages the wallets for you, which is similar to how centralized exchanges work. This approach is easier for beginners but less ideal for users who want full self-custody.

Many users still withdraw to hardware wallets for long-term storage. Later in this article, you’ll learn step-by-step how to do that safely.

If you’re comparing how different apps store your assets, these guides can help:

- top 10 safest crypto apps in 2025

- which crypto trading app is best for U.S. investors

- take a 1-minute quiz to find the best app

Has Cash App Ever Been Hacked? (2025)

Cash App itself has never had a direct hack of user Bitcoin wallets as of 2025. That’s important because it shows that its Bitcoin infrastructure—wallet management, security systems, storage—has been stable over the years.

However, there was an incident in 2022 involving a former employee downloading internal customer reports. This was not a hack, and no Bitcoin was stolen. But it reminds users that no system is perfect.

Most Cash App-related scams today come from:

- Fake Cash App support numbers

- Phishing emails

- Fake giveaways

- Social media impersonation

- Sending BTC to the wrong wallet address

These scams target users—not Cash App’s systems.

If you want to see how Cash App compares to safety standards across other major trading apps, explore:

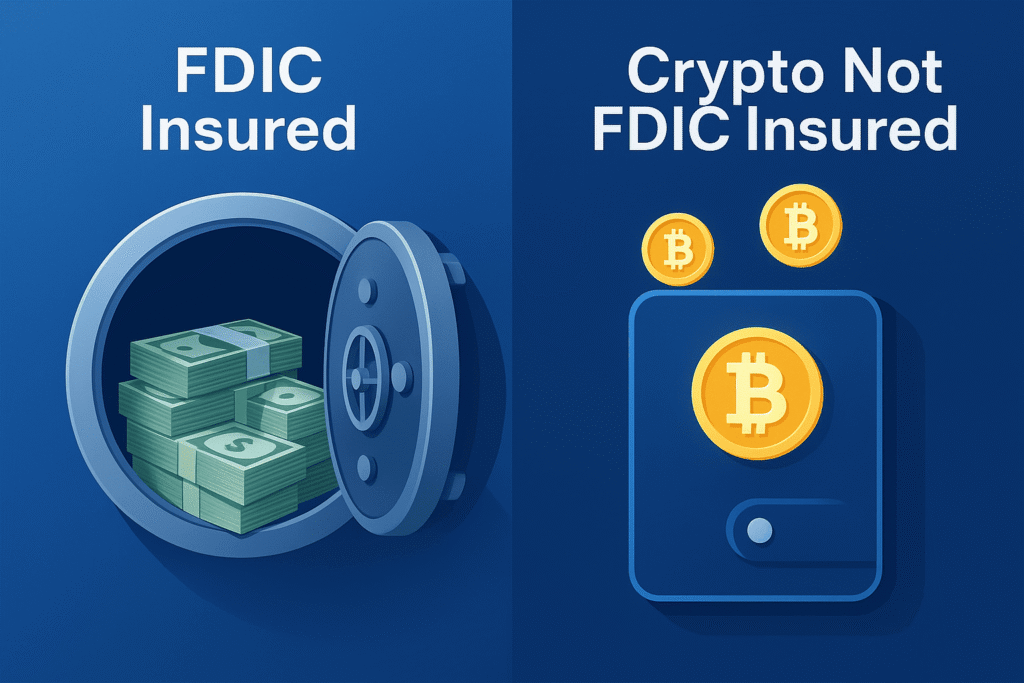

Cash App Crypto Insurance & FDIC Clarification

One of the biggest misunderstandings about Cash App is the idea that Bitcoin in the app is FDIC insured. It is not. FDIC insurance covers cash balances, not crypto assets.

Here’s the clear breakdown:

- Your USD balance in Cash App → FDIC insured

- Your Bitcoin in Cash App → NOT insured

This is the same rule used by Coinbase, Kraken, Binance.US, and other regulated U.S. exchanges. No major app offers FDIC insurance on crypto itself.

Cash App does maintain security insurance for business operations, but this does not protect users if their Bitcoin is lost due to a system failure. That’s why many long-term investors move their BTC to hardware wallets.

Later sections will explain exactly how to withdraw safely.

