Best Crypto Investing Apps in 2025: Secure & Easy Platforms for Beginners

Crypto investing has gone mainstream in 2025, with over 420 million people worldwide now holding digital assets, according to Statista. Mobile-first platforms are driving this surge—making crypto trading as effortless as using PayPal. As highlighted in Brian Armstrong’s crypto predictions for 2025, the next wave of growth will come from user-friendly investing apps built for everyday investors. Today’s platforms are revolutionizing access by offering low fees, real-time data, and built-in learning tools. Simply put, crypto made easy with beginner apps has become the new normal for anyone entering digital finance.

What Is a Crypto Investing App?

A crypto investing app is your all-in-one gateway to the digital asset world. Instead of using complicated exchanges or desktop platforms, these mobile apps let you buy, sell, and manage cryptocurrencies right from your phone. Think of them as your personal crypto bank—secure, flexible, and always within reach.

Most top crypto trading apps go beyond simple trading. They combine investing tools, real-time portfolio tracking, staking options, and even AI-based insights to help you make smarter decisions. The goal is simple: make crypto investing accessible for everyone, not just tech-savvy traders.

These apps usually connect directly to your payment methods, like bank accounts or credit cards, allowing seamless deposits and withdrawals. They also provide transparent charts, live prices, and market updates so you can react quickly to trends.

In short, a crypto investing app bridges the gap between traditional finance and the digital economy. Whether you’re holding Bitcoin long-term or exploring altcoins for short-term gains, these apps offer a safe, easy, and mobile-first way to grow your investments.

Why Use Crypto Investing Apps in 2025?

The year 2025 marks a major turning point for crypto adoption. According to Statista, over 420 million people worldwide now own cryptocurrency — a number expected to reach 600 million by 2027. What was once seen as complex and risky is now becoming mainstream, thanks to user-friendly investing apps. These tools remove barriers, making digital investing accessible to anyone with a smartphone.

For U.S. investors, our review of the top crypto apps for beginners shows that platforms like Coinbase, Kraken, and BitGlide are leading with low fees, AI-powered insights, and improved staking options—features once exclusive to professional traders.

Let’s explore why these apps have become essential for modern investors.

Easier Way to Start Investing

In 2025, onboarding new crypto users is smoother than ever. Apps like Coinbase report that over 75% of new users complete registration and buy their first crypto within 24 hours. These platforms are designed to make crypto made easy with beginner apps—featuring built-in tutorials, instant verification, and guided purchase options.

24/7 Access

Unlike the stock market, crypto operates 24 hours a day, 7 days a week. You can trade during a commute, lunch break, or late at night. This flexibility has driven a 38% increase in mobile trading volume since 2023.

Low Fees and Fast Transactions

New-generation investing apps leverage optimized blockchain networks to cut costs. Kraken’s average trading fee sits around 0.16%, while BitMart offers zero-fee trading on select pairs, making it easier for small investors to participate without losing profits to commissions.

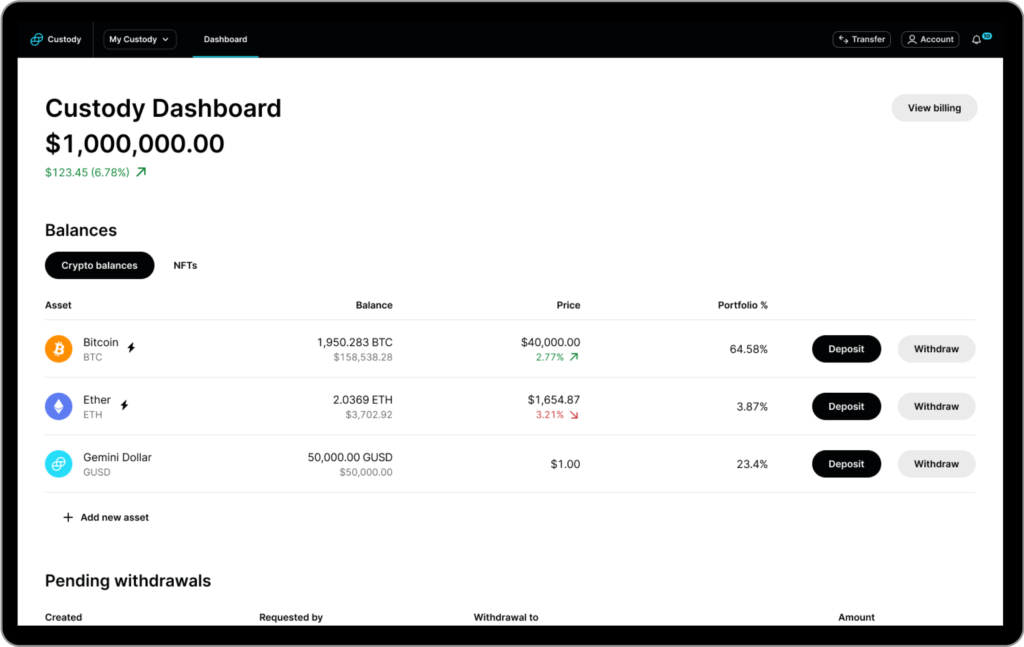

Easy Portfolio Tracking

Apps now offer real-time performance dashboards. According to Gemini’s 2025 update, over 80% of its users rely on built-in profit and loss trackers instead of third-party tools.

Strong Security

Security remains a top concern, and apps are stepping up. Coinbase stores 98% of customer funds in cold storage, while Crypto.com provides $750 million in insurance coverage against potential breaches.

