Which Crypto App Do Most Americans Use? Beginner-Friendly Breakdown

Crypto has become a mainstream investment choice in the United States. Millions of Americans now use mobile apps to buy, sell, and hold digital assets like Bitcoin and Ethereum. But when people ask, “Which crypto app do most Americans use?” the answer isn’t as simple as checking download charts. Popularity depends on trust, regulation, ease of use, and real-world activity. In this beginner-friendly guide, we break down U.S. crypto app usage using real data, user behavior, and insights from leading crypto apps USA investors rely on today.

Table Of Content

What Does “Most Used Crypto App in the USA” Actually Mean?

When someone searches for the most used crypto app in the USA, they usually expect one clear winner. In reality, the phrase can mean different things depending on how “used” is measured. Some apps dominate app store downloads, while others lead in active users or total funds held. These differences matter because an app can look popular on the surface but have low long-term engagement.

For example, an app may rank as the most downloaded crypto app USA during bull markets because new users sign up quickly. However, many of those users may stop trading after a short time. Another platform may grow more slowly but keep users active for years, making it the largest crypto app by users in the USA based on funded accounts and retention.

Key Metrics

Usage is commonly measured through monthly active users, verified accounts, trading volume, and how often users return to the app.

Why Claims Differ

Crypto companies often highlight whichever metric makes them look strongest. This is why claims about crypto exchange popularity in the USA can feel confusing or even contradictory.

Real Examples

Coinbase leads in funded U.S. accounts, Robinhood frequently tops download charts, and Kraken attracts experienced traders. These differences become clearer when comparing platforms directly, such as in detailed Coinbase vs Robinhood breakdowns.

Why Crypto App Popularity Matters to American Users

In the U.S., crypto app popularity is not just about trends or social media buzz. It often reflects deeper signals like trust, reliability, and long-term survival. American users tend to be cautious with financial apps, especially when real money and taxes are involved. That’s why the most popular apps usually earn their position over time.

Shows Trust and Safety

When millions of Americans use the same crypto app, it sends a strong trust signal. Popular apps are constantly reviewed, audited, and tested during market crashes. Weak platforms fail fast in the U.S. market. Strong ones survive because users trust them with real funds, personal data, and compliance requirements tied to US regulated crypto exchanges.

Means High Liquidity

Popularity also brings liquidity. More users mean more buyers and sellers at any moment. This leads to smoother trades, better pricing, and fewer surprises. It’s similar to shopping at a busy store instead of an empty one—you’re more likely to get fair value quickly.

Boosts Easy Access

Highly used apps invest heavily in clean design, fast onboarding, and educational tools. These platforms know that ease of use keeps users active. This is one reason beginner-focused platforms grow faster than complex trading-only apps.

Drives Growth Potential

Popular crypto apps attract developers, partners, and institutions. That growth loop improves features, expands asset support, and strengthens long-term stability—key reasons why crypto exchange popularity in the USA matters beyond headlines.

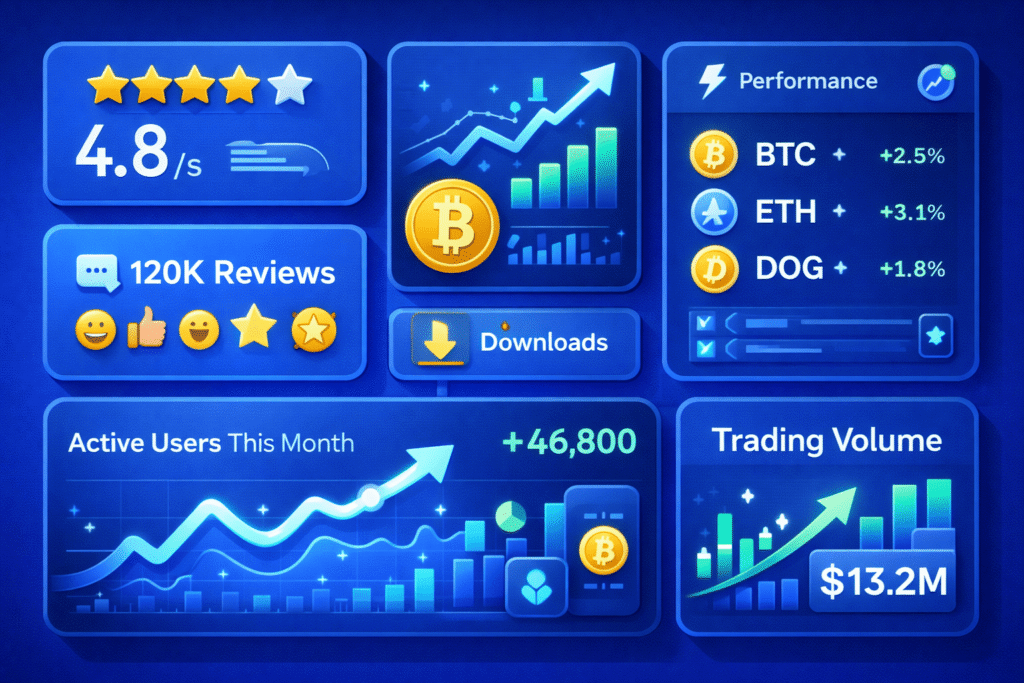

Key Metrics Used to Rank Crypto Apps in the USA

Crypto apps in the U.S. are ranked using a mix of public data, app store signals, and real user behavior. No single metric tells the full story. Instead, analysts look at patterns across several indicators to understand which platforms Americans actually rely on.