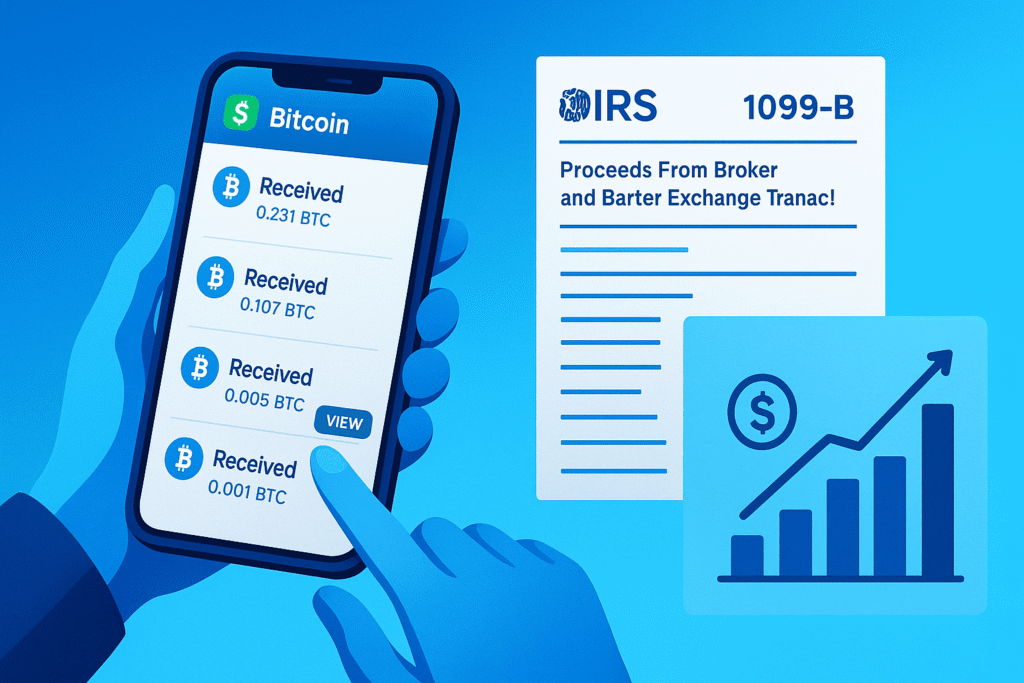

Cash App Bitcoin Taxes & IRS Reporting (250 words)

Like all U.S. crypto platforms, Cash App must report certain transactions to the IRS. When you buy, sell, or transfer Bitcoin, it may generate a taxable event.

Cash App provides:

- Form 1099-B (for capital gains/losses)

- Bitcoin transaction history

- Cost basis information

Selling BTC for profit creates capital gains tax; selling at a loss creates capital losses. Even sending or receiving BTC can have tax implications depending on how it’s used.

Because Cash App is fully U.S.-regulated, it handles reporting automatically, making it easier for users to track their tax responsibilities.

Is It Safe to Link My Bank Account to Cash App?

Generally, yes—linking your bank account to Cash App is safe. The app uses encryption, secure connections, and verified banking channels to handle transfers. It also requires identity checks before enabling key banking features.

However, users should still follow good practices:

- Use a strong password and PIN

- Avoid using Cash App on public Wi-Fi

- Turn on extra login notifications

Cash App cannot pull money without your permission, and your bank account remains protected by your bank’s security policies.

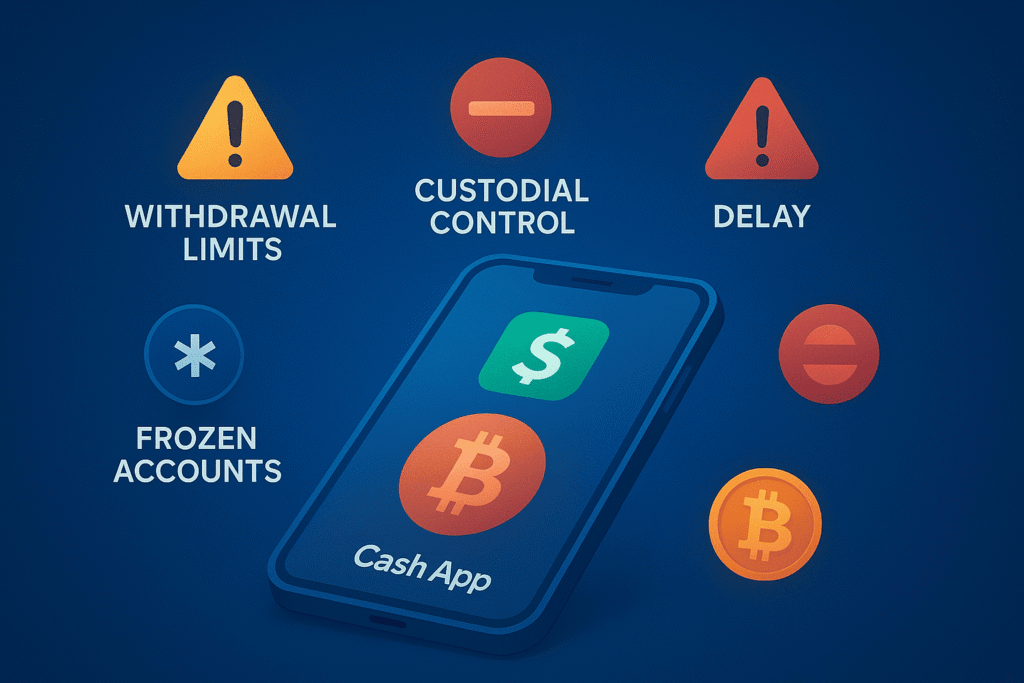

Risks of Using Cash App

Even though Cash App is one of the easiest platforms for buying, selling, and holding crypto, it does come with certain risks you should understand before investing. These risks don’t make Cash App unsafe—but they do highlight why users must stay cautious and informed.