Earning Rewards

Staking through mobile apps has become a steady income stream. For example, users staking Ethereum through Kraken or Coinbase can earn between 3.2% and 5% APY, while some DeFi-linked apps offer up to 8% on stablecoins.

Global Investment Opportunities

Crypto investing apps now support access to global markets with multi-currency wallets and international fiat deposits. Platforms like BitMart list 1,700+ cryptocurrencies, giving investors exposure to emerging tokens and international projects.

Key Features to Look for in a Crypto Investing App

Not all crypto investing apps are created equal. The best ones balance security, usability, and cost-efficiency—helping you grow your portfolio without unnecessary risks. Before downloading, it’s smart to compare the key features of leading crypto trading apps to see which platform suits your goals. Here’s what to look for in 2025.

Strong Security

Security should always come first. Look for apps that offer two-factor authentication (2FA), cold storage, and insurance coverage. Coinbase secures 98% of assets offline, while Crypto.com backs user funds with $750 million in insurance.

Easy to Use

A smooth interface makes all the difference for beginners. Apps like BitGlide and Gemini are known for clean dashboards and simple onboarding that takes less than 10 minutes. Even first-time users can easily buy their first crypto with guided prompts.

Real-Time Market Data

Live charts, price alerts, and AI insights are must-haves. In 2025, many apps integrate tools like TradingView charts and AI-powered portfolio suggestions to help investors react to market changes quickly.

Portfolio Tracking

Top apps now offer built-in tracking tools. Gemini reports that over 80% of its users monitor performance through in-app profit/loss dashboards, eliminating the need for external spreadsheets.

Low and Transparent Fees

Hidden costs can eat into profits. Fee-conscious investors should explore crypto trading apps with no fees. BitMart, for instance, offers zero-fee trading on select pairs, while Kraken averages just 0.16% per trade.

Wide Range of Cryptocurrencies

Diversification is key. Some platforms, like BitMart, list over 1,700 digital assets, compared to just 200–250 on most exchanges.

Fast and Reliable Performance

A good app shouldn’t freeze during market swings. Binance and Kraken boast 99.9% uptime, ensuring trades execute even during high volatility.

Helpful Educational Content

Apps that include tutorials and explainers help users learn while they invest. Coinbase’s “Learn and Earn” program has rewarded over $100 million in free crypto for completing lessons.

Customer Support

Responsive support matters. Look for 24/7 chat options or fast email response times. In 2025, Coinbase and Crypto.com rank among the top for customer satisfaction.

Integration and Compatibility

Modern apps connect easily with hardware wallets, DeFi tools, and tax software, giving users more flexibility to manage assets across platforms.

How to Choose the Right Crypto Investing App for Beginners

Choosing your first crypto investing app can feel like picking the right pair of shoes — you need comfort, reliability, and a fit that suits your style. The good news? In 2025, the best crypto investing platforms are built specifically for beginners, offering smooth interfaces, low fees, and hands-on learning tools.

If you’re unsure where to start, check out our step-by-step guide on how to use a crypto app as a beginner. But before downloading anything, here are key factors to consider.

Easy-to-Use Interface

A simple dashboard saves time and confusion. Apps like Coinbase and BitGlide offer clean layouts that even first-time users can navigate easily. BitGlide’s 2025 update includes a “Quick Buy” feature that lets users purchase Bitcoin or Ethereum in under 60 seconds, making it ideal for beginners.

Security Features

Never compromise on security. Look for 2FA (Two-Factor Authentication), biometric login, and insurance-backed protection. Coinbase’s cold storage system secures 98% of funds offline, while Kraken uses bank-level encryption and regular third-party audits to maintain trust.

Low and Clear Fees

Transparency matters. Hidden fees can silently drain your returns. Kraken remains one of the best options with 0.16% average trading fees, while BitMart and Binance periodically offer zero-fee promotions for popular pairs.

Supports Popular Cryptocurrencies

Pick an app that supports top assets like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Cardano (ADA). Coinbase lists over 250 assets, while BitMart leads with 1,700+ coins, giving users more freedom to diversify.

Educational Resources

Beginners learn best by doing. Coinbase’s “Learn and Earn” feature has rewarded users with over $100 million in crypto for completing bite-sized lessons. BitGlide’s in-app academy also provides easy video tutorials explaining everything from wallet safety to dollar-cost averaging.

Customer Support

Good support means less stress when things go wrong. Coinbase, Crypto.com, and BitGlide all offer 24/7 live chat. Many users say fast support helped them recover locked accounts or resolve withdrawal issues quickly.

Newer platforms like the BitGlide crypto investing app are earning praise for combining all these features into one beginner-friendly package—offering smooth UX, strong security, and AI-guided portfolio insights.

Best Crypto Investing Apps in 2025 (Ranked & Reviewed)

Choosing the right app can be overwhelming given the hundreds of options available today. To simplify things, we’ve ranked and reviewed the top crypto investing apps in 2025 based on security, ease of use, fees, supported assets, and customer satisfaction.