User Ratings

App Store and Google Play ratings show how users feel about an app. Consistently high ratings suggest good user experience, stable performance, and responsive support. However, ratings alone can be misleading if they come from a small or short-term user base.

Number of Reviews

Review volume adds context to ratings. An app with hundreds of thousands of reviews reflects real adoption at scale. This is why review count is often used to estimate which platform may be the largest crypto app by users in the USA.

Downloads

Downloads measure interest, not loyalty. During bull markets, many apps see spikes and become the most downloaded crypto app USA for short periods. Analysts usually combine downloads with retention data to avoid false signals.

App Performance

Crashes, lag, and failed orders during high volatility can permanently damage trust. Apps that remain stable during market spikes tend to rank higher in long-term usage, especially among serious investors.

Keywords and Metadata

Search visibility also matters. Apps that dominate searches related to crypto exchange popularity in the USA often reflect real-world brand recognition. This visibility reinforces trust and drives organic adoption, creating a feedback loop that keeps top apps on top.

Real-World Usage Data: How Americans Actually Use Crypto Apps

When we ask “Which crypto app do most Americans use?” the answer becomes clearer once we look at how people really behave — not just what headlines say. In 2025, millions of Americans aren’t just downloading crypto apps; they are using them in distinct ways, based on age, investing goals, and experience level. Understanding this real usage helps explain why certain platforms dominate.

Who Uses Crypto Apps

American crypto app users come from many walks of life, but a few trends stand out:

- Everyday investors who treat crypto like a long‑term asset

- Young adults (25–44) who explore crypto as part of their financial toolkit

- Experienced traders seeking deeper tools and lower fees

Platforms like Coinbase and Robinhood attract a broad mix of casual and serious users. According to usage data, Coinbase regularly sees several million monthly active users in the U.S., indicating people come back month after month — not just once. Meanwhile, Robinhood’s large base of over 27 million U.S. funded accounts shows many Americans use the same app for both stocks and crypto, even if they don’t trade crypto every day.

Main Ways Americans Use Crypto Apps

In practice, most Americans use crypto apps for:

- Buying and holding major coins like Bitcoin and Ethereum

- Price tracking and portfolio checks

- Occasional trading during market opportunities

Day trading — buying and selling multiple times a day — is far less common than long‑term holding for most people. This is why apps that focus on user experience and simplicity tend to have the highest engagement among mainstream users.

Apps with strong liquidity and responsive trading interfaces, like Coinbase or Kraken, keep more active traders engaged. Meanwhile, apps like Cash App make it easy to buy crypto on the go, and that’s enough for many people to stick with them as primary tools.

Top Reasons Americans Trade Crypto

People use crypto apps for a few core reasons:

- Long‑term investment

- Portfolio diversification

- Easy access to digital assets without traditional brokers

Most users aren’t buying crypto to pay for daily items. Instead, they view it like digital gold — something you hold and monitor.

Trends in Ownership

Across the board, Bitcoin and Ethereum remain the most held assets. Most Americans begin with these major coins before exploring altcoins or DeFi tokens. This explains why apps that simplify access to major assets often become the default choice for new users.

In summary, real usage data shows that Americans are not passive download numbers — they are active participants whose habits influence which apps continue to grow and dominate.

The Most Used Crypto Apps in the USA (2025 Data)

Understanding the “most used crypto app in the USA” requires looking beyond simple download numbers. Usage can mean active monthly users, account holdings, or even trading frequency. By analyzing real-world behavior, we can see which apps Americans truly rely on in 2025.