Scams and Fraud

Cash App has always been a hotspot for impersonation scams, fake giveaways, and “Cash-Flipping” schemes—especially on social media. Scammers often pose as Cash App support agents or influencers promising unrealistic returns. Since Cash App transactions are fast and often irreversible, losing money to a scam usually means it’s gone for good. Cash App does offer some fraud protections, but they are limited, especially when crypto is involved. Users must stay alert and only trust official support channels.

No Bank Protection

Traditional bank accounts have FDIC insurance, meaning deposits are protected up to $250,000. Cash App balances stored in the app are not FDIC-insured when sitting in your wallet (except for funds held in a Cash App-linked bank partner account, which most users don’t activate). Crypto assets, including Bitcoin on Cash App, are also not insured. If Cash App ever experienced a severe technical failure, hack, or outage, your funds would not have the same protection as a traditional bank.

Account Issues

Cash App sometimes freezes accounts for suspicious activity, even when users haven’t done anything wrong. These automated security checks can temporarily lock your Bitcoin, stocks, or cash balance. Resolution times vary—some users get access back in hours, others in days.

Other Limits

Cash App imposes weekly Bitcoin withdrawal limits, sending limits, and identity verification requirements. These restrictions can slow down experienced traders who need flexibility. Additionally, crypto withdrawals sometimes face delays during network congestion.

Real-World Crypto Scam Risks

Crypto scams are rising every year, and Cash App users are often targeted because the platform is easy to access, fast to use, and popular among beginners. Understanding real-world scam scenarios helps you stay prepared and avoid losing money.

Fake Cash App Support Agents

One of the most common scams involves fraudsters pretending to be Cash App customer support on Twitter, Instagram, or even via phone calls. They ask users for their login code, email, or Bitcoin withdrawal address. Once they gain access, they drain the account instantly.

Tip: Cash App support will never ask for your sign-in code or PIN.

Giveaway & “Bitcoin Flip” Scams

Scammers promote fake giveaways like “Send $100, get $1,000 back” or “We flip your Bitcoin.” These posts look convincing and often use stolen profile pictures of influencers or entrepreneurs. Once you send money, the scammer disappears. There is no flipping—just theft.

These scams peak during bull markets when FOMO is high.

Phishing Websites & Fake Login Pages

Many users fall for phishing links that look identical to Cash App’s official website. These pages steal login details and route funds to a scammer’s wallet.

Tip: Always check the URL before logging in.

Investment Scam Groups on Telegram & Discord

Fraudulent groups promise “guaranteed daily profits,” “AI crypto signals,” or “whale alerts.” They pressure users to send BTC to “activate” their trading account.

Once the BTC is sent, it’s gone forever—Bitcoin transactions cannot be reversed.

Romance & Trust Scams

Scammers build emotional relationships through Instagram or dating apps, then convince victims to “invest together.” Victims end up sending Bitcoin through Cash App to a scammer-controlled wallet.

Cash App Daily Limits, Withdrawal Limits & Restrictions

Before using Cash App for buying, selling, or transferring crypto, you need to understand how its limits work. Cash App is designed for everyday users, not high-volume traders, so its daily and weekly restrictions can affect how you manage Bitcoin transactions.

Bitcoin Purchase Limits

Cash App allows users to buy Bitcoin easily, but purchase amounts depend on identity verification.

- Unverified accounts have very low buying power and may be restricted to small transactions.

- Verified accounts can typically buy up to several thousand dollars worth of BTC per week, depending on activity and risk checks.

Cash App adjusts limits dynamically based on your account history, spending behavior, and compliance checks.

Bitcoin Withdrawal Limits

This is the biggest restriction that advanced users often dislike.

Cash App currently limits BTC withdrawals to:

- A few thousand dollars per week (varies by user)

- A capped amount per 24-hour period

You must also enable Bitcoin withdrawals by completing full KYC, including providing your legal name, date of birth, and photo ID.

Additionally, Cash App requires you to withdraw at least a minimum amount of Bitcoin; tiny amounts below this threshold cannot be sent to an external wallet.

Sending & Receiving Limits

Regular Cash App payments also follow limits:

- Unverified users: can send/receive low amounts per month

- Verified users: can send and receive unlimited payments, but the app may still flag large or unusual transfers

For crypto transfers, network congestion can slow down withdrawals, especially during peak traffic.