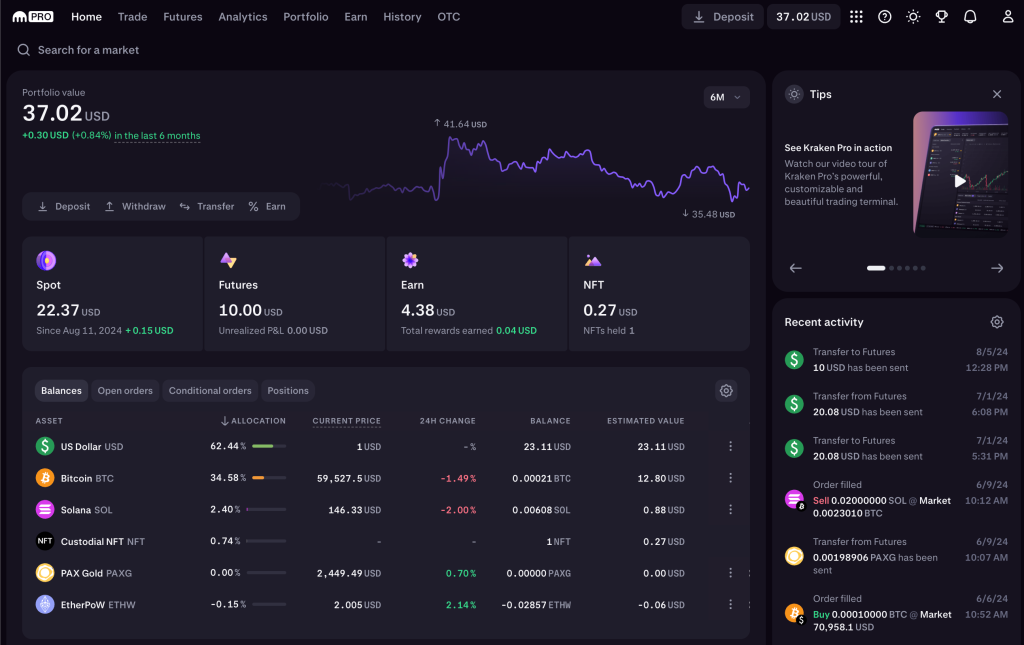

Kraken

Overview: Kraken has been a trusted name since 2011, known for strong security and low fees.

Official Link to Download :-

For Android User – Kraken

For IOS User – Kraken

Key Features:

- Security: 98% of funds in cold storage, two-factor authentication, and regular audits.

- Fees: Maker fees from 0.16%, taker fees from 0.26%, with discounts for high-volume traders.

- Assets: Supports over 200 cryptocurrencies, including BTC, ETH, SOL, and ADA.

- Special Features: Offers staking, margin trading, and futures trading.

Why It’s Great for Beginners: Kraken’s user interface has been simplified for 2025, with a Quick Buy option and built-in portfolio tracking. Users can also stake crypto directly in-app to earn passive rewards.

Gemini

Overview: Gemini is highly regulated in the U.S., offering top-notch security and a beginner-friendly experience.

Official Link to Download :-

For Android User – Gemini

For IOS User – Gemini

Key Features:

- Security: SOC 2 Type 2 compliance, biometric login, and $200 million in insurance coverage.

- Fees: Trading fees range from 0.35% for small trades, with low-cost Gemini ActiveTrader for experienced users.

- Assets: Supports over 100 cryptocurrencies, plus a secure mobile crypto wallet.

- Special Features: Earn program allows staking of stablecoins and BTC.

Why It’s Great for Beginners: Gemini’s clean mobile interface and built-in learning resources make it easy to start investing safely.

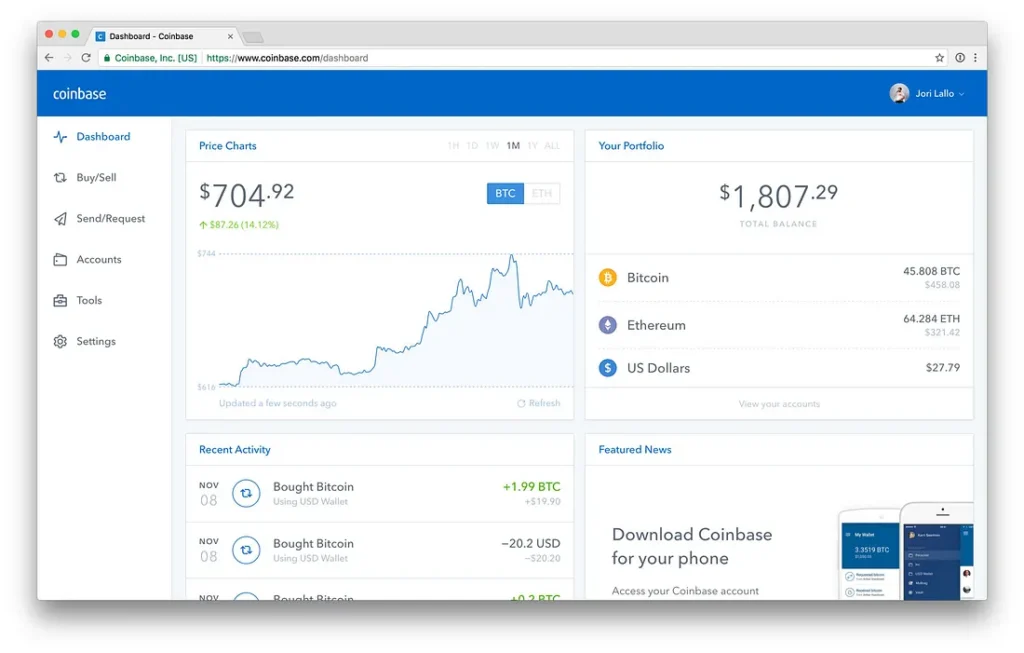

Coinbase

Overview: Coinbase is one of the largest and most recognized crypto platforms globally.