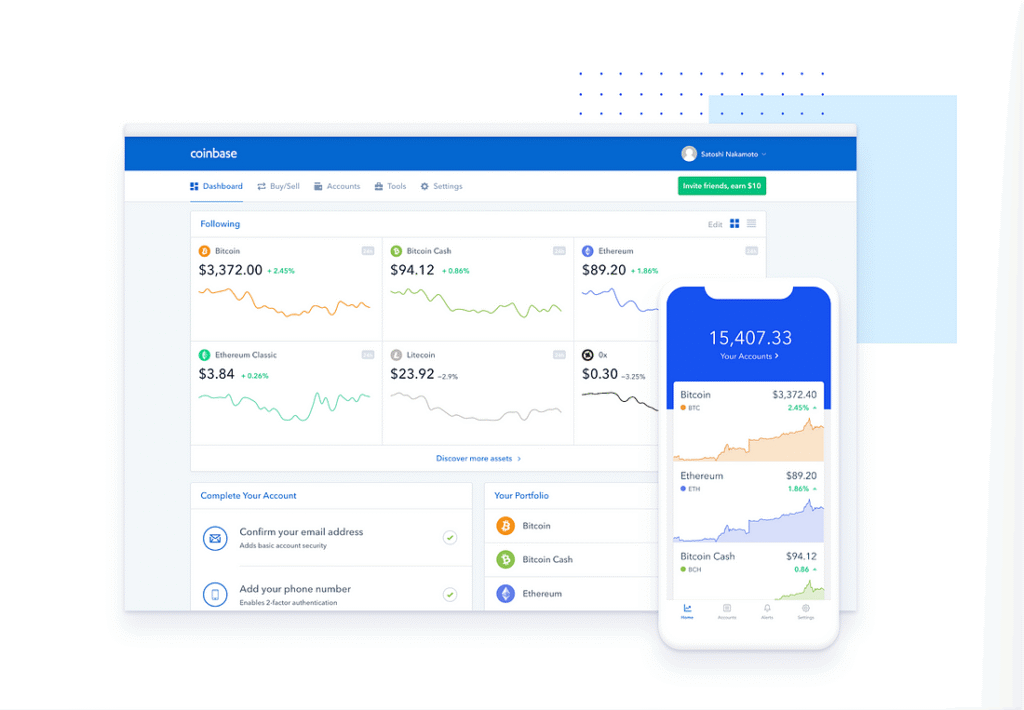

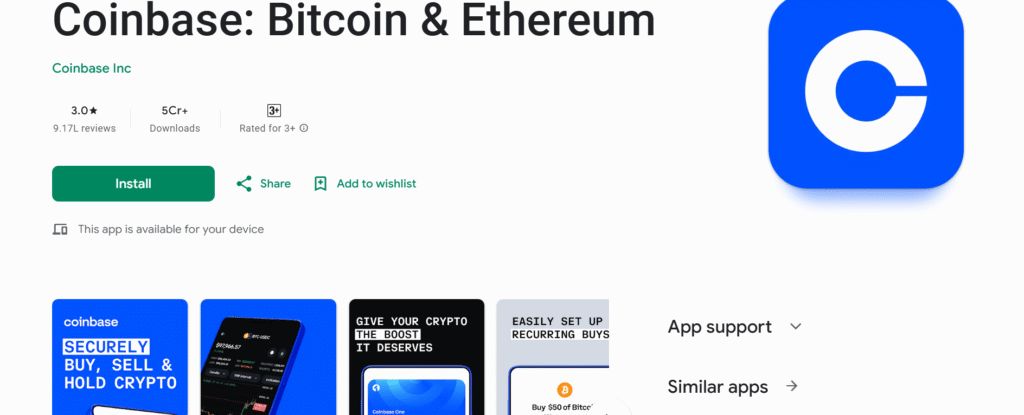

Coinbase: The Market Leader

Official link to Download App :

ForAndroid – Coinbase

For IOS – Coinbase

Coinbase remains the top choice for American crypto investors who want reliability and ease of use. In 2025, it sees roughly 8–9 million monthly active users in the U.S., making it the most “lived-in” crypto app. Many users log in regularly to check balances, trade, and stake coins.

Why Americans choose Coinbase:

- Beginner-friendly interface and intuitive navigation

- Strong U.S. regulatory compliance

- Wide asset selection, from Bitcoin and Ethereum to popular altcoins

Coinbase’s trusted reputation, combined with robust security measures, explains why it’s often the first app Americans turn to when buying crypto.

Learn more about Coinbase vs Robinhood: Coinbase vs Robinhood

Robinhood: Popular for Beginner Investors

Official link to Download App :

ForAndroid – Robinhood

For IOS – Robinhood

Robinhood isn’t exclusively a crypto app, but it has a massive user base of over 27 million funded U.S. accounts. Many Americans first try crypto here because they already use the app for stocks or ETFs.

Key points:

- High accessibility for casual investors

- Simplified buying and selling

- Integration with other financial products

Although not all Robinhood users trade crypto monthly, its consistent presence in app store top charts shows it remains a go-to entry point for first-time crypto investors.

Kraken: Advanced Tools for Experienced Traders

Official link to Download App :

ForAndroid – Kraken

For IOS – Kraken

Kraken is smaller than Coinbase or Robinhood but highly respected among experienced traders. It recorded 1–1.5 million U.S. downloads in early 2025, with users engaging in more frequent trades and larger holdings.

Why Kraken attracts serious traders:

- Advanced trading options and staking

- Strong security track record

- Low latency and high liquidity during volatile markets

Kraken’s features are tailored to those who want full control over trading strategies, making it the choice for U.S. professionals.

Cash App: Bringing Crypto to Everyone

Official link to Download App :

ForAndroid – Cash App

For IOS – Cash App

Cash App is widely used in the U.S., with over 57 million American users, many of whom buy Bitcoin regularly.

Why Cash App matters:

- Simple Bitcoin purchases integrated with peer-to-peer payments

- Appeals to casual or young investors

- Provides a low-friction way to enter crypto without a dedicated trading platform

This ease of use explains why Cash App often serves as a first crypto experience for many Americans.