Other Restrictions

- Cash App may pause transfers if it detects unusual activity

- High-risk transactions may be reviewed manually

- Bitcoin sent to the wrong wallet address cannot be recovered

- Some regions have additional crypto restrictions

Understanding these limits helps you plan your transactions better, especially if you trade frequently or rely on self-custody wallets.

How Cash App Handles Your Bitcoin

Cash App makes Bitcoin simple for beginners, but understanding how the app manages buying, storing, sending, and selling helps you use it more safely and efficiently. Here’s a clear breakdown of how Bitcoin works inside Cash App.

Buying Bitcoin

Cash App lets you buy Bitcoin instantly using your Cash App balance or linked debit card. You can purchase as little as a few dollars’ worth, making it extremely beginner-friendly.

Every BTC purchase shows your price, fees, and estimated market rate before confirming. Cash App supports recurring buys, allowing automatic daily, weekly, or monthly Bitcoin purchases.

Owning and Storing It

Once you buy Bitcoin, Cash App holds it in a custodial wallet, meaning Cash App controls the private keys, not you.

This is convenient for new users but not ideal for long-term crypto holders who prefer self-custody.

Your Bitcoin balance can rise or fall depending on the market, and it’s stored with Cash App’s security infrastructure—encrypted, monitored, and protected by advanced authentication.

Sending and Receiving

Cash App allows:

- On-chain BTC transfers to external wallets

- Lightning Network payments for fast, low-fee Bitcoin transfers

To withdraw BTC, you must verify your identity. There are daily and weekly limits, and transactions may take longer if the Bitcoin network is congested.

Selling Bitcoin

You can convert Bitcoin back to USD anytime. The sale is instant, and funds appear in your Cash App balance. The platform charges a small fee and spread, similar to other retail crypto apps.

Security and Fees

Cash App uses encryption, PIN protection, 2FA, and fraud monitoring to secure your Bitcoin. Fees include:

- A small trading fee

- A spread between buy/sell prices

- Network fees for BTC withdrawals

Lightning transfers usually cost almost nothing.

Cash App Crypto Pros

Cash App offers several advantages that make it one of the most popular apps for buying, selling, and holding Bitcoin in the U.S. Its simplicity, speed, and convenience appeal to both beginners and casual crypto users. Here’s a closer look at the main pros.

User-Friendly Interface

Cash App is designed with beginners in mind. Its clean, intuitive interface makes buying, selling, sending, and receiving Bitcoin extremely simple. You don’t need to understand complicated order books, charts, or advanced trading features. A few taps are all it takes to complete a transaction.

For users exploring other modern trading apps, check out key features modern crypto apps offer to see how simplicity and design can impact trading experience.

Fast and Instant Transactions

Purchases and sales on Cash App are almost instant. Your Bitcoin is available immediately in your account, and USD conversions are quick. Recurring buys make it easy to automate investing, helping you steadily accumulate Bitcoin over time.

Strong Security Measures

Cash App uses data encryption, PIN protection, two-factor authentication, and fraud monitoring. While it’s not perfect, these protections provide peace of mind for everyday users, especially beginners.

Regulated and U.S.-Compliant

Cash App operates under U.S. regulations, including FINCEN compliance. This gives users some assurance that the platform adheres to legal standards and anti-money-laundering protocols.

Low Minimums and Accessibility

You can buy very small amounts of Bitcoin, making Cash App accessible for anyone who wants to start investing with limited funds.

Overall, Cash App excels at convenience, ease of use, and accessibility, making it a great choice for newcomers or casual Bitcoin buyers who prioritize simplicity over advanced features.

Cash App Crypto Cons

While Cash App has many advantages, it’s not perfect for everyone. Understanding the downsides is crucial before relying on it as your primary crypto platform.

Limited Crypto Support

Cash App only supports Bitcoin (BTC). If you want to buy, sell, or store altcoins like Ethereum (ETH), Solana (SOL), or Dogecoin (DOGE), you’ll need another platform. This limitation restricts your ability to diversify your crypto portfolio.

For beginners exploring other apps with more coins, see best crypto trading apps in the USA.

No Private Key Access

Cash App is a custodial wallet, meaning you don’t control the private keys. This can be risky for long-term holders because your Bitcoin is dependent on Cash App’s security infrastructure. Self-custody wallets or hardware wallets offer more control and safety for serious investors.

Higher Fees

Compared to advanced crypto exchanges, Cash App’s buy/sell fees and spreads are relatively high. For small transactions, it’s negligible, but frequent or high-volume traders may pay significantly more. You can compare fees using crypto exchange fee comparison for better alternatives.

Limited Advanced Features

Cash App lacks features like:

- Limit and stop orders

- Advanced charting and analysis

- Staking or earning rewards

Advanced traders or active investors may find Cash App too basic for serious strategies.