Official Link to Download :-

For Android User – Coinbase

For IOS User – Coinbase

Key Features:

- Security: 98% of assets in cold storage, insurance protection against hacks.

- Fees: Standard fees ~1.49%, though Coinbase Pro offers lower trading fees for active users.

- Assets: Supports 250+ cryptocurrencies with daily market insights.

- Special Features: “Learn and Earn” rewards program, recurring buys, and staking options.

Why It’s Great for Beginners: Coinbase offers guided tutorials and intuitive charts. Its educational resources have rewarded users with over $100 million in crypto while learning the basics.

Crypto.com

Overview: Crypto.com combines investing, payments, and earning features in one ecosystem.

Official Link to Download :-

For Android User – Crypto.com

For IOS User – Crypto.com

Key Features:

- Security: Two-factor authentication, cold storage, and insurance coverage.

- Fees: Trading fees from 0.04% to 0.40%, depending on volume and token staking.

- Assets: Supports over 350 cryptocurrencies and stablecoins.

- Special Features: Crypto debit cards, staking, and DeFi integration.

Why It’s Great for Beginners: The app provides easy-to-use tools for recurring buys, staking, and crypto spending, helping new users integrate crypto into everyday life.

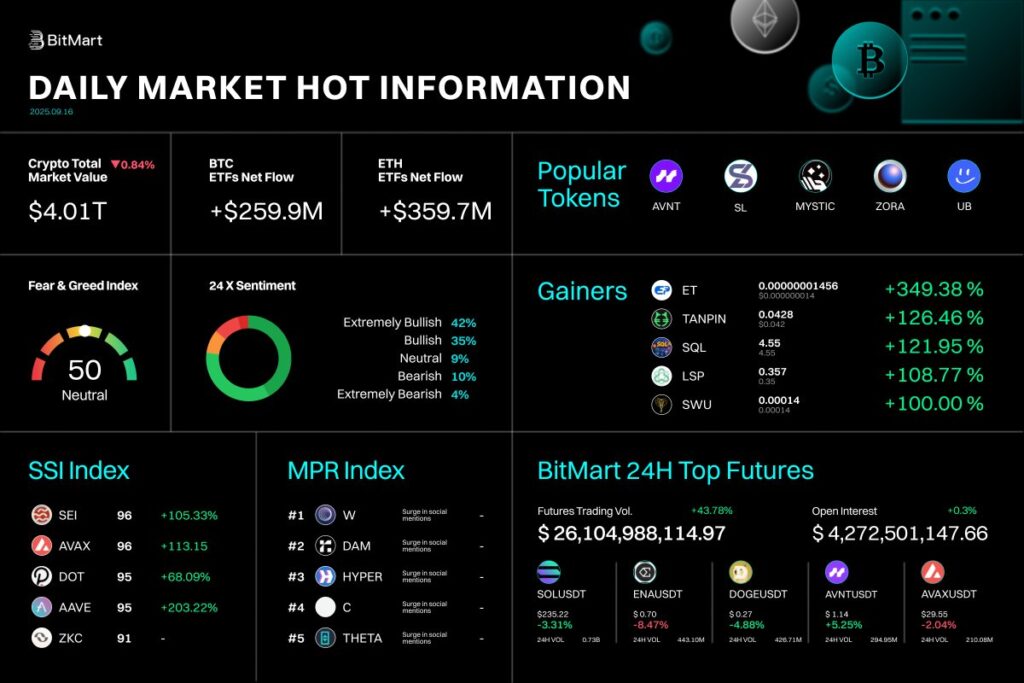

BitMart

Overview: BitMart is ideal for investors seeking a wide range of cryptocurrencies.

Official Link to Download :-

For IOS User – BitMart

Key Features:

- Security: Cold storage, multi-signature wallets, and regular security audits.

- Fees: Standard trading fee 0.25%, with occasional zero-fee trading pairs.

- Assets: Offers over 1,700 cryptocurrencies, the largest selection among mainstream apps.

- Special Features: AI-powered investing assistants, auto-portfolio rebalancing, and NFT marketplace.

Why It’s Great for Beginners: While slightly more advanced, BitMart’s mobile app includes tutorials and automated tools, helping beginners explore a huge crypto variety without getting overwhelmed.

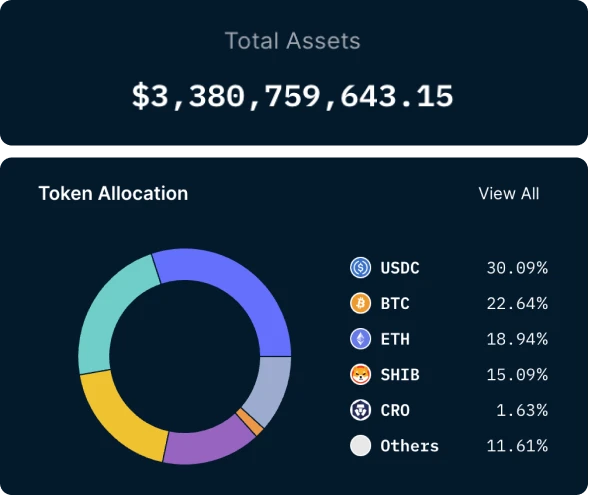

Which Crypto Investing App Offers the Largest Selection?

For investors who want access to a wide variety of digital assets, BitMart clearly leads the pack. It supports over 1,700 cryptocurrencies, including top coins like Bitcoin, Ethereum, Solana, and Cardano, as well as niche altcoins and emerging tokens.

