Hayden Adams Biography: How One Idea Turned Into a $1 Trillion DeFi Revolution

Every major revolution starts with one simple idea — and in the world of decentralized finance, that idea came from Hayden Adams. What began as a personal struggle after losing his job eventually sparked a protocol that crossed $1 trillion in trading volume and reshaped crypto forever. His creation, Uniswap, didn’t just change how people trade tokens. It proved that anyone, anywhere, can build without waiting for permission. Before diving deeper, remember this: one idea truly can shift an entire industry.

Table Of Content

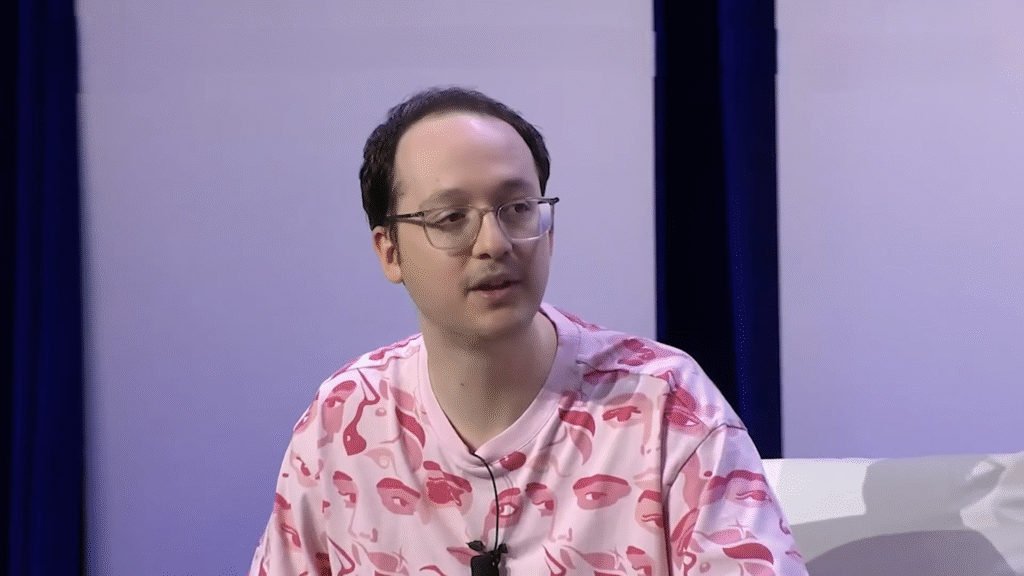

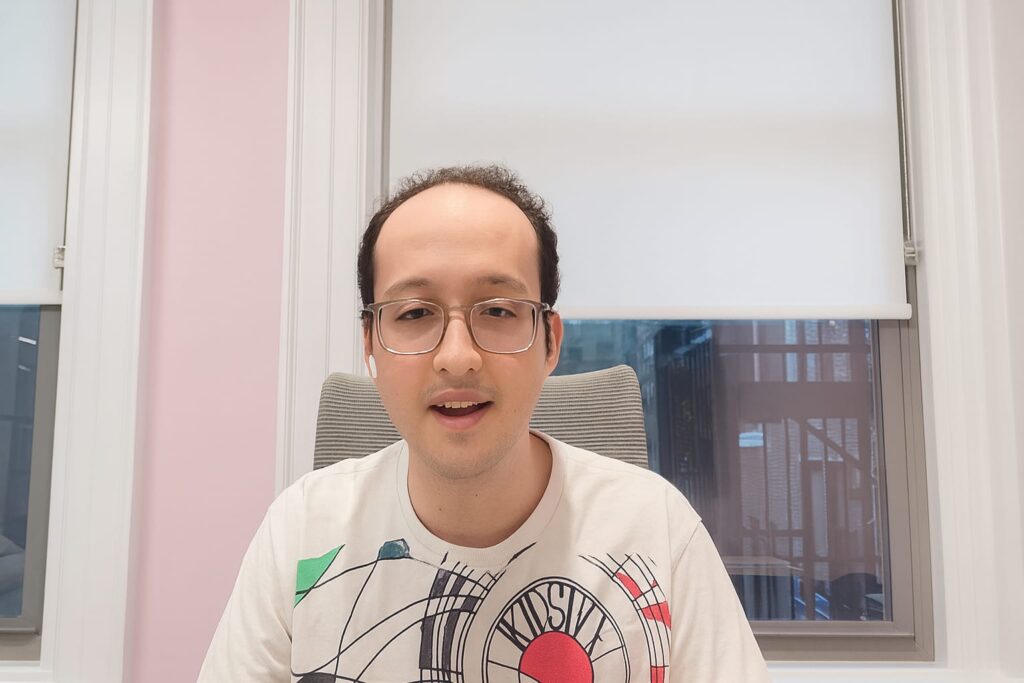

Who Is Hayden Adams?

Hayden Adams is the creator of Uniswap, the world’s most influential decentralized exchange (DEX) and one of the biggest innovations in crypto history. When people search for “Hayden Adams Uniswap” or “Hayden Adams crypto,” they often expect a billionaire-founder story. But Hayden’s journey is surprisingly relatable. He wasn’t a celebrity developer or a business genius. He was simply a young engineer trying to figure out life after getting fired.

Before Uniswap, Adams worked in mechanical engineering, not software. He wasn’t involved in crypto from the start, nor was he surrounded by venture capitalists or Silicon Valley mentors. Instead, he discovered Ethereum through a friend and slowly fell into the rabbit hole.

What makes Hayden stand out is how he turned curiosity into action. He learned Solidity from scratch, coded Uniswap himself, and pushed the automated market maker (AMM) model into the mainstream. Today, Uniswap processes billions in daily volume and sits at the heart of DeFi.

Adams went from unemployed to becoming one of the most influential blockchain innovators of this decade — all because he trusted a simple idea and followed it through.

Early Life & Education: The Foundations of a Future DeFi Pioneer

Hayden’s rise in crypto didn’t come from early tech exposure or wealthy connections. It started with a simple childhood shaped by curiosity and a practical approach to learning. His early life and education built the foundation that later helped him understand complex systems like Ethereum and AMMs. Here’s a closer look at where it all began.