Other Notable Apps

- Gemini: Focused on U.S. regulatory compliance and security; steadily growing

- Blockchain.com: Popular for self-custody wallets and exchange features

- OKX: Gaining traction in the U.S., especially among cross-border traders

Internal link: Compare more apps: Best Crypto Trading Apps USA

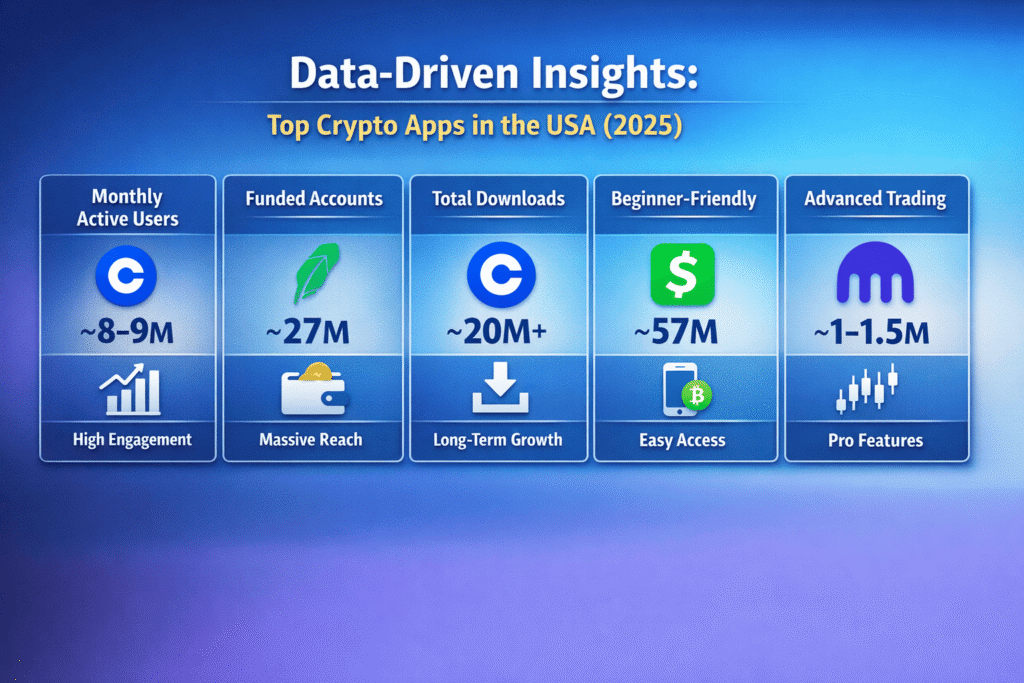

Data-Driven Insights

Here’s a snapshot of metrics that matter most:

What This Means for Americans

- Coinbase dominates active trading. Its monthly active users outpace other crypto-only apps.

- Robinhood is king of raw accounts. Many Americans use it as their first crypto app, even if they don’t trade often.

- Cash App introduces crypto to everyday users. Its peer-to-peer integration and simplicity make it a popular entry point.

- Kraken serves professionals. Advanced features and security keep serious traders engaged.

These numbers show that Americans choose apps not just by popularity but by trust, ease of use, and functionality, which is why each platform appeals to a different segment of users.

Why Coinbase Dominates the U.S. Crypto Market

If you’ve ever wondered why Coinbase feels like the default crypto app for Americans, the answer lies in a combination of timing, trust, and strategic growth. Let’s break down why Coinbase continues to dominate the U.S. crypto landscape in 2025.

Got There First

Coinbase launched in 2012, long before crypto became mainstream. By establishing itself early, it captured a huge audience of U.S. users looking for a reliable and regulated platform.

Being first matters in crypto because newcomers often stick with the app they first learn to trust. Even today, years later, millions of Americans continue to use Coinbase as their main gateway to Bitcoin, Ethereum, and other assets.

Trusted and Safe

Trust is a massive factor in U.S. adoption. Coinbase is fully U.S.-regulated, insured for digital assets in case of hacks, and has strong compliance with KYC and AML regulations.

This reassurance gives users peace of mind. Unlike some smaller apps or offshore exchanges, Americans feel confident their crypto is secure. The 8–9 million monthly active U.S. users reflect that confidence — people aren’t just downloading the app; they’re actively trading and holding funds.

Big Company Wins

Coinbase benefits from strong financial backing, global infrastructure, and professional customer support. Its size allows it to:

- Maintain high liquidity for faster trades

- Offer advanced features like staking, recurring buys, and educational resources

- Build a polished, beginner-friendly interface without sacrificing security

Smaller apps often struggle to match these combined features, which keeps Coinbase at the top of users’ minds.

U.S. Market King

Finally, Coinbase’s U.S.-centric approach plays a key role. Unlike some competitors that focus on global markets first, Coinbase tailors its offerings to American users:

- Supports U.S. bank integrations

- Follows domestic tax reporting rules automatically

- Complies fully with SEC, FinCEN, and other regulators

This localized focus not only attracts beginners but also keeps professional traders engaged, reinforcing Coinbase’s dominance in the U.S. crypto ecosystem.

For a deeper comparison with competitors, check out Coinbase vs Robinhood.

In Summary

Coinbase dominates the U.S. market because it combines first-mover advantage, trustworthiness, institutional backing, and U.S.-focused services. It’s not just about being the most downloaded app; it’s about being the one Americans return to consistently for trading, investing, and managing their crypto.