By comparison:

- Kraken: ~200 coins

- Coinbase: ~250 coins

- Gemini: ~100 coins

- Crypto.com: ~350 coins

A larger selection allows investors to diversify portfolios, explore new projects, and tap into potential high-growth opportunities. However, beginners should balance variety with usability—too many options can be overwhelming without proper guidance.

AI-Powered Investing Assistants and Auto-Portfolio Features

In 2025, AI tools are transforming crypto investing. Many apps now include AI assistants that provide:

- Personalized portfolio allocation suggestions based on risk tolerance

- Alerts for market changes or volatility

- Auto-rebalancing of assets to maintain desired risk exposure

For example, BitMart and BitGlide offer auto-portfolio features that let beginners invest without constantly monitoring the markets. AI can even suggest staking or reward-earning opportunities based on market trends, making investing more hands-off and safer for newcomers.

Hidden Fees & Transparency: What Beginners Often Miss

Even small fees can eat into your crypto profits if you’re not careful. Here’s what to watch out for:

- Spread Fees: This is the difference between the price to buy and the price to sell a coin. Even a small gap can reduce profits over multiple trades.

- Deposit & Withdrawal Fees: Moving money in or out of your app may incur extra charges. For example, Kraken or Binance have different fees depending on the payment method.

- Network Fees: Sending crypto between wallets requires blockchain fees, which can fluctuate based on network traffic.

- Inactivity Fees: Some apps charge small monthly fees if your account isn’t active.

- Conversion Fees: Exchanging one coin for another, or converting fiat currency, often comes with hidden charges.

- Premium Feature Fees: Advanced features like auto-portfolio tools or AI assistants may have subscription costs.

💡 Tip: Always check the app’s fee schedule before trading. Platforms like Kraken, Coinbase Pro, and Gemini are known for clear, transparent pricing that beginners can trust.

Regulation & Compliance of Crypto Investing Apps in 2025

Regulation is a key factor when choosing a crypto investing app. In 2025, platforms are increasingly held to strict standards to protect investors, prevent fraud, and ensure legal compliance. Understanding these rules helps beginners invest safely and avoid legal issues.

KYC & AML Requirements

Most reputable apps require Know Your Customer (KYC) verification and Anti-Money Laundering (AML) checks. This means you’ll need to submit an ID and sometimes proof of address. For example, Gemini and Coinbase verify accounts within 24–48 hours. These steps prevent illegal activity and keep your funds secure.

Licensing and Official Registration

Apps operating legally must have proper licenses. Coinbase is registered in all 50 U.S. states and holds multiple international licenses, while Kraken has licenses in Europe, Canada, and Asia. Licensed apps provide investors confidence that their funds are regulated and monitored.

Tax Compliance on Crypto Profits

Many platforms now offer built-in tax reporting tools. Coinbase, Kraken, and Crypto.com allow users to download tax-ready reports, helping comply with IRS regulations in the U.S. or similar authorities elsewhere. This feature simplifies tax filing for beginners and avoids penalties for underreporting crypto gains.

Global Oversight

Leading apps comply with international standards, including anti-fraud protocols, secure storage, and financial reporting. This ensures that even if you live outside the U.S., your investments follow globally recognized rules, reducing the risk of scams or sudden account freezes.

💡 Tip for Beginners: Always choose apps with verified licenses, clear KYC processes, and tax reporting tools. This ensures your investing journey is legal, safe, and hassle-free. For example, Top 10 safest crypto trading apps in 2025 offer all these compliance features in one place.

Security Considerations for Beginner Investors

Investing in crypto is exciting, but it comes with risks. Security should be your top priority—especially for beginners. Here’s how to protect your funds in 2025.

Use Strong Passwords and Two-Factor Authentication (2FA)

Always create a unique, complex password for your crypto accounts. Combine letters, numbers, and symbols. Enable 2FA for an extra layer of protection. Apps like Coinbase, Kraken, and BitGlide support Google Authenticator or SMS-based 2FA.

Pick Safe and Reputable Apps or Exchanges

Stick to well-known, regulated apps. Coinbase, Kraken, and Gemini have proven track records and comply with U.S. and global regulations. Avoid unverified apps with glowing promises but no official licensing.

Protect Your Crypto with Secure Wallets

Don’t leave large amounts of crypto on exchanges. Use hardware wallets like Ledger or Trezor for long-term storage. Mobile wallets can be convenient, but hardware wallets reduce the risk of hacking.

Watch Out for Phishing Scams

Be cautious of emails, messages, or websites that mimic crypto apps. Always double-check URLs and never share your private keys. Even experienced traders fall for fake login pages.

Keep Your Devices and Internet Secure

Update your phone, tablet, or computer regularly, and use antivirus software. Avoid public Wi-Fi when making transactions. A secure device is your first line of defense.

Never Share Your Private Keys

Your private key is your crypto’s password. Sharing it or storing it online can lead to irreversible losses. Treat it like cash in a safe.

Stay Informed and Avoid Unrealistic Promises

Be skeptical of apps or influencers promising guaranteed returns or “double your crypto in days.” Legitimate platforms never guarantee profits. Keep learning and verify claims before acting.

💡 Pro Tip: Platforms like Top 10 safest crypto trading apps in 2025 combine strong security, regulation, and user-friendly tools to help beginners invest safely.

Are Crypto Investing Apps Safe?

The short answer: yes, but with precautions. Crypto investing apps in 2025 have become much safer than in the early days, thanks to regulation, advanced security measures, and insurance coverage. However, no system is completely risk-free, so understanding safety protocols is crucial.