Where He Grew Up

Hayden Adams grew up in New York, surrounded by a typical American environment that encouraged curiosity and independence. He wasn’t born into a wealthy tech family. His background was modest and grounded, which later shaped the humility people associate with him. Growing up, he was the kind of kid who enjoyed understanding how things worked — machines, systems, anything mechanical.

School Days

During school, Hayden leaned more toward engineering than computers. He liked solving practical problems and preferred building over reading theory. This mindset eventually led him to study mechanical engineering, a field grounded in physics, math, and real-world problem-solving. While it had nothing to do with crypto at the time, this discipline taught Hayden how to break down complex ideas into simple, workable parts — a skill that later played a huge role in how Uniswap was created.

First Job Spark

After graduating, Hayden landed his first professional job at Siemens as a mechanical engineer. It wasn’t glamorous, but it gave him valuable experience working with structured processes and large teams. Still, something felt missing. The traditional engineering path didn’t offer the creativity or flexibility he wanted. He felt boxed in — a feeling many young professionals can relate to.

Path to DeFi

Hayden didn’t immediately jump into crypto after graduation. In fact, his entry into blockchain was accidental. He didn’t even know Solidity existed during his early years as an engineer. But life had a different plan. The skills he learned — patience, problem-solving, and resilience — set the stage for a major turning point that would soon push him into the world of decentralized finance.

The Turning Point: Getting Fired & Discovering Crypto

Every breakthrough story has a moment where everything falls apart before it gets better. For Hayden Adams, that moment was losing his job. What felt like a major setback eventually became the spark that pushed him into crypto and changed his entire path. This turning point reshaped his future — and DeFi itself

Early Job Loss

In 2017, Hayden Adams faced a major setback — he was unexpectedly fired from Siemens. Losing your job is painful for anyone, but for Hayden, it felt like the ground disappeared beneath his feet. He didn’t have savings, investors, or a backup plan. He was confused, frustrated, and unsure of his next steps. But this moment of uncertainty eventually became the turning point that changed his life.

If you’re new to crypto and want to understand earning models, here’s a simple guide on how much passive income you can earn staking $1,000: Earn Passive Income.

Friend’s Crypto Push

After losing his job, a close friend encouraged him to look into crypto — specifically Ethereum. This wasn’t financial advice. It was more like, “Hey, you’re not doing anything right now. Why not explore this?” Hayden had no plan, but he had time and curiosity, so he began reading about Ethereum, smart contracts, and decentralized applications.

Self-Taught Path

Because Hayden had no coding background in blockchain development, he started from scratch. He learned Solidity online, watched tutorials, and studied open-source Ethereum projects. This period was filled with trial and error. He built prototypes, broke them, and built again.

But this challenge triggered his creativity. He didn’t want to create just another app. He wanted something that solved a real problem. That’s when he came across an idea originally shared by Vitalik Buterin — an idea about automated market makers — and it completely changed his direction.

Hayden realized that Ethereum didn’t need just decentralized applications. It needed decentralized trading itself. This insight would later grow into Uniswap.

His job loss, which once felt like a curse, had pushed him toward the opportunity of a lifetime. What started as rock bottom slowly became the beginning of a billion-dollar revolution.

The Viral Vitalik Message That Changed Everything

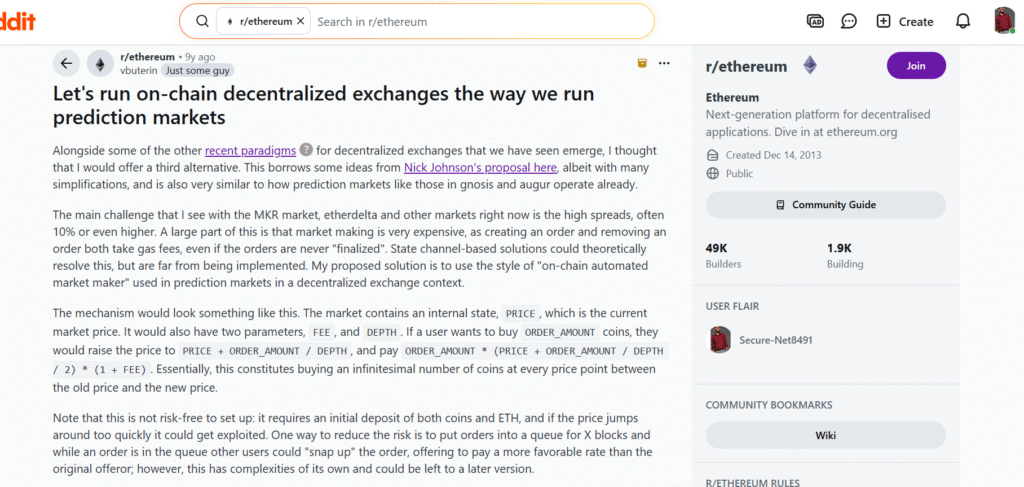

📌 Note: This original 2016 post itself is also referenced in academic and protocol documents as: Let’s run on‑chain decentralized exchanges the way we run prediction markets” by Vitalik Buterin.

Even after entering crypto, Hayden’s journey wasn’t smooth. He was still struggling to make sense of the space until one idea — shared by Vitalik Buterin — changed everything. It was a concept so simple yet so powerful that it became the core blueprint for Uniswap. This section covers the message that altered Hayden’s direction forever

Adams’ Tough Start

Hayden was struggling financially and emotionally while learning crypto development. But he kept going, even when things felt impossible. During this period, he discovered a powerful blog post and forum message from Vitalik Buterin, the creator of Ethereum.

Vitalik’s Key Idea

Vitalik had shared a simple, elegant idea: automated market makers can replace traditional order books using the formula x * y = k. This wasn’t a finished product. It was more like a seed — a concept waiting for someone to bring it to life. Hayden felt an instant connection with this idea. He loved the simplicity behind it.

“To understand why automated market makers changed crypto forever, check out our deep-dive on the highest paying staking exchanges right now.”