Withdrawal and Transaction Limits

Daily and weekly BTC withdrawal limits, along with on-chain network delays, may restrict fast movement of funds—especially for large investors.

Cash App is best for beginners or casual users who value simplicity and convenience. However, serious crypto traders or long-term holders may need more flexible platforms.

Cash App vs Top Crypto Exchanges

When it comes to buying, selling, and managing Bitcoin, Cash App is often compared to top U.S. crypto exchanges like Coinbase, Kraken, Binance.US, and emerging platforms like BitGlide. Understanding how it stacks up can help you choose the right platform for your trading style.

Cash App

Cash App is beginner-friendly and mobile-first. Its strengths include:

- Simple interface for buying and selling BTC

- Instant transactions and quick withdrawals

- Low minimum purchase amounts

- Strong U.S. compliance and regulation

However, it only supports Bitcoin, lacks advanced trading tools, and charges higher fees compared to major exchanges.

Coinbase

Coinbase is one of the most trusted U.S. crypto exchanges. It supports hundreds of cryptocurrencies, staking rewards, and offers both beginner-friendly and advanced interfaces. Coinbase is ideal for users who want multiple crypto options and educational resources.

- Pros: Wide coin selection, staking, educational rewards

- Cons: Higher fees on the standard platform (lower on Coinbase Advanced)

Kraken

Kraken appeals to more experienced traders. It offers advanced order types, high liquidity, and competitive fees. U.S. users can access margin trading, staking, and comprehensive security features.

- Pros: Advanced tools, low fees, staking options

- Cons: Interface may be overwhelming for beginners

Binance.US

Binance.US is a low-fee exchange with a large selection of altcoins. It’s great for active traders and those looking to minimize trading costs.

- Pros: Low fees, multiple coins, advanced charts

- Cons: Not available in all U.S. states, may be complex for newcomers

BitGlide (2025 Trend)

BitGlide is gaining attention as the “Robinhood of crypto.” It combines simplicity with low fees, making it suitable for beginners who want fast execution and a modern interface.

Key Takeaways

- Beginners & casual buyers: Cash App is perfect for simplicity and speed.

- Diverse portfolios & staking: Coinbase or Kraken are better suited.

- Low fees & active trading: Binance.US and BitGlide shine.

For a detailed look at beginner vs. advanced apps, check out:

In short, Cash App excels at convenience but cannot replace full-featured exchanges for serious crypto investors.

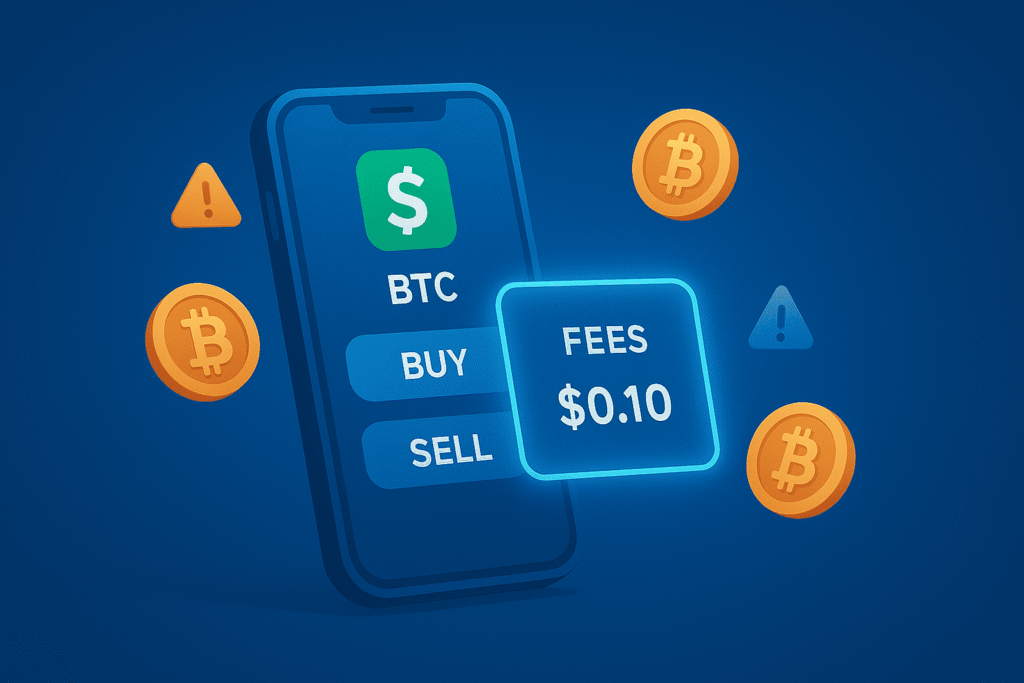

Cash App Crypto Fees for Bitcoin

Understanding fees is crucial before buying or selling Bitcoin on Cash App. While the platform is convenient, its fees can be higher than traditional exchanges. Here’s a breakdown of how Cash App crypto fees work in 2025.