Why they are generally safe:

- Regulation & Licensing: Platforms like Coinbase, Gemini, and Kraken are fully licensed in multiple jurisdictions and comply with KYC/AML laws. This reduces the risk of fraud or sudden shutdowns.

- Insurance & Cold Storage: Leading apps store 98% of user funds offline in cold wallets and often provide insurance against hacks. Coinbase, for example, insures digital assets held on its servers up to $255 million.

- Secure Authentication: Two-factor authentication (2FA) and biometric logins make unauthorized access extremely difficult.

Risks to keep in mind:

- Leaving funds on unverified apps or exchanges with weak security can lead to theft.

- Phishing attacks, scams, and malware can compromise even secure accounts if users are careless.

- Cryptocurrency markets are volatile; losses can occur even without hacking or fraud.

Bottom line for beginners: Crypto apps like Coinbase, Kraken, Gemini, and BitGlide are safe when used correctly. Always enable security features, use reputable apps, and avoid suspicious links or offers. Treat your private keys like cash—never share them, and consider hardware wallets for long-term storage.

💡 Tip: Beginners can start with small amounts on trusted apps to get comfortable before scaling up investments.

How is Investing in Crypto Different from Investing in Stocks?

Investing in crypto can feel similar to stocks at first glance, but there are key differences every beginner should understand.

What You Are Buying

- Stocks: When you buy a stock, you own a fraction of a company. Your returns come from dividends and stock price growth.

- Crypto: Buying a cryptocurrency means you own a digital token. There’s no company behind it in the traditional sense (except for stablecoins or tokens backed by projects). The value is driven mainly by market demand, adoption, and speculation.

Market Regulation

- Stocks: Heavily regulated by government bodies (e.g., SEC in the U.S.). Reporting and transparency are mandatory.

- Crypto: Regulation varies by country. In 2025, major apps like Coinbase, Kraken, and Gemini comply with global standards, but smaller exchanges may operate with less oversight.

Trading Hours and Volatility

- Stocks: Traditional exchanges have fixed trading hours, and prices generally move more slowly.

- Crypto: Markets are open 24/7, and prices can swing dramatically in hours. For example, Bitcoin’s price fluctuated between $27,500 and $30,000 in a single week in October 2025. This offers opportunities but increases risk.

Security and Ownership

- Stocks: Held in brokerage accounts; the broker manages security.

- Crypto: You are responsible for securing your tokens. Storing crypto in wallets (hardware or mobile) is critical to prevent theft.

Investment Purpose

- Stocks: Typically viewed as a long-term investment for growth or income.

- Crypto: Can be used for investing, trading, staking, payments, or even DeFi activities. Beginners should focus on learning, small-scale investing, and understanding risk.

💡 Tip: Think of crypto like a digital high-tech asset: exciting, flexible, but requiring more personal responsibility. Start small, use trusted apps, and gradually explore features like staking or AI portfolio tools.

Benefits of Using Investing Apps Over Traditional Exchanges

Crypto investing apps have transformed how beginners enter the digital asset market. Unlike traditional exchanges, these apps provide convenience, speed, and accessibility that are perfect for new investors.

Easy to Use

Investing apps are designed with simplicity in mind. Platforms like Coinbase, Gemini, and BitGlide allow users to buy crypto with just a few taps, without navigating complex order books or trading interfaces. Beginners can invest confidently without prior experience.

24/7 Access

Traditional stock exchanges have fixed hours, but crypto markets never sleep. Apps provide access anytime, anywhere, so you can monitor prices, trade, or manage your portfolio whenever needed.

Lower Fees

Many crypto apps offer competitive fee structures compared to traditional brokers. For instance, Coinbase Pro and Kraken have lower spreads and reduced trading fees for active users, helping beginners maximize returns.

Fast Transactions

Deposits, withdrawals, and crypto trades happen in minutes or hours, unlike bank transfers or traditional stock settlements that can take days. Mobile wallets integrated within apps further simplify transfers.

Global and Inclusive

Apps let you invest in cryptocurrencies worldwide, not limited by geographic borders. Whether it’s Bitcoin, Ethereum, or emerging altcoins, apps provide access to global markets that were previously hard for beginners to reach.

More Control and Privacy

Unlike traditional brokers, crypto apps allow you to control your private keys and manage wallets directly. This provides both ownership and flexibility, while still offering regulatory compliance.

Transparent and Secure

Leading apps use cold storage, 2FA, and insurance coverage, making them safer than keeping funds in local wallets or unregulated platforms. Beginners can invest with peace of mind knowing their funds are protected.

💡 Tip: Apps like Kraken and Coinbase combine user-friendly interfaces, strong security, and global access, making them ideal for new investors in 2025.

How to Get Started with a Crypto Investing App

Starting your crypto journey in 2025 is easier than ever, thanks to beginner-friendly apps. Here’s a step-by-step guide to get you going safely and efficiently.

Choose a Crypto Investing App

Pick a reputable, regulated app that fits your needs. Top options in 2025 include Coinbase, Kraken, Gemini, Crypto.com, and BitGlide. Consider factors like fees, security features, available cryptocurrencies, and user interface.

Create and Verify Your Account

Sign up with your email and set a strong password. Complete KYC verification by submitting your ID and proof of address. This step is crucial for security and legal compliance. Most apps verify accounts within 24–48 hours.