By understanding these factors, it becomes clear why Coinbase remains the most used crypto app in the USA, even as competitors like Robinhood, Kraken, and Cash App continue to grow.

Coinbase vs Robinhood vs Kraken: What Americans Actually Prefer

When deciding which crypto app to use, Americans often weigh trust, ease of use, fees, and features. Coinbase, Robinhood, and Kraken each appeal to different segments of the U.S. crypto market. Let’s break down how Americans really use and prefer these apps in 2025.

Coinbase: Preferred by Active Crypto Traders

For U.S. users who trade frequently or hold multiple crypto assets, Coinbase is the go-to platform. Here’s why:

- High engagement: Millions of monthly active users log in regularly to check balances, buy, sell, or stake crypto.

- Wide asset selection: From Bitcoin and Ethereum to trending altcoins, users have access to over 150 coins.

- Security and trust: As a fully U.S.-regulated exchange, Coinbase reassures Americans that their funds are protected.

Active traders often stick with Coinbase because it combines ease of use with robust features. Beginners might start with Coinbase’s simple interface, but they can gradually explore advanced options like staking or recurring buys without switching apps.

Learn more about Coinbase vs Robinhood: Coinbase vs Robinhood

Robinhood: Casual Investors’ Choice

Robinhood attracts casual or first-time investors who are already familiar with stock trading. In the U.S., it has over 27 million funded accounts, many of which include crypto. Americans use Robinhood for:

- Simple crypto access: Buying Bitcoin or Ethereum in a few taps

- Integrated financial services: Combining stocks, ETFs, and crypto in one app

- Beginner-friendly experience: Clean interface with minimal technical jargon

However, Robinhood isn’t ideal for heavy trading. Its crypto trading tools are basic, and some users report slightly higher spreads than dedicated crypto exchanges. Still, its accessibility keeps it a top choice for Americans who want one app for all financial needs.

Kraken: Advanced Users’ Favorite

Kraken attracts a smaller but more engaged U.S. user base, typically advanced traders or professional investors. With about 1–1.5 million U.S. downloads in early 2025, Kraken users value:

- Advanced trading tools: Margin trading, futures, and staking options

- High liquidity: Smooth execution even in volatile markets

- Security-first approach: Regulatory compliance and strong cybersecurity practices

Kraken isn’t designed for casual users. Instead, Americans who want full control over trades and deeper functionality turn to Kraken. For this audience, Kraken is a trusted and reliable option.

What Americans Actually Prefer

When Americans are asked about app preference:

- Coinbase dominates among active traders and those holding multiple assets

- Robinhood leads among casual investors and beginners

- Kraken excels with advanced users seeking professional tools

Other factors influencing choice include regional availability, customer support, app performance, and fees. For instance, some U.S. users may prefer Robinhood for its bank integrations or Cash App for ease of buying Bitcoin on the go.

For beginners looking for the easiest entry point, check out: best beginner app

Beginner vs Professional Preference Breakdown in the USA

Not all Americans approach crypto in the same way. Usage patterns differ dramatically between beginners and professional traders, and understanding these differences explains why certain apps dominate specific user segments.

Beginners: Ease and Accessibility Are Key

For U.S. beginners entering the crypto world in 2025, ease of use and trust are the top priorities:

- Cash App and Robinhood are favorites because they simplify crypto purchases.

- Many first-time investors prefer apps that integrate crypto with familiar features like peer-to-peer payments or stock trading.

- Beginners typically stick to major coins like Bitcoin and Ethereum, avoiding more complex altcoins or trading strategies.

Americans new to crypto also value educational content. Apps that provide in-app guides, tutorials, and clear pricing earn higher loyalty among beginners.

For beginners looking for the easiest entry point, check out: best beginner app

Professionals: Control, Features, and Liquidity Matter

Professional and experienced traders behave differently:

- They prioritize advanced trading tools like limit orders, margin trading, and staking options.

- Coinbase and Kraken dominate this segment because of robust security, U.S. regulatory compliance, and deeper liquidity.

- Professionals often hold multiple assets, trade frequently, and need apps that execute trades reliably even during market volatility.

These users are less concerned with simplicity; they want control and flexibility. A beginner-friendly app might feel limiting to professionals.

Observed Usage Patterns in the U.S.

- Beginners: Mostly younger adults (25–35), casual investors, or first-time crypto buyers; prefer simple interfaces and fewer technical options.

- Professionals: Often older (35+), experienced with crypto or financial markets; prioritize security, advanced features, and trading efficiency.

This distinction explains why Coinbase can appeal to both groups, offering simplicity for beginners alongside advanced tools for seasoned traders. Meanwhile, Robinhood and Cash App skew younger and less technical, and Kraken focuses on professionals seeking deeper trading control.

Key Takeaway

The U.S. crypto app market is segmented by experience:

By understanding these patterns, Americans can choose an app that matches their experience and goals, ensuring a smoother journey into crypto.

App Store & Google Play Review Sentiment Analysis

One of the most honest ways to understand which crypto apps Americans actually like is by reading App Store and Google Play reviews. Downloads show interest, but reviews reveal real user experience—the good, the bad, and the frustrating.

In 2025, review sentiment clearly shows why some apps stay popular while others struggle to retain users.