Buy/Sell Fees by Amount

Cash App charges a service fee on every BTC transaction. This fee varies depending on the transaction size and current market conditions. Smaller purchases usually incur a higher percentage relative to the amount, while larger purchases may have slightly lower percentages.

For example:

- Buying $10–$50 worth of BTC may incur a 1–2% service fee

- Buying $500–$1,000 may have a slightly lower percentage

The fee is clearly displayed before confirming any transaction, so users know exactly what they will pay.

Extra Spread Cost

Cash App also adds a spread on Bitcoin trades. This means the purchase price of BTC is slightly higher than the market rate, and the selling price is slightly lower. Spreads fluctuate with market volatility and liquidity, often ranging between 0.5%–1.5%.

Withdrawal Fees

Sending BTC to an external wallet requires paying a network (miner) fee, which is not controlled by Cash App. This fee depends on Bitcoin network congestion and can vary from a few cents to several dollars.

Unlike some exchanges, Cash App does not charge extra withdrawal fees beyond the network cost, which is transparent and shown before confirming the transfer.

Key Takeaways

- Cash App fees are higher than most advanced crypto exchanges.

- The simplicity and speed may justify these costs for beginners.

- Active traders or high-volume users may want to compare with crypto exchange fee comparison to find more cost-efficient options.

- For safe crypto storage, consider combining Cash App with a hardware wallet for long-term holdings.

How to Send/Receive BTC on Cash App

Sending and receiving Bitcoin on Cash App is straightforward, but beginners must understand the process to avoid mistakes. Here’s a step-by-step guide to safely manage BTC transfers.

Set Up Cash App for Bitcoin

- Ensure your account is verified (KYC complete) to unlock Bitcoin sending and receiving.

- Enable two-factor authentication and set up a Cash App security lock for extra protection.

Get Bitcoin into Your Cash App

- Buy Bitcoin directly on Cash App using your linked bank account or balance.

- Alternatively, receive BTC from an external wallet by selecting “Deposit Bitcoin” and copying your Cash App wallet address.

Send Bitcoin from Cash App

- Open the Bitcoin section in the app.

- Tap “Send” and enter the recipient’s BTC wallet address.

- Enter the amount and review transaction fees.

- Confirm the transfer.

Tip: Always double-check the wallet address. BTC sent to the wrong address cannot be reversed.

Receive Bitcoin on Cash App

- Tap “Deposit Bitcoin”.

- Share your Cash App BTC address with the sender or scan a QR code.

- Wait for the transaction to confirm on the blockchain.

Key Tips for Safety

- Avoid sending Bitcoin over unsecured networks.

- Keep addresses and QR codes private.

- Confirm transactions carefully before sending large amounts.

- Use top 10 safest crypto trading apps in 2025 as references for security best practices.

Following these steps ensures smooth, secure Bitcoin transfers while minimizing the risk of scams or errors.

How to Withdraw Bitcoin to a Hardware Wallet Safely

If you want full control over your Bitcoin, withdrawing from Cash App to a hardware wallet is a smart move. Hardware wallets store your private keys offline, making your crypto much safer from hacks or app failures. Here’s how to do it safely.

What You Need First

- A verified Cash App account with sufficient BTC balance.

- A hardware wallet like Ledger or Trezor.

- The wallet properly set up with a secure PIN and recovery phrase stored offline.

Generate Wallet Address

- Open your hardware wallet’s companion app.

- Locate the Bitcoin receive address.

- Copy the address carefully—this is where your BTC will be sent.

Start Withdrawal on Cash App

- Open Cash App and navigate to the Bitcoin section.

- Tap “Withdraw Bitcoin”.

- Paste your hardware wallet address as the destination.

- Enter the amount you want to transfer and review fees.

Confirm and Wait Safely

- Double-check the address to avoid mistakes. BTC sent to the wrong address is unrecoverable.

- Confirm the withdrawal and wait for blockchain confirmations. Network speed can vary, so it may take several minutes to complete.

Key Safety Tips

- Never share your hardware wallet recovery phrase.

- Avoid public Wi-Fi when making withdrawals.

- Send a small test amount first before transferring large balances.

- Keep your hardware wallet firmware updated for security.

By following these steps, you ensure your Bitcoin is securely stored offline, giving you full control and reducing reliance on Cash App’s custodial wallet. For users exploring long-term strategies, hardware wallets are the safest choice for serious investors.

Is Cash App Good for Long-Term Bitcoin Investing?

Cash App is convenient for beginners and casual crypto users, but when it comes to long-term Bitcoin investing, there are several factors to consider.

Convenience and Accessibility

Cash App makes buying and holding Bitcoin simple. You can purchase small amounts, set up recurring buys, and monitor your portfolio on a mobile-friendly interface. For users starting their crypto journey, this ease of use is appealing.