The Viral Push

Vitalik didn’t just share the idea. He commented publicly about how excited he was to see someone execute it. This recognition was huge for Hayden. The Ethereum community noticed him, developers joined his early discussions, and people began offering feedback.

Uniswap’s Big Impact

This viral push became the spark that turned Hayden’s project into a community-driven movement. What began as a lonely project on his laptop slowly grew into something bigger — a protocol that millions would one day use. The idea was simple, but the impact was enormous. Vitalik planted the seed, but Hayden turned it into a trillion-dollar ecosystem.

Real Origin Story: How Hayden Adams Survived While Building Uniswap

Before Uniswap became one of the biggest names in crypto, Hayden Adams went through a tough period that tested his patience, confidence, and resilience. He wasn’t backed by wealthy investors or a large development team. He was building alone, learning as he went, and trying to survive financially while chasing an idea most people didn’t understand yet.

Job Loss Hits Hard

After losing his mechanical engineering job, Hayden struggled to find new opportunities. Companies weren’t hiring, and he lacked the software development background needed for most technical roles. The uncertainty pushed him into a survival mindset. He picked up freelance gigs, lived on a tight budget, and focused on learning Solidity every day.

Discovers Crypto World

During this time, Ethereum became his main escape — a world where creativity mattered more than credentials. He spent long nights reading whitepapers, exploring GitHub repositories, and understanding how smart contracts worked. Crypto felt chaotic, but that chaos excited him. It offered freedom that traditional engineering didn’t.

Builds in Secret

Hayden began working on Uniswap quietly. He didn’t announce it or post about it on social media. He simply coded, experimented, and refined. Many early versions failed. Some didn’t even compile. But each failure taught him something new. Within months, he built a basic prototype of the AMM model using Vitalik’s formula.

Hayden Adams’ creation helped millions participate in decentralized finance much like how modern users rely on liquid staking tokens such as Lido and Rocket Pool.

Launches Amid Fear

When it was time to launch Uniswap in 2018, Hayden was terrified. He wasn’t sure if anyone would use it. He wasn’t sure if the AMM design was robust enough. But he pushed ahead, shared it with the community, and hoped for the best. The early response was slow but positive. Slowly, developers, traders, and liquidity providers began showing up — marking the birth of a new era in DeFi.

What Is Uniswap?

Official Link : Uniswap

Uniswap is a decentralized exchange (DEX) built on Ethereum that allows anyone to trade tokens without relying on traditional order books or centralized intermediaries. Instead of matching buyers and sellers, Uniswap uses automated market makers (AMMs), where liquidity comes from users who deposit assets into pools.

Think of Uniswap as a vending machine for tokens. Instead of asking someone to sell you a drink, you simply tap a machine that always has what you need — thanks to the people who refill it. In Uniswap’s case, users “refill” the pools by adding liquidity.

Uniswap became famous because of three core features:

- Permissionless access — anyone with an Ethereum wallet can swap tokens instantly.

- Liquidity pools — trades happen using assets deposited by real users, not exchanges.

- Decentralization — there is no central authority controlling the platform.

Because of these features, Uniswap quickly became a favorite among traders. It solved liquidity issues for thousands of new tokens and offered a transparent trading experience.

New builders inspired by Uniswap often compare centralized vs decentralized yield models — here’s a full breakdown of the pros and cons of staking on centralized exchanges to understand the difference in control and transparency.

Over time, Uniswap evolved beyond trading. It became a hub for DeFi, powering new apps, yield strategies, arbitrage systems, and even entire protocols built on top of its liquidity. Its simplicity and reliability turned it into the backbone of Ethereum’s ecosystem.

Today, Uniswap processes billions in daily volume and remains one of the most trusted and widely used DEXs in crypto.