Coinbase Review Sentiment: Trust Wins, Fees Hurt

Coinbase consistently holds 4.5+ stars on the App Store and around 4.1–4.3 stars on Google Play in the U.S.

What users praise most:

- Clean and beginner-friendly interface

- Strong security and account protection

- Reliable uptime during market volatility

Common complaints:

- Higher fees compared to competitors

- Occasional account verification delays

- Customer support response times during peak demand

Overall sentiment:

👉 “Expensive, but reliable.”

Many Americans are willing to pay slightly higher fees because Coinbase feels safe and familiar, especially for long-term holding.

Robinhood Review Sentiment: Simplicity Over Depth

Robinhood averages 4.2–4.4 stars across U.S. app stores.

Positive feedback highlights:

- Extremely simple crypto buying process

- Smooth integration with stocks and ETFs

- No obvious trading fees (at first glance)

Negative feedback trends:

- Limited crypto features

- Users confused by spreads

- Lack of crypto withdrawals in earlier versions (still mentioned in older reviews)

Overall sentiment:

👉 “Easy to use, but not for serious crypto trading.”

Americans like Robinhood for convenience, not control.

Kraken Review Sentiment: Power Users Speak Loudly

Kraken’s ratings are slightly lower on average (around 4.0 stars), but context matters.

Positive reviews focus on:

- Advanced trading tools

- Strong security reputation

- Lower fees for active traders

Negative reviews often mention:

- Steep learning curve

- Complex interface for beginners

- Slower onboarding process

Overall sentiment:

👉 “Excellent for pros, overwhelming for beginners.”

Key Insight from Review Data

Across U.S. app stores, a clear pattern emerges:

- Beginners leave higher ratings for simple apps

- Advanced users leave detailed, critical reviews

- Trust and stability matter more than flashy features

This explains why Coinbase remains the most used crypto app in the USA—not because it’s perfect, but because it delivers consistent reliability, which Americans value most when real money is involved.

Fees, Spreads & the Real Cost of “Free” Crypto Apps

Many crypto apps in the U.S. advertise “free trading”, but experienced users know that free rarely means zero cost. Instead of charging visible fees, many apps earn money in quieter ways — mainly through spreads.

Let’s break down what Americans are actually paying in 2025.

Trading Fees vs Spreads: What’s the Difference?

- Trading fees are clearly listed (for example, 0.4% per trade).

- Spreads are hidden costs — the difference between the buy price and the sell price.

Apps that advertise “zero fees” often widen the spread instead.

How Popular U.S. Crypto Apps Charge Users

Coinbase

- Charges transparent trading fees

- Offers Coinbase Advanced for lower fees

- Users know upfront what they’re paying

This clarity builds trust, even if fees feel higher at first.

Robinhood

- Promotes “commission-free crypto”

- Makes money through wider spreads

- Users may pay more without realizing it

Many casual investors prefer Robinhood because costs aren’t obvious — but they’re still there.

Cash App

- Includes spreads in buy/sell prices

- Fees vary based on market volatility

- Best suited for small, occasional purchases

Kraken

- Lower trading fees for active traders

- Tight spreads due to high liquidity

- More cost-effective for frequent trading

A Simple Example

Imagine buying $1,000 worth of Bitcoin:

- App with a 1.5% spread → You instantly lose $15

- App with a 0.4% fee → You lose $4

That difference adds up quickly over time.

Why Americans Still Choose “Free” Apps

Despite hidden costs, free-fee apps remain popular because:

- They feel easier and less intimidating

- Beginners don’t notice spreads at first

- Convenience often outweighs cost awareness

Internal link: See a full breakdown of crypto fees here:

crypto fees

Key Takeaway

In the U.S., the cheapest app isn’t always the one that says “free.”

Americans who trade often usually move toward transparent-fee platforms, while casual users stick with simplicity.

Understanding fees is a big step toward choosing the right crypto app for your goals.

Trust & Safety Signals That Drive U.S. Crypto App Adoption

When Americans choose a crypto app, trust matters more than hype. Unlike early crypto adopters, today’s U.S. users treat crypto as real money — which means safety signals strongly influence which apps become the most used crypto apps in the USA.

Let’s look at what actually builds trust in 2025.

Regulation Comes First

U.S. users overwhelmingly prefer U.S.-regulated crypto exchanges. Apps that comply with SEC, FinCEN, and state-level rules feel safer, even if they’re slightly more restrictive.

This is why platforms like Coinbase, Kraken, and Gemini consistently outperform offshore exchanges in the American market. Regulation reassures users that:

- Funds are handled legally

- Disputes can be addressed

- The company is accountable

Security Features Americans Look For

Before funding an account, most U.S. users check for:

- Two-factor authentication (2FA)

- Biometric login (Face ID / fingerprint)

- Cold storage for customer assets

- Insurance against hacks or breaches

Apps that clearly explain these protections in simple language earn higher trust and better long-term retention.

Transparency Builds Confidence

Trust also comes from clear communication, not technical jargon. Americans prefer apps that:

- Show fees upfront

- Explain risks clearly

- Provide tax documents automatically

Apps that hide fees or delay withdrawals often receive negative reviews, even if they offer advanced features.