Custodial Wallet Limitations

Cash App uses a custodial wallet, meaning you do not hold the private keys. While Cash App employs strong security measures, relying on a third party introduces risk. If your goal is to hold Bitcoin for several years, self-custody wallets or hardware wallets are safer options. You can learn how to withdraw Bitcoin to a hardware wallet safely to gain full control.

Fee Considerations

Frequent purchases or sales on Cash App can accumulate fees over time. For long-term investors making occasional buys, this may be manageable. For high-volume investing, platforms with lower trading fees may be more cost-efficient.

Regulation and Security

Cash App is U.S.-regulated and insured against certain operational risks, providing some peace of mind for long-term holders. However, it is not FDIC-insured for crypto balances, and BTC is subject to market volatility.

Bottom line: Cash App is a solid starting point for beginners looking to invest in Bitcoin gradually. Serious long-term investors should consider transferring funds to a self-custody or hardware wallet to maximize security and control.

Cash App for Active Traders

Cash App is designed primarily for beginners and casual users, so it’s not the ideal platform for active traders. While it offers convenience and quick transactions, several factors limit its suitability for frequent or high-volume trading.

Limited Trading Features

Active traders often need tools like limit orders, stop-loss, margin trading, and advanced charting. Cash App does not provide these options. Trades are executed instantly at market price, which is simple but lacks flexibility for strategic trading.

High Fees for Frequent Trading

Cash App’s buy/sell fees and spread can accumulate quickly if you trade Bitcoin often. In comparison, exchanges like Kraken, Binance.US, or Coinbase Advanced offer lower fees for high-volume traders. For fee comparisons, see crypto exchange fee comparison.

Withdrawal and Daily Limits

Daily and weekly Bitcoin withdrawal limits may hinder active traders who need to move funds quickly. Network congestion can also delay transactions.

Mobile-First Focus

Cash App is optimized for mobile, which is convenient for quick trades but may be limiting for users who prefer desktop platforms with multi-window charting and portfolio tracking.

Bottom line: Cash App is excellent for casual trading or long-term accumulation, but serious active traders should consider full-featured crypto exchanges that provide advanced tools, lower fees, and greater flexibility.

How to Use Cash App More Safely

While Cash App is convenient for buying, selling, and sending Bitcoin, practicing safe habits is crucial to protect your funds. Here are key strategies to enhance security and reduce risk.

Create Strong Passwords

Always use a unique, strong password for your Cash App account. Avoid using the same password across multiple platforms. Consider a password manager to securely store complex passwords.

Turn On Security Lock

Enable Cash App’s security lock feature, which requires a PIN or Touch ID/Face ID to authorize transactions. This adds an extra layer of protection if your phone is lost or stolen.

Enable Notifications

Turn on instant notifications for all account activity. This allows you to detect unauthorized transactions quickly and take immediate action.

Verify Recipients

Before sending Bitcoin, double-check wallet addresses. Scammers often replace a single character in a Bitcoin address to steal funds. Always copy and paste carefully or scan QR codes directly.

Watch for Scams

Be wary of messages claiming to be Cash App support or promising unrealistic Bitcoin returns. Cash App will never ask for your PIN or sign-in code. For scam awareness, see top 10 safest crypto trading apps in 2025.

Extra Device Tips

- Keep your phone’s OS and apps updated.

- Avoid public Wi-Fi when making crypto transactions.

- Use hardware wallets for long-term Bitcoin storage.

By following these steps, you can significantly reduce the risk of fraud, account theft, and accidental loss. Safe practices combined with Cash App’s built-in security features make it easier to use the app confidently for Bitcoin trading and storage.

Cash App Customer Support for Crypto

Customer support is an essential aspect of any crypto platform, especially for beginners. Cash App offers a range of support options, but there are limitations to consider.

In-App Support

Cash App provides in-app support through the “Profile → Support” section. Users can submit questions about Bitcoin transactions, account issues, or verification problems. Response times vary but are generally within 24–48 hours.

Live Chat and Email

Cash App offers live chat and email support for more complex issues. These channels can help with transaction errors, withdrawal problems, or security concerns. Keep in mind that Cash App will never ask for your PIN or sign-in code over email or chat.

Self-Help Resources

The app includes a Help Center with guides on buying, selling, sending, and receiving Bitcoin. Topics include troubleshooting failed transactions, understanding fees, and account verification. These resources are particularly useful for beginners.

Limitations to Know

- No phone support is available for crypto-related issues.

- Response times may be slower during high-traffic periods or crypto market volatility.

- Some problems, like mistaken Bitcoin transfers, cannot be reversed.

Tips for Effective Support

- Always provide clear transaction details (time, amount, and transaction ID) when contacting support.

- Document all communications for reference.