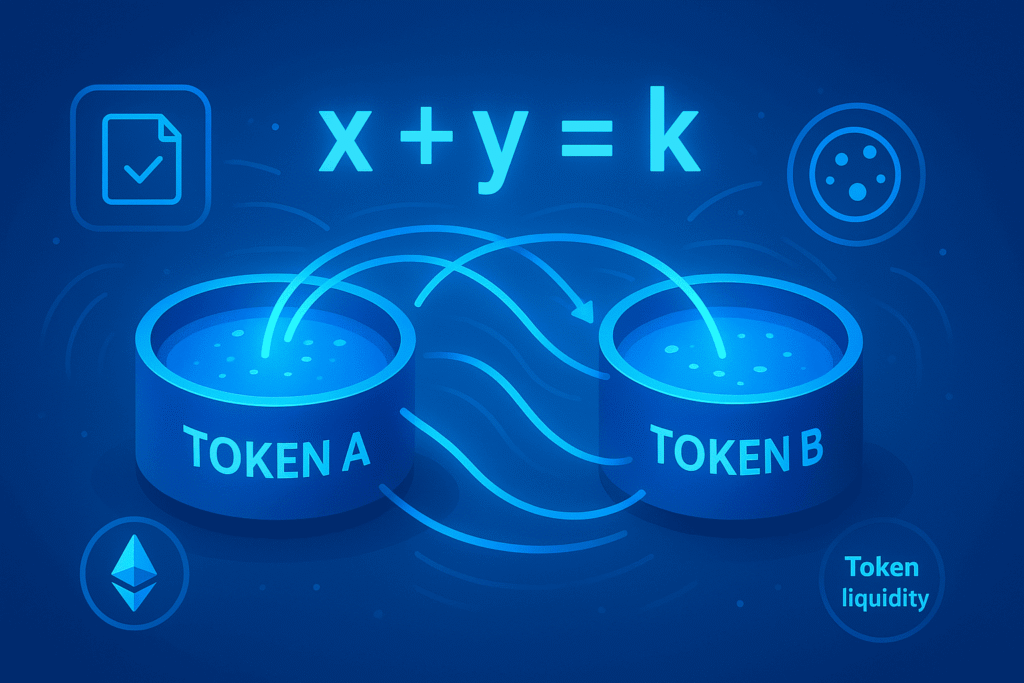

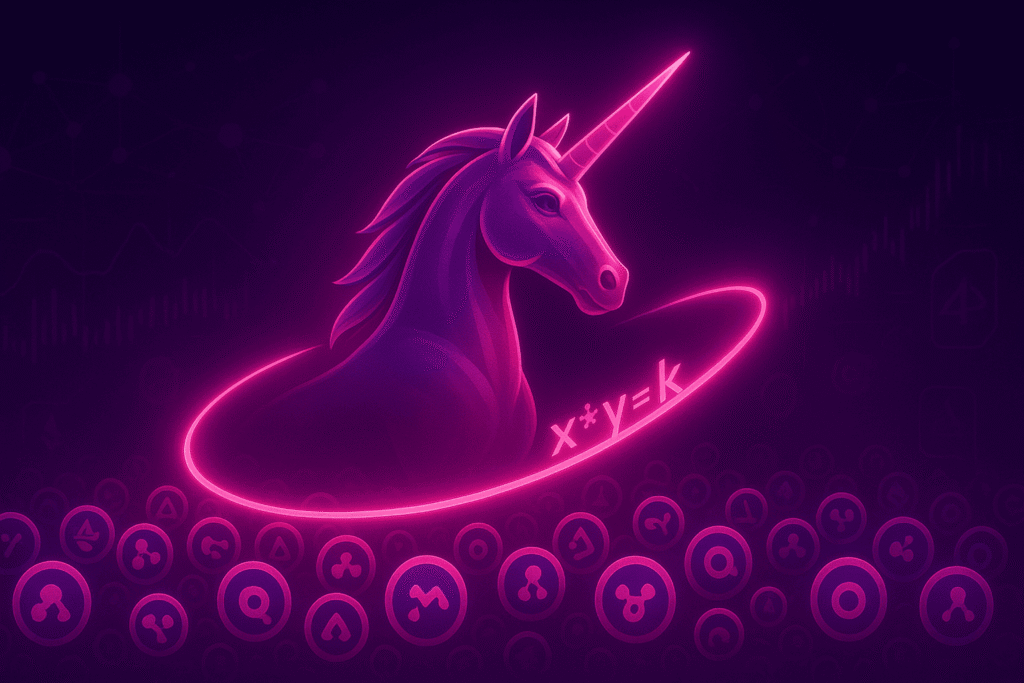

AMMs Explained: How x * y = k Triggered a DeFi Revolution

At the heart of Uniswap lies one elegant equation: x • y = k. This formula is known as the constant product market maker model. It’s the reason Uniswap works without an order book and why it became a template for hundreds of other protocols.

Let’s break it down simply.

In traditional exchanges, buyers and sellers create lists of prices. A trade only happens when both sides agree. But in DeFi, traders want instant access without waiting for someone else.

This is where AMMs shine.

The Formula

- x = amount of Token A in the pool

- y = amount of Token B in the pool

- k = constant value

No matter how many swaps happen, the product of x and y must always equal k. This creates a pricing curve that automatically adjusts depending on supply and demand.

Why It Works

Imagine two buckets connected by a pipe. When water enters one bucket, the other loses some. The balance always shifts but follows a predictable pattern. AMMs work the same way: swapping one token changes the ratio between the two, which changes the price.

Benefits of AMMs

- Always-on liquidity: Traders can always swap.

- Anyone can provide liquidity: No professional market makers needed.

- Transparent pricing: Simple math replaces complex order systems.

- No permission required: A teenager with a wallet can trade like a hedge fund.

To understand why automated market makers changed crypto forever, check out our deep-dive on the highest paying staking exchanges, which also rely on innovative yield models.

Limitations

AMMs aren’t perfect. They can suffer from:

- Impermanent loss

- Slippage

- Front-running by bots

Still, the benefits far outweigh the downsides. The x*y=k model democratized market making and turned everyday users into liquidity providers. It inspired Curve, SushiSwap, PancakeSwap, Balancer, and almost every other DEX in existence today.

This simple equation didn’t just change trading — it flipped the entire financial system inside-out.

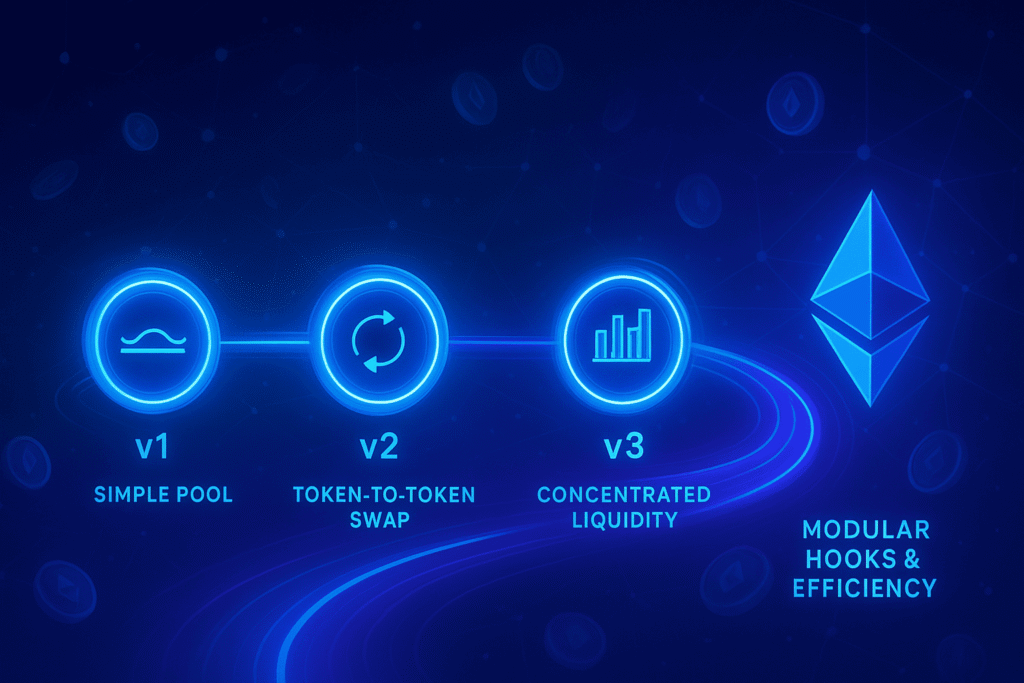

Uniswap v1 to v4: The Full Technical Evolution

Uniswap’s journey from v1 to v4 shows how a simple idea can evolve into a sophisticated ecosystem. Each version introduced meaningful upgrades that solved real problems users faced.