Brand Reputation Matters

In the U.S., brand recognition plays a huge role. Publicly known companies or apps backed by well-known institutions are seen as safer choices.

That’s one reason Coinbase remains dominant — it’s not just a crypto app; it’s a recognized financial brand.

Customer Support Is a Hidden Trust Signal

Americans expect responsive support when money is involved. While no crypto app has perfect customer service, platforms that offer:

- Live chat

- Clear help centers

- Fast account recovery

earn more trust over time.

Key Takeaway

In the U.S., the most popular crypto apps aren’t the flashiest — they’re the ones that feel safe, transparent, and accountable. Trust isn’t built overnight, and the apps that invest in security and regulation continue to dominate adoption in 2025.

How U.S. Regulations & Taxes Influence Crypto App Popularity

In the United States, crypto adoption doesn’t happen in a vacuum. Regulations and taxes directly shape which apps Americans trust, use, and stick with. In fact, compliance has become one of the biggest competitive advantages in 2025.

Strict Rules Hurt Some Apps

U.S. crypto rules are strict compared to many other countries. Exchanges must follow:

- SEC and FinCEN regulations

- State-level licensing requirements

- Strong KYC and AML policies

Many global exchanges either limit features or exit the U.S. market entirely because compliance is expensive. This is why Americans mostly gravitate toward US regulated crypto exchanges like Coinbase, Kraken, and Gemini. Even if these apps offer fewer tokens, users prefer legality over risk.

Taxes Add User Hassle

Crypto taxes are another major factor. In the U.S.:

- Every crypto trade is a taxable event

- Staking rewards are treated as income

- Users must report gains and losses annually

Apps that automatically generate tax reports or integrate with tax software gain a clear advantage. Americans don’t want surprises during tax season, and platforms that simplify reporting earn higher long-term loyalty.

2025 Changes Help Popularity

Recent regulatory clarity has helped mainstream adoption. Clearer rules around custody, disclosures, and reporting make crypto apps feel more like traditional financial platforms.

This shift benefits large, compliant apps the most. Smaller or non-compliant platforms struggle to compete, which strengthens the position of established leaders.

Apps Must Follow KYC Rules

Know Your Customer (KYC) rules are unavoidable in the U.S. While some users dislike identity verification, most Americans accept it as a tradeoff for safety.

Apps that make KYC fast and transparent see better onboarding completion and fewer abandoned sign-ups.

Regional & Demographic Crypto App Preferences in the USA

Crypto app usage in the United States isn’t evenly distributed. Where people live and who they are plays a big role in which crypto apps become popular. By 2025, clear regional and demographic trends explain why certain apps dominate specific parts of the country.

Regional Preferences Across the U.S.

- West Coast (California, Washington):

Tech-forward users lean toward Coinbase and Kraken. Many users here are early adopters who value advanced features, security, and long-term investing. - Northeast (New York, Massachusetts):

Strong regulatory awareness drives preference for US regulated crypto exchanges. Users often choose Coinbase due to its compliance and reputation. - South & Midwest:

Adoption is growing fastest in these regions. Simpler apps like Robinhood and Cash App perform well because they feel familiar and easy to use. - Texas & Florida:

High crypto interest and business-friendly environments support a mix of platforms, with Coinbase dominating overall usage.

Age-Based App Preferences

- 18–25:

Prefer Cash App and Robinhood for quick Bitcoin purchases and simple UI. - 26–40:

The largest crypto user group. Many start with beginner apps, then migrate to Coinbase as their holdings grow. - 40+:

More cautious, security-focused users. Strong preference for regulated platforms with clear tax support.

Income & Experience Levels

- Higher-income users:

Tend to use Coinbase or Kraken for portfolio management, staking, and recurring investments. - New investors:

Choose apps with minimal friction and fewer decisions.

This explains why Coinbase continues to grow — it successfully bridges multiple demographics and regions without alienating any single group.

Key Takeaway

In the U.S., crypto app popularity depends on local culture, age, and experience. Apps that adapt to these differences gain wider adoption, while one-size-fits-all platforms struggle.

. Trends Shaping the Most-Used Crypto Apps in the USA (2025–2026)

- All-in-One Apps Are Winning

- Americans prefer one app for crypto, investing, staking, and recurring buys

- Standalone “crypto-only” apps are losing long-term users

- Beginner-First Design Drives Growth

- Simple language and guided onboarding attract new users

- Fewer buttons and clear steps increase app retention

- Regulation-Focused Platforms Gain Trust

- U.S. users favor apps that follow SEC and FinCEN rules

- Built-in tax reports and transparent KYC boost adoption

- Compliance is now viewed as a safety feature

- Mobile Performance Matters Most

- Fast load times and stable performance during volatility are critical

- Apps that crash during market spikes lose users quickly

- Trust Beats Marketing Hype

- Americans prefer reliability over flashy promotions

- Clear fees, honest disclosures, and good support build loyalty

- Long-Term Investing Is Rising

- More users hold crypto instead of frequent trading

- Apps offering staking and auto-invest tools grow faster

Key Takeaway

- The most-used crypto apps in the USA (2025–2026) will feel like trusted financial apps, not speculative trading platforms

- Simplicity, compliance, and reliability decide the winners

How to Choose the Right Crypto App for Your Goals

Choosing the right crypto app in the U.S. depends on how you plan to use crypto. The most popular app isn’t always the best fit. A beginner buying Bitcoin monthly needs something very different from an active trader.