- Use official channels only; avoid third-party websites claiming to offer Cash App support.

While Cash App’s support is functional for basic crypto issues, it may not meet the needs of active traders or high-volume users. Combining Cash App with external resources and security precautions can help resolve problems efficiently.

Real User Sentiment (2025)

Understanding real user sentiment is crucial when evaluating Cash App for Bitcoin and crypto transactions. In 2025, feedback from beginners, casual investors, and tech-savvy users reveals a mix of praise and concerns.

Positive Sentiments

Many users appreciate Cash App’s simplicity and convenience. Buying Bitcoin takes just a few taps, and the mobile-first interface makes it accessible for people who are new to crypto. Recurring buys and instant transactions are highly valued, especially for beginners who want to accumulate Bitcoin gradually.

Security measures like PIN protection, two-factor authentication, and instant notifications are also well-received. Users feel confident that their BTC is safeguarded within Cash App’s regulated environment. Casual traders often highlight the low minimum purchase amounts, making crypto accessible without committing large sums.

Mixed Opinions

Some users mention high fees and spreads as a downside. While acceptable for small, occasional purchases, these costs become noticeable for frequent traders. Another common point is the custodial wallet limitation. Tech-savvy users who understand self-custody express concern about not having direct control over private keys.

Negative Feedback

A few users report frustration with withdrawal limits and transaction delays, particularly during times of network congestion. There are also occasional complaints about customer support response times, especially for complex issues.

Overall Trends

- Beginners: overwhelmingly positive; value ease of use and regulatory compliance

- Active traders: mixed; prefer more advanced tools, lower fees, and self-custody

- Security-conscious investors: cautious; recommend transferring Bitcoin to a hardware wallet

In summary, real user sentiment in 2025 shows Cash App as a reliable choice for casual users and beginners, but less suited for active traders or long-term investors seeking full control.

Final Verdict: Should You Use Cash App for Crypto in 2025?

Cash App remains one of the most convenient and beginner-friendly platforms for buying, selling, and holding Bitcoin in 2025. Its mobile-first design, instant transactions, and low minimum purchase amounts make it ideal for casual users and newcomers to crypto. Strong security measures, including PIN protection, two-factor authentication, and regulatory compliance, add peace of mind for everyday Bitcoin management.

However, Cash App has limitations. It only supports Bitcoin, uses a custodial wallet (so you don’t hold private keys), and charges higher fees compared to full-featured exchanges. Active traders or long-term investors may find its lack of advanced trading tools, limited withdrawal options, and fee structure restrictive.

Bottom line:

- Beginners & casual investors: Cash App is safe, simple, and accessible.

- Active traders & long-term holders: Consider transferring BTC to a hardware wallet or using more advanced exchanges for control, lower fees, and flexibility.

For more insights and comparisons of crypto trading platforms, explore all crypto trading app reviews here.

Frequently Asked Questions

Still have questions about using Cash App for Bitcoin? Whether you’re a beginner or a seasoned trader, these FAQs cover the most common concerns—safety, fees, withdrawals, and more—to help you make informed decisions in 2025.

Q1: Is Cash App safe for buying Bitcoin?

Yes. Cash App is U.S.-regulated, uses encryption, PINs, two-factor authentication, and fraud monitoring to protect users’ Bitcoin.

Q2: Can Cash App be hacked?

While no system is completely immune, Cash App has strong security measures. Most hacks occur due to user error, like sharing passwords or falling for scams.

Q3: Does Cash App give private keys?

No. Cash App uses a custodial wallet, meaning you do not control private keys. For full control, consider withdrawing Bitcoin to a hardware wallet.

Q4: Does Cash App charge fees?

Yes. Cash App charges service fees and adds a spread to Bitcoin trades. Network fees apply for sending Bitcoin off-platform.

Q5: Is Cash App good for beginners?

Absolutely. Its simple interface, low minimum purchases, and instant transactions make it beginner-friendly.

Q6: Can I withdraw to a hardware wallet?

Yes. You can withdraw BTC to any external wallet, including hardware wallets, to gain full custody.

Q7: Is Cash App regulated in the U.S.?

Yes. Cash App operates under U.S. regulations, including FINCEN compliance.

Q8: Does Cash App support ETH?

No. As of 2025, Cash App only supports Bitcoin. Users looking for Ethereum or other altcoins need a full-featured exchange.

About the Author ✍️

Abhishek Chandravanshi is a crypto enthusiast and founder of CryptoTrendd.com, where he explores crypto trading apps, Bitcoin security, and insights for aspiring crypto entrepreneurs. With a focus on helping beginners and casual investors navigate platforms like Cash App, Abhishek provides practical reviews, safety tips, and the latest trends in digital currency. His in-depth guides, including the “Is Cash App Safe for Crypto? Full Review 2025,” aim to make crypto trading accessible, secure, and profitable for everyone