Uniswap v1 Basics

Launched in 2018, v1 introduced the AMM model with a single liquidity pool per token pair (ETH–ERC20).

Key features:

- Swaps between ETH and any token

- Constant product formula

- Fully decentralized and open-source

v1 proved the concept but lacked token-to-token swaps, forcing users to route indirectly through ETH.

Uniswap v2 Improvements

In 2020, v2 solved this limitation.

New features:

- ERC20-to-ERC20 swaps

- Flash swaps

- Price oracles

This version made trading smoother and eliminated the need to convert everything through ETH. Flash swaps allowed developers to borrow tokens instantly and repay within one transaction — a powerful tool for arbitrage and DeFi strategies.

Uniswap v3 Efficiency Leap

Released in 2021, v3 was a game-changer.

Major upgrades:

- Concentrated liquidity

- Multiple fee tiers

- Higher capital efficiency

Liquidity providers could now choose specific price ranges, allowing them to earn more with less capital. This version made Uniswap the most efficient DEX on Ethereum and pushed trading volume past traditional exchanges on some days.

Uniswap v4 Innovations

v4 is all about flexibility and modularity.

Highlights:

- Hooks — custom logic for swaps

- Singleton architecture — all pools in one contract

- Gas savings

- New pool standards

Hooks allow developers to build custom AMMs, dynamic fees, on-chain limit orders, or entirely new liquidity models. V4 turns Uniswap into a platform where builders can experiment freely.

This evolution shows how Hayden Adams kept pushing boundaries instead of staying comfortable with early success.

How Uniswap Became a $1 Trillion Protocol: Data-Driven Timeline

Uniswap didn’t hit $1 trillion overnight. It took years of community support, upgrades, and market growth. Here’s the timeline that explains how it happened.

Launch Basics

- 2018: Uniswap v1 launches quietly

- Early traction came from Ethereum enthusiasts testing AMMs

- Liquidity was limited, but UX was clean and simple

- Community trust helped the protocol grow slowly but steadily

Key Upgrades

- 2020: v2 enables token-to-token swaps

- More pairs → more volume

- Flash swaps attract arbitrage bots

- Liquidity mining brings new users

Uniswap became the go-to exchange for new tokens during the DeFi summer, and volume exploded.

First Milestone

- 2021: Uniswap crosses hundreds of billions in cumulative volume

- v3 boosts capital efficiency

- Trading activity surges as fees drop

- More liquidity means less slippage

- NFT boom brings new users

Uniswap becomes more popular than centralized exchanges for certain assets.

Recent Growth

- 2022–2024: Layer 2 expansion (Arbitrum, Optimism, Polygon)

- Fees decrease dramatically

- Liquidity grows deeper

- On-chain swap volume rises even during bear markets

By 2024, Uniswap’s total trading volume crosses $1 trillion — a milestone few imagined when Hayden built the first prototype.

Why Uniswap Dominates Over 100+ AMM Competitors

Despite dozens of DEXs launching after it, Uniswap remains the most trusted AMM. Here’s why:

First Mover

Uniswap introduced AMMs when no one else believed in them. This early advantage allowed it to build a strong community and attract the best developers in DeFi.

Deeper Liquidity

Because Uniswap is the default choice for most new tokens, liquidity naturally grows here first. More liquidity means tighter prices, lower slippage, and better user experience.

Easy to Use

Uniswap’s interface is famously simple — no charts, no order books, no stress. You connect your wallet, pick two tokens, and swap. That’s it.

Constant Upgrades

Other DEXs either copy Uniswap or fade away. Meanwhile, Uniswap continues building:

- v3 introduced concentrated liquidity

- v4 is enabling a modular AMM future

- Multichain support improves accessibility

These innovations keep Uniswap far ahead of competitors.

Many U.S. users also struggle with staking rules, similar to the compliance challenges Uniswap faced. Here’s a simple breakdown of the IRS staking rules for anyone dealing with regulatory pressure in crypto.

Hayden Adams vs Other DeFi Founders

When comparing Hayden Adams to other DeFi founders, several differences stand out.

Unlike founders who came from finance or computer science backgrounds, Hayden entered crypto as an outsider. He didn’t have a team, VC funding, or experience in running a startup. Many DeFi founders were deeply technical from day one — like Robert Leshner (Compound) or Rune Christensen (MakerDAO). Hayden, on the other hand, learned everything from scratch.

Another key difference is his focus. While some founders build products to compete with centralized exchanges, Hayden built Uniswap purely around Ethereum’s philosophy: openness, permissionlessness, and decentralization.

Where others chased profit, Hayden chased simplicity.

Where others played it safe, Hayden experimented.

Where others followed trends, Hayden shaped them.

This underdog journey is what made him a blockchain innovator. He didn’t just join the DeFi movement — he defined it.

Inside the Uniswap Labs Team: Hayden’s Leadership Style

Hayden Adams isn’t the kind of founder who sits above the team giving orders. He leads more like a builder among builders — someone who prefers solving problems side by side rather than from a distance. His leadership style inside Uniswap Labs is rooted in openness, collaboration, and technical curiosity.

Instead of micromanaging, he encourages autonomy. Teams at Uniswap Labs are often small and specialized. Designers, engineers, and researchers work closely together, with Hayden jumping into discussions whenever needed. He’s known for asking sharp questions that get people thinking more deeply about the product rather than forcing a specific direction.

Another aspect of his leadership is transparency. Hayden often shares thoughts openly with the community, especially during major upgrades like v3 and v4. He champions open-source culture and believes innovation should not be locked behind closed doors.