Know Your Goals

Start by defining your purpose:

- Long-term investing → Look for secure apps with recurring buys

- Casual buying → Simple apps with fewer features work best

- Active trading → Low fees and advanced order options matter

- Earning rewards → Choose apps that support staking or yield

Clear goals prevent overpaying and confusion.

Check Security First

Security should be your top priority. Always choose apps that offer:

- Two-factor authentication (2FA)

- Biometric login

- Cold storage for funds

- Full U.S. regulatory compliance

This is why many Americans trust US regulated crypto exchanges over offshore platforms.

Compare Fees and Costs

Don’t rely on “free trading” claims. Check:

- Trading fees

- Buy/sell spreads

- Withdrawal costs

Hidden fees can reduce profits over time.

Compare real crypto fees here:

crypto fees

Test Ease of Use

Before funding an account:

- Download the app

- Explore features

- Review the onboarding process

If it feels confusing early, it won’t improve later.

Match to Your Needs

- Beginners → Simple, guided apps

- Long-term investors → Secure, regulated platforms

- Active traders → Advanced tools and lower fees

Learn how to choose app wisely here:

choose app

Final Takeaway

The best crypto app is the one that matches your goals, comfort level, and trading style—not just the biggest name.

Common Myths About the “Most Popular” Crypto Apps

Crypto app popularity often creates confusion. Many Americans assume that if an app is widely used, it must work a certain way. In reality, several common beliefs about popular crypto apps are misleading.

Myth 1: Apps Store Your Coins

Many users think crypto apps actually “hold” their coins. In truth, apps act as platforms that manage access to your assets. Ownership depends on custody settings, not just the app itself. This is why security features and withdrawal control matter.

Myth 2: All Popular Apps Are Safe

High downloads don’t guarantee safety. Some apps gain popularity because they are easy to use, not because they are secure. Americans should always check regulation status and security practices.

Myth 3: Popular Apps Guarantee Quick Profits

No app can guarantee profits. Crypto prices move independently of the platform you use. Popular apps reduce friction—but they don’t remove risk.

Myth 4: Crypto Apps Are Too Hard to Use

Modern apps are far simpler than early exchanges. Many popular platforms are designed specifically for beginners, with guided steps and clear explanations.

Myth 5: No KYC Means Better Privacy

In the U.S., skipping identity checks often increases risk. KYC exists to protect users, prevent fraud, and keep apps compliant. Most Americans accept this tradeoff for safety.

Conclusion

So, which crypto app do most Americans use? The answer isn’t just about downloads—it’s about trust, regulation, and real-world usability. In 2025, U.S. users consistently gravitate toward apps that feel safe, transparent, and easy to use. That’s why regulated platforms with strong security, clear fees, and reliable performance continue to dominate the market.

What stands out is that Americans don’t choose apps blindly. Beginners prioritize simplicity, while experienced traders look for control and lower costs. Over time, many users evolve from basic apps to more robust platforms as their confidence grows.

The key takeaway is simple: the “best” or “most popular” crypto app depends on your goals. By understanding fees, security, and features—and choosing an app that matches your needs—you make smarter, safer decisions in the U.S. crypto market.

FAQs – Most Used Crypto Apps in the USA

Choosing the right crypto app in the U.S. can be confusing. These common questions reflect what Americans actually search for when deciding which crypto app to trust and use.

Which crypto app is used most in the USA?

Coinbase is generally the most used crypto app in the USA in 2025, based on active users, trust, and overall engagement.

Is Coinbase really the most trusted crypto app in America?

Yes. Coinbase is U.S.-regulated, transparent about fees, and known for strong security, which makes it highly trusted.

Do Americans prefer Robinhood or Coinbase for crypto?

Robinhood is popular with casual investors, while Coinbase is preferred by users who actively trade or hold multiple cryptocurrencies.

What is the safest crypto app for U.S. users?

Coinbase and Kraken are considered among the safest due to regulation, cold storage, and account protection features.

Which crypto app is best for beginners in the USA?

Coinbase, Cash App, and Robinhood are beginner-friendly because of their simple design.

Which crypto app do professional traders use?

Professional U.S. traders typically use Coinbase Advanced or Kraken.

Are free crypto trading apps popular?

Yes, but most “free” apps earn through spreads rather than visible fees.

Can non-U.S. residents use U.S. crypto apps?

Some can, but access depends on local regulations and verification rules.

About the Author ✍️

Abhishek Chandravanshi is the Founder of CryptoTrendd.com, a research-driven platform focused on trending crypto apps and the entrepreneurs shaping the digital asset industry. He analyzes how real users adopt crypto platforms, with a special focus on U.S. market behavior, trust, and regulation. Through this clear, beginner-friendly breakdowns, Abhishek helps readers understand which crypto apps are actually used by Americans and how to choose platforms that align with their investing goals.

One Comment