Deposit Money into Your Account

Transfer funds using bank transfer, debit/credit card, or PayPal (availability depends on the app). Check for deposit fees; some apps like Coinbase Pro offer fee-free deposits for certain methods.

Select and Buy Cryptocurrency

Browse available coins and select your first investment. Beginners often start with Bitcoin (BTC) or Ethereum (ETH) due to stability and market recognition. Enter the amount, review fees, and confirm the purchase.

Secure Your Investments

- Enable Two-Factor Authentication (2FA).

- Consider transferring large amounts to hardware wallets like Ledger or Trezor for long-term storage.

- Avoid leaving funds on apps for extended periods unless necessary.

Track and Manage Your Portfolio

Use the app’s portfolio dashboard to monitor gains, losses, and allocation. Many apps also offer alerts, AI suggestions, and performance charts to help beginners make informed decisions.

💡 Pro Tip: Start small to get comfortable. Apps like How to use a crypto app as a beginner offer detailed tutorials for step-by-step guidance.

Top Mistakes Beginners Make While Using Crypto Apps (and How to Avoid Them)

Crypto investing can be exciting, but beginners often fall into common traps. Understanding these mistakes helps you protect your funds and invest smarter.

Chasing Quick Riches

Many new investors buy hype coins or follow trends hoping to get rich fast.

Avoid it: Focus on well-known cryptocurrencies like Bitcoin and Ethereum first.

Skipping Research

Investing without understanding the coin or project can lead to losses.

Avoid it: Read whitepapers, check the team behind the project, and follow credible news sources.

Falling for Hype Coins

Social media can push coins that lack fundamentals.

Avoid it: Verify market cap, liquidity, and adoption before buying.

Leaving Money on Exchanges

Storing crypto long-term on exchanges exposes it to hacks.

Avoid it: Use hardware wallets or trusted mobile wallets for long-term storage.

Investing More Than You Can Afford to Lose

Crypto is volatile; over-investing can cause stress or financial harm.

Avoid it: Only invest money you are willing to lose.

Ignoring Stop-Loss Orders

Without stop-losses, losses can spiral during sudden market drops.

Avoid it: Use built-in app tools to manage risk automatically.

Falling for Scams

Fake apps, phishing links, or fraudulent ICOs are common.

Avoid it: Download apps only from official stores and check licensing.

Emotional Trading

Buying during FOMO (fear of missing out) or panic selling can destroy gains.

Avoid it: Stick to your plan and trade strategically.

Believing Fake News

Crypto markets are highly influenced by rumors.

Avoid it: Follow official channels, verified news, and credible analysts.

Ignoring Education

Many beginners skip learning about crypto fundamentals.

Avoid it: Use app tutorials, webinars, and guides to improve your knowledge.

Case Study: Jane’s First Crypto Investment

Jane, a beginner in 2025, invested $1,000 in a trending altcoin without research. Within a week, the coin dropped 40%, and she panicked, selling at a loss. Later, she switched to Bitcoin and Ethereum, used a hardware wallet, and set up stop-losses. Within three months, her portfolio stabilized, and she avoided emotional trading mistakes.

💡 Lesson: Start slow, research every investment, and use app tools to manage risk. Learning from mistakes early prevents bigger losses later.

Tips to Maximize Profits While Staying Safe

Investing in crypto is exciting, but maximizing profits requires strategy, discipline, and security. Here are top tips for beginners in 2025:

Understand How Crypto Works

Before investing, learn about blockchain, wallets, and how transactions work. Knowledge reduces mistakes and prevents losses.

Invest Only What You Can Afford to Lose

Crypto markets are volatile. Treat your investment like risk capital—never use money meant for essentials.

Use Secure Crypto Wallets

Store long-term holdings in hardware wallets or secure mobile wallets. Avoid leaving large sums on exchanges.

Enable Two-Factor Authentication (2FA)

Protect your accounts with 2FA and strong passwords. Apps like Coinbase, Kraken, and BitGlide offer multiple authentication options.

Take Profits in Steps

Instead of cashing out everything at once, sell portions of your gains as prices rise. This reduces risk and locks in profits gradually.

Use Stop-Loss and Trailing Stop Orders

Set automatic stop-losses to limit losses during sudden drops. Trailing stops can help secure profits while staying in a rising market.

Diversify Your Investments

Avoid putting all your funds into one coin. Spread investments across multiple well-established cryptocurrencies to reduce risk.

Stay Updated and Avoid FOMO

Follow credible news, updates, and regulatory changes. Don’t buy just because others are—FOMO often leads to losses.

Regularly Check Your Accounts

Monitor your portfolio and app notifications. Detecting irregular activity early prevents potential hacks or mistakes.

Reinvest Wisely or Secure Profits

Decide whether to reinvest gains or secure them in fiat or stablecoins. Balancing growth and safety is key for long-term success.

💡 Pro Tip: Even beginners can build wealth safely by combining small, informed investments with strong security practices. Apps like Kraken, Coinbase, and BitGlide provide tools to implement all these tips efficiently.

How We Picked the Best Cryptocurrency Exchanges and Apps

Choosing the right crypto app is crucial for beginners. In 2025, we evaluated platforms using a clear, data-driven approach to ensure safety, usability, and profitability.

Security First

We prioritized apps with strong encryption, cold storage, insurance coverage, and two-factor authentication (2FA). Platforms like Coinbase, Kraken, and Gemini excel in protecting user funds.

Easy-to-Use Interface

Beginners need apps with intuitive dashboards, simple navigation, and clear trading options. We tested each platform for ease of account setup, trading, and portfolio management.