He’s also known for giving young developers chances. Many early Uniswap contributors were new to crypto but passionate about building. Hayden created an environment where experimentation is encouraged, failure is acceptable, and creativity is expected.

Overall, Hayden’s leadership style can be described in three words: vision-driven, people-first, and engineering-focused. This balance is one reason Uniswap Labs continues shipping products that shape the entire DeFi ecosystem.

Governance Power: UNI Token Launch & the Decentralization Blueprint

The launch of the UNI token in 2020 marked a major milestone. It wasn’t just another governance token — it was a blueprint for how decentralized protocols could hand power to the community.

Before UNI, Uniswap was already popular. But competitors like SushiSwap launched “vampire attacks” to steal liquidity, forcing Hayden and the team to rethink decentralization. The solution was simple but powerful: give users ownership.

Airdrop Changes Everything

Uniswap famously airdropped 400 UNI tokens to every wallet that had ever used the protocol. People who once made a single swap now had voting power over the platform they helped grow. It turned users into stakeholders and transformed Uniswap into a community-governed ecosystem.

Governance Framework

UNI holders can:

- Vote on protocol upgrades

- Propose changes

- Allocate treasury funds

- Shape fee structures

This governance design makes Uniswap resilient. No single entity can control it, not even Hayden. Instead, decisions come from a balance of developers, token holders, institutions, and community members.

Decentralization Blueprint

Uniswap’s governance model became an example for other protocols like Aave, Compound, and Curve. It showed that decentralization doesn’t mean giving up structure — it means spreading power intelligently.

The UNI launch didn’t just reinforce community trust. It helped Uniswap grow into the decentralized giant it is today.

Regulatory Wars: Uniswap vs SEC & Hayden’s Bank Account Closure

As DeFi grew, regulators began paying attention — and not always in a friendly way. Uniswap, being the largest decentralized exchange, became one of the main targets.

Uniswap Under the SEC Microscope

The SEC reportedly started looking into Uniswap Labs as early as 2021. They wanted to understand how the platform worked, how liquidity pools operated, and whether any part of the system violated securities laws.

Uniswap Labs defended itself by emphasizing:

- It doesn’t control user funds

- Trades are peer-to-peer

- Code executes transactions autonomously

- Governance is distributed

Still, the scrutiny put pressure on the team and on Hayden personally.

Bank Account Closure

One of the most alarming incidents was when Hayden Adams revealed that his personal bank account was closed without clear explanation. He suggested regulatory pressure may have influenced the decision. This sparked community outrage and raised questions about how innovators in crypto were being treated.

Many U.S. users also struggle with staking rules, similar to the compliance challenges Uniswap faced. For a clearer understanding of the tax side, here’s a simple breakdown of the IRS staking rules that often confuse everyday investors.

A Founder Under Pressure

Despite the challenges, Hayden stayed vocal and firm about protecting decentralized finance. He posted updates, supported open-source builders, and pushed for clear, fair regulation — not blanket crackdowns.

Community Support

Crypto users rallied behind Hayden, seeing the incident as a sign that DeFi founders were facing increasing pressure. Many viewed it as a battle between the old financial system and a new one powered by code, freedom, and transparency.

Is Uniswap Truly Decentralized?

Uniswap often calls itself decentralized — but what does that actually mean?

At its core, Uniswap is decentralized because:

- No central entity holds user funds

- Smart contracts automate all trades

- Anyone can create a pool

- Governance is controlled by UNI holders

However, decentralization isn’t absolute. Uniswap Labs still develops upgrades, maintains the interface, and influences community discussions. Governance decisions can also be dominated by large token holders, such as institutions or whales.

So the real answer is: Uniswap is decentralized in operation but semi-centralized in direction.

The protocol itself runs autonomously, but its future is shaped by governance votes and development decisions.

Even with these limitations, Uniswap remains one of the most decentralized major protocols in crypto — especially compared to centralized exchanges.

Hayden Adams’ Net Worth (2025): Data-Backed Estimation

Estimating Hayden Adams’ net worth is tricky because most of his wealth is tied to crypto assets, especially UNI tokens. Unlike traditional entrepreneurs who hold equity in a private company, Hayden’s wealth fluctuates with market cycles.

Key factors in his net worth:

- UNI token holdings (significant portion)

- ETH holdings

- Investments in early-stage crypto projects

- His role at Uniswap Labs

If UNI and ETH prices rise, his net worth increases dramatically. When markets fall, so does his wealth. Public blockchain data suggests Hayden owns a notable share of UNI, though exact numbers are unclear.

Reasonable estimates place his 2025 net worth somewhere between $150 million to $300 million, depending largely on token valuations.

Hayden’s Personal Crypto Portfolio & Investments

Hayden’s portfolio is mostly aligned with the future he believes in: Ethereum, decentralized exchanges, community-owned systems, and open-source innovation.

His main holdings include:

- ETH — long-term conviction

- UNI — core governance asset

- L2 ecosystem tokens — scaling solutions for Ethereum

- DeFi projects — Aave, Maker, Curve, Lido

- Developer-focused investments — tooling and infrastructure startups

Hayden has also supported early-stage founders who build permissionless systems. Unlike investors who chase hype, he tends to back ideas with strong technical foundations and clear value for the Ethereum ecosystem.

His investment philosophy mirrors his personality: rational, principle-driven, and long-term focused.

If you’re new to crypto and want to understand earning models, here’s a simple guide on how much passive income you can earn using staking — check out our Earn Passive Income breakdown.

Uniswap’s Role in Ethereum’s L2 Explosion

Ethereum’s Layer-2 ecosystem exploded between 2023 and 2025, with rollups like Arbitrum, Optimism, Base, zkSync, Linea, and Scroll bringing transaction fees down to fractions of a cent. But none of that growth would have reached mainstream adoption without one crucial piece of infrastructure at the center of it all — Uniswap.

Uniswap became the gateway to L2 activity.

When users bridged to a new chain, the very first thing they interacted with was usually a Uniswap deployment, because it provided the deep liquidity and familiar interface needed to actually use the chain.

The Liquidity Anchor of Every Major Layer-2

When an L2 launched support for Ethereum, Uniswap often became:

- the first major DEX to deploy

- the deepest pool of stablecoin liquidity

- the primary price discovery engine

- the default base for new token launches

This accelerated adoption dramatically. New L2 projects didn’t need to build liquidity systems from scratch — Uniswap gave them a turnkey trading layer.

Lower Fees → Higher On-Chain Trading

The biggest barrier to on-chain trading was Ethereum mainnet gas fees. L2s eliminated that barrier.

With swaps costing a fraction of a cent, users:

- traded more frequently

- experimented with new tokens

- became liquidity providers

- moved away from centralized exchanges

Uniswap became the first time many users truly experienced “CEX-level speed” in a permissionless system.

The Foundation for On-Chain Economies

On every L2, DeFi ecosystems formed around Uniswap pools:

- lending protocols used Uniswap for oracle-free pricing

- liquid staking tokens gained liquidity through AMMs

- real-world asset issuers used Uniswap for settlement

- meme tokens and experimental projects launched instantly

Uniswap transformed L2s from empty highways into full economic environments.

Hayden’s Strategic Bet Proved Right

Hayden always believed rollups were the future of Ethereum scalability.

Uniswap’s early, aggressive expansion on L2s positioned it as the default liquidity layer of the entire rollup ecosystem, reinforcing its dominance across the multi-chain world.

Hayden Adams’ Most Influential Interviews, Quotes & Tweets

Hayden Adams has never been the loudest voice in crypto, but when he speaks, the industry listens. His interviews, quotes, and tweets often reveal the mindset of a builder who believes in simplicity, openness, and user-first design. Over the years, several moments stood out and shaped how people view both Hayden and Uniswap.

The “Build What You Want to Use” Philosophy

In multiple interviews, Hayden has repeated the idea that Uniswap grew from a personal need, not a business plan.

One of his most reshared lines comes from a podcast conversation:

“I didn’t build Uniswap because I wanted a company. I built it because I wanted this tool to exist in the world.”

This statement resonated deeply with developers who often feel pressured to chase hype instead of solving real problems.

His Viral Tweet on Decentralization

Hayden’s most famous tweet came during the debate around centralized exchange dominance. He wrote:

“If you don’t want gatekeepers deciding what you can trade, build on-chain. Code is the only way to guarantee freedom.”

The tweet became a rallying cry for DeFi builders. It highlighted his belief that decentralization isn’t a marketing slogan — it’s the foundation of long-term crypto resilience.

Interviews During the UNI Token Launch

When UNI was introduced, Hayden appeared on several crypto podcasts explaining the governance vision behind the token. His most important quote from that period was:

“UNI isn’t just a reward. It’s a responsibility. Holders decide how this protocol evolves.”

This mindset separated Uniswap from pure-profit platforms and showed that community control was a serious priority.

Reaction to Regulatory Pressure

Hayden also made headlines when regulators increased scrutiny on DeFi. He tweeted:

“Innovation shouldn’t be punished. We’re building open systems that help people, and we’ll keep pushing forward.”

This captured both his frustration and his determination.

Together, these interviews and tweets shaped Hayden Adams’ reputation as a thoughtful, principled, and resilient builder in the crypto industry.

The Uniswap Grants Program: Building the Next Wave of DeFi

The Uniswap Grants Program (UGP) is one of Hayden Adams’ most impactful initiatives, even though it often receives less attention than Uniswap’s major technical upgrades. Created to support builders, researchers, educators, and open-source contributors, UGP became a launchpad for the next generation of DeFi innovation.

Instead of operating like a traditional accelerator, UGP takes a simple approach: fund anyone creating value for the Uniswap ecosystem. This includes developers building tools, dashboards, liquidity analytics, onboarding guides, or even experimental features that strengthen the protocol’s future.

Supporting Early-Stage Builders

UGP has issued millions of dollars in grants to small teams that wouldn’t normally attract VC funding.

These grants helped kickstart:

- Improved front-end tools for LPs

- Multichain explorers for Uniswap deployments

- Research reports on MEV and liquidity fragmentation

- Educational programs focused on DeFi safety

For new developers, getting a UGP grant is often the first big signal that they’re working on something meaningful.

Strengthening the DeFi Ecosystem

The program also funds public goods — tools that help everyone but aren’t tied to profits.

This includes:

- GAS optimization research

- Better routing algorithms

- Security audits

- Infrastructure for on-chain governance

These contributions make Uniswap more secure, accessible, and future-proof.

Hayden’s Vision Behind UGP

Hayden Adams has emphasized that decentralized finance grows only when builders have support and freedom.

UGP reflects that belief: it empowers creators without controlling them.

By backing open-source projects, UGP ensures the Uniswap ecosystem keeps expanding far beyond what a single company or team could achieve. It’s one of the clearest examples of how Hayden’s leadership continues to shape the next wave of DeFi builders.

Hayden Adams’ Vision for the Future of DeFi

Hayden Adams has always viewed decentralized finance as more than just trading tokens. His long-term vision focuses on building an open financial system where anyone, anywhere, can access markets without permission or hidden barriers. This belief has shaped every stage of Uniswap’s evolution and still guides its future direction.

A World Without Gatekeepers

Hayden imagines a world where financial services are as accessible as the internet.

He believes people shouldn’t need banks, brokers, or centralized exchanges to interact with global markets.

In his view, protocols like Uniswap prove that transparent, automated systems can replace entire layers of traditional finance — and do it with fewer costs and fewer risks.

Scaling Through Layer-2 and Beyond

Hayden sees Ethereum’s L2 ecosystem as the backbone of the next decade of growth.

He expects rollups to unlock:

- near-zero fee swaps

- instant settlement

- deeper liquidity

- global retail access

To him, this isn’t just technical progress — it’s economic freedom becoming real for millions of users.

Interoperability and Cross-Chain Liquidity

Another key part of Hayden’s vision is a future where blockchains talk to each other seamlessly. He often highlights that liquidity shouldn’t be trapped on separate networks. As cross-chain bridges improve, he believes Uniswap will evolve into a universal liquidity layer that connects all major ecosystems.