Variety of Cryptocurrencies

A wide selection allows users to diversify portfolios. Apps like BitMart stand out with over 1,700 coins, while Coinbase and Kraken offer popular and stable options for safer investing.

Reasonable Fees

We analyzed trading spreads, deposit/withdrawal fees, and premium features. Apps like Coinbase Pro and Kraken offer transparent, low-fee structures ideal for beginners.

Payment Methods

We checked availability of bank transfers, debit/credit cards, and PayPal, ensuring smooth deposits and withdrawals across regions.

Reputation and Reviews

User feedback, regulatory compliance, and app stability were assessed. Platforms with positive reviews, fast support, and regulatory licenses ranked higher.

Good Customer Support

Responsive customer service is essential, especially for beginners. We tested chat, email, and phone support to ensure quick, helpful assistance.

Additional Features

We considered staking, portfolio tracking, AI assistants, and educational resources. Apps providing learning tools and smart investing options received extra points.

💡 Tip: By focusing on security, ease of use, low fees, and educational resources, beginners can confidently choose apps that match their investing style. For detailed comparisons, check Coinbase vs Robinhood vs BitGlide comparison.

Future of Crypto Investing Apps (2025 & Beyond)

Crypto investing apps have come a long way, but the future promises even more innovation, convenience, and security for beginners and experienced traders alike.

AI-Powered Investing Assistants

In 2025, many apps are integrating AI-driven tools to help users make smarter decisions. These assistants can analyze market trends, suggest portfolio adjustments, and even automate trading based on your risk profile. Apps like BitGlide are leading this trend.

Expanded Global Access

Crypto apps are breaking geographical barriers, allowing investors from previously restricted countries to access major coins and decentralized finance (DeFi) products safely.

Enhanced Security Features

Expect biometric authentication, multi-signature wallets, and improved cold storage solutions. Security innovations will continue to reduce risks of hacks and scams, giving beginners more confidence.

Staking and Passive Income Integration

More apps will combine trading and passive income features like staking, yield farming, and interest-bearing wallets, allowing users to grow their investments without active trading.

Regulation and Transparency

Regulators worldwide are working to standardize crypto rules. Apps will increasingly adopt transparent fee structures, tax reporting, and compliance protocols, making crypto investing safer for newcomers.

Education and Gamification

To engage beginners, apps will add interactive tutorials, gamified investing challenges, and AI-guided simulations, turning learning into an enjoyable experience.

💡 Looking Ahead: The next decade will make crypto investing more accessible, secure, and rewarding, with apps acting as the bridge between traditional finance and digital assets. Beginners who adopt these platforms early will have a head start in mastering the evolving crypto landscape.

Frequently Asked Questions (FAQs)

Which app offers the lowest fees in 2025?

Platforms like Kraken, Coinbase Pro, and Gemini offer some of the lowest trading fees in 2025. Kraken’s tiered fee structure can go as low as 0.16% per trade, while Coinbase Pro offers 0.50% or less for small trades. Always check the fee table before investing.

Can I stake crypto directly through investing apps?

Yes. Apps like Crypto.com, Kraken, and Coinbase allow users to stake popular coins such as Ethereum, Cardano, and Solana. Staking rewards can range from 3% to 8% APY depending on the coin and duration.

What’s the difference between trading and investing apps?

- Trading apps focus on frequent buying and selling for short-term gains.

- Investing apps focus on long-term growth and portfolio management, often including features like staking and automated rebalancing.

Do I need KYC verification to start?

Most regulated apps require KYC verification to comply with laws and protect your funds. This involves submitting an ID and sometimes proof of address. Some privacy-focused apps allow limited transactions without KYC, but with withdrawal limits.

Which app supports both crypto and stocks?

Apps like Robinhood and eToro support both asset types, allowing beginners to diversify their investments in one platform.

Can I earn passive income through these apps?

Yes. Through staking, lending, or interest-bearing accounts, many apps let users earn passive income. For example, Crypto.com offers interest on stablecoins and other cryptocurrencies.

Are these apps legal to use in the U.S. and India?

Regulated apps like Coinbase, Kraken, Gemini, and BitGlide are legal in both countries, provided users comply with local tax and reporting rules. Always check local regulations before investing.

How do I secure my funds on mobile investing apps?

- Use 2FA and strong passwords.

- Enable biometric login if available.

- Transfer large holdings to hardware wallets.

- Avoid clicking suspicious links or downloading unofficial apps.

💡 Pro Tip: Regularly reviewing these FAQs and following security best practices ensures beginners can invest confidently while minimizing risk.

Conclusion

Crypto investing apps in 2025 make entering the digital asset market easier, safer, and more accessible than ever. Beginners can start small, use trusted apps like Coinbase, Kraken, Gemini, and BitGlide, and gradually explore features like staking, AI portfolio tools, and global trading opportunities. By focusing on security, research, and disciplined investing, new users can navigate the volatile crypto landscape with confidence.

If you’re ready to start your crypto journey, explore our guides on the best crypto trading apps for beginners 2025 and see which platform fits your goals today.

Follow Us On Social Media

Abhishek Chandravanshi is the founder of CryptoTrendd.com and a crypto enthusiast focused on helping beginners navigate the digital asset world. In this article, he shares his expertise on the best crypto investing apps in 2025, highlighting platforms that are secure, beginner-friendly, and packed with features like portfolio tracking, AI tools, and staking options. Abhishek’s goal is to make crypto investing easy, safe, and accessible for everyone

3 Comments