User Empowerment Through Decentralization

Hayden consistently emphasizes that decentralization should give users more control, not complexity.

He wants DeFi tools that feel simple, intuitive, and safe — without sacrificing openness.

In short, Hayden’s vision is a financial system powered by users, not institutions, with Uniswap acting as the engine that keeps it running.

Expert Takeaways: Lessons Crypto Entrepreneurs Can Learn from Hayden Adams

Hayden Adams’ journey from being an unemployed mechanical engineer to becoming one of the most influential builders in crypto is packed with lessons for entrepreneurs. His story shows that success in Web3 doesn’t come from luck or perfect timing — it comes from bold decisions, stubborn persistence, and a willingness to build without waiting for permission. Here are the most important takeaways inspired by his path.

Switch Careers Boldly

Hayden didn’t start in software. He wasn’t a seasoned blockchain developer. He came from a traditional engineering background and still made one of the most important protocols in crypto.

His story shows that you don’t need the “perfect” resume to innovate. What matters is the willingness to:

- learn new skills quickly

- go all-in when the opportunity is right

- trust your instincts even when others don’t

Switching careers can feel risky, but Hayden’s jump into crypto proves that bold shifts often lead to the biggest rewards.

Build Without Gatekeepers

One of Hayden’s strongest beliefs is that great ideas shouldn’t require permission.

He didn’t raise capital. He didn’t wait for approval.

He just built.

This mindset is crucial in Web3, where open-source tools and public blockchains give anyone the ability to create. Uniswap exists because someone decided to follow an idea rather than wait for validation.

For new entrepreneurs, the lesson is simple: build first, pitch later.

Embrace Constant Innovation

Uniswap didn’t stop evolving after v1.

Hayden pushed v2, v3, v4 — each one introducing new ideas that reshaped DeFi.

The takeaway here: crypto never stands still.

Entrepreneurs who succeed are the ones who:

- iterate quickly

- stay curious

- challenge old assumptions

- keep improving even after success

Innovation isn’t a goal — it’s a habit.

Network and Persist

Hayden’s rise wasn’t achieved in isolation. Meeting Vitalik Buterin, attending Ethereum events, and connecting with builders helped shape Uniswap’s future.

Networking created opportunities that skill alone couldn’t.

But persistence mattered even more. Hayden kept building through uncertainty, low funds, and doubt from others.

The lesson: keep showing up — even when progress feels slow.

Key Lessons for Crypto Traders From Uniswap’s Journey

Uniswap didn’t just change how developers build — it also changed how traders think. The protocol introduced new habits, new risks, and new opportunities that every crypto trader can learn from. Whether someone is swapping tokens, providing liquidity, or exploring new chains, Uniswap’s story offers a roadmap for smarter, safer trading.

Control Your Funds

One of the biggest lessons from Uniswap is simple: you control your crypto when it stays in your wallet.

There are no custodians, waiting periods, or frozen withdrawals. Traders keep full ownership of their assets while using the protocol.

This self-custody model gives freedom but also responsibility — it teaches traders to understand wallets, seed phrases, and security practices.

Use Liquidity Pools

Uniswap introduced millions of traders to liquidity pools, a way to earn yield without relying on centralized platforms.

By supplying tokens to a pool, traders earn fees from swaps. It’s a simple system, but powerful because:

- rewards come from real trading activity

- funds stay decentralized

- anyone can participate without approval

Liquidity pools opened the door to new passive income strategies.

(If you want to explore centralized alternatives, here’s a full breakdown of the pros and cons of staking on centralized exchanges for comparison.)

Embrace Permissionless Access

Uniswap proves that the best opportunities often appear in open systems.

There’s no KYC, no limits, no waiting — just instant access.

This teaches traders to value platforms that let them act quickly and independently, especially during major market events.

Watch Impermanent Loss

Liquidity providers don’t just earn; they also face risks.

Impermanent loss is a key one. When token prices diverge, LPs may end up with less value than if they simply held the tokens.

Uniswap’s rise taught traders to evaluate pools carefully, understand price volatility, and balance risk vs. reward.

Rely on Arbitrage Balance

Traders also learned how arbitrage keeps markets fair.

Whenever prices drift, bots and traders rebalance pools by swapping tokens.

This constant correction keeps Uniswap prices aligned with the broader market — and teaches traders how automated markets reach equilibrium without order books.

Frequently Asked Questions

Before wrapping up Hayden Adams’ story, here are some of the most common questions people ask about his journey, Uniswap’s growth, and the future of DeFi. These quick answers help clarify everything covered in the biography and offer extra insight for curious readers.

What makes AMMs better than order-book exchanges?

AMMs use liquidity pools instead of order books, enabling instant, permissionless trading without relying on buyers or sellers. This makes decentralized trading faster, open, and accessible 24/7.

How much UNI does Hayden Adams own?

The exact amount is not publicly disclosed. Adams received a significant allocation at launch, but holdings fluctuate over time due to transfers and on-chain activity.

What inspired the creation of Uniswap?

Vitalik Buterin’s concept of automated market makers inspired Adams. He built Uniswap to provide a simple, decentralized way to swap tokens without gatekeepers.

How does Uniswap generate revenue?

Trading fees go directly to liquidity providers. A protocol fee can be enabled through governance but remains optional.

Is Hayden Adams still leading Uniswap Labs?

Yes, he continues to guide development, upgrades, and governance decisions.

What’s next for Uniswap and DeFi?

Plans include Layer 2 expansion, cross-chain liquidity, better AMMs, and stronger community governance.

✍️ About the Author

Abhishek Chandravanshi is a crypto enthusiast and founder of CryptoTrendd.com, covering crypto trading apps and inspiring crypto entrepreneur stories. In This Article He explores journeys like Hayden Adams’, showing how one idea turned into a $1 trillion DeFi revolution. Through in-depth research and engaging storytelling, Abhishek helps readers understand the people, innovations, and strategies shaping the crypto world