Best DeFi Staking Platforms in USA 2025

DeFi staking has become one of the fastest-growing ways to earn passive income in 2025. If you’re new to the concept, check out our complete guide to crypto staking to understand how it compares to exchange-based staking.

What makes DeFi staking different is its decentralized nature — no centralized exchange controls your funds. Instead, everything runs on transparent smart contracts, giving investors more control, higher yields, and participation in shaping the blockchain ecosystem.

What is DeFi Staking?

DeFi staking stands for Decentralized Finance staking — a process where you lock your cryptocurrency in a smart contract on a decentralized platform to earn rewards. These rewards are often paid out in native tokens, governance coins, or stablecoins depending on the protocol.

Unlike centralized platforms like Coinbase or Kraken, DeFi staking happens directly on blockchain protocols such as Ethereum, Solana, or Avalanche — without intermediaries. It’s the blockchain community, not a company, that validates transactions and distributes rewards.

However, with the rise of new models like restaking, the line between CeFi and DeFi is starting to blur. Here’s how restaking is changing DeFi in 2025.

Still, the core benefit remains — complete ownership of your assets. No third party can freeze, block, or redirect your funds. It’s a fair, transparent system that rewards long-term network participation.

Yet, it’s important to remember that some of the risks of staking on exchanges also apply to DeFi — including market volatility, liquidity risks, and smart contract bugs.

In short, DeFi staking gives you the best of both worlds — higher autonomy and better returns — as long as you choose your platform wisely.

How Does DeFi Staking Work?

At its core, DeFi staking is about supporting blockchain networks by locking up tokens for a set period. In return, you receive yield or annual percentage yield (APY) as an incentive.

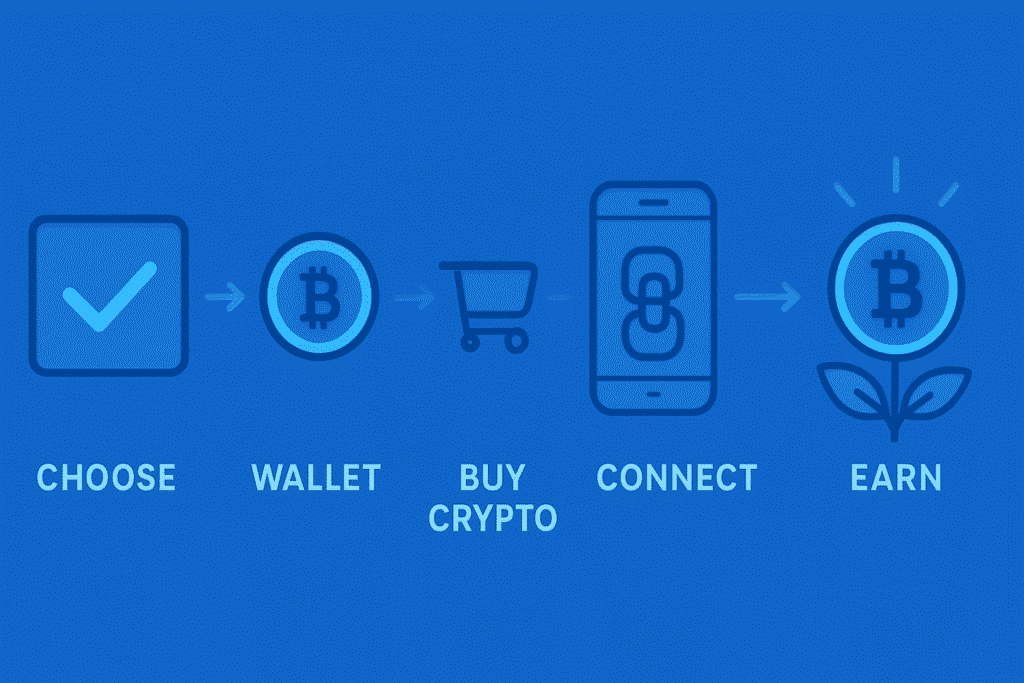

Here’s how it works step by step:

- Select a DeFi protocol — Choose from platforms like Lido, Rocket Pool, Aave, or Curve.

- Lock tokens in a smart contract — This ensures they contribute to the network’s consensus process.

- Earn rewards — The network pays you yield based on how long and how much you’ve staked.

- Withdraw anytime (or after lock period) — Depending on the protocol, some allow instant unstaking while others require waiting.

Unlike exchange staking, DeFi users maintain full custody of their crypto using wallets like MetaMask or Ledger. Smart contracts handle everything transparently — no customer support tickets or withdrawal delays.

DeFi staking pools also make it accessible to everyone. You don’t need thousands of dollars or technical validator setups. You can stake even small amounts through liquidity pools and still earn rewards proportionally.

The result? A permissionless, global staking economy where returns are driven by code — not corporate policy.

Why DeFi Staking Is Gaining Popularity in the USA

The U.S. crypto community is shifting rapidly toward decentralized platforms. Why? Because DeFi staking offers what many traditional and centralized systems can’t — freedom, higher yields, and transparency.

The surge in DeFi staking is partly due to higher yields. Some protocols offer the highest staking APY for U.S. users, often outperforming centralized exchanges by wide margins.

For many investors, it’s a low-effort way to earn passive income by staking crypto. You can stake stablecoins, ETH, or governance tokens without relying on a bank or exchange.

Another big factor is transparency. Every transaction, reward, or fee is traceable on the blockchain. In a time when regulatory oversight and privacy concerns are growing, DeFi offers a sense of financial self-sovereignty that’s deeply appealing to American investors.

Lastly, the rise of user-friendly DeFi interfaces has lowered the learning curve. You no longer need to code or understand smart contracts deeply. Modern dashboards make staking as simple as clicking “Connect Wallet” and “Stake.”

In short, DeFi staking in the USA isn’t just about returns — it’s about control, security, and financial independence.

Benefits of DeFi Staking for U.S. Investors

DeFi staking offers more than just attractive returns. It represents a paradigm shift in how investors interact with money. Here’s how it benefits U.S. users:

Earn Passive Income

You earn steady rewards just by locking your crypto. Depending on the token and platform, here’s how much you can earn staking crypto versus traditional banking yields.

Help Secure the Network

Your staked tokens strengthen the blockchain’s security. You’re literally helping to keep the network decentralized and reliable.

Lower Barriers and Flexibility

Unlike exchange staking, DeFi allows partial, flexible staking. No high minimums or strict lock-ups unless you choose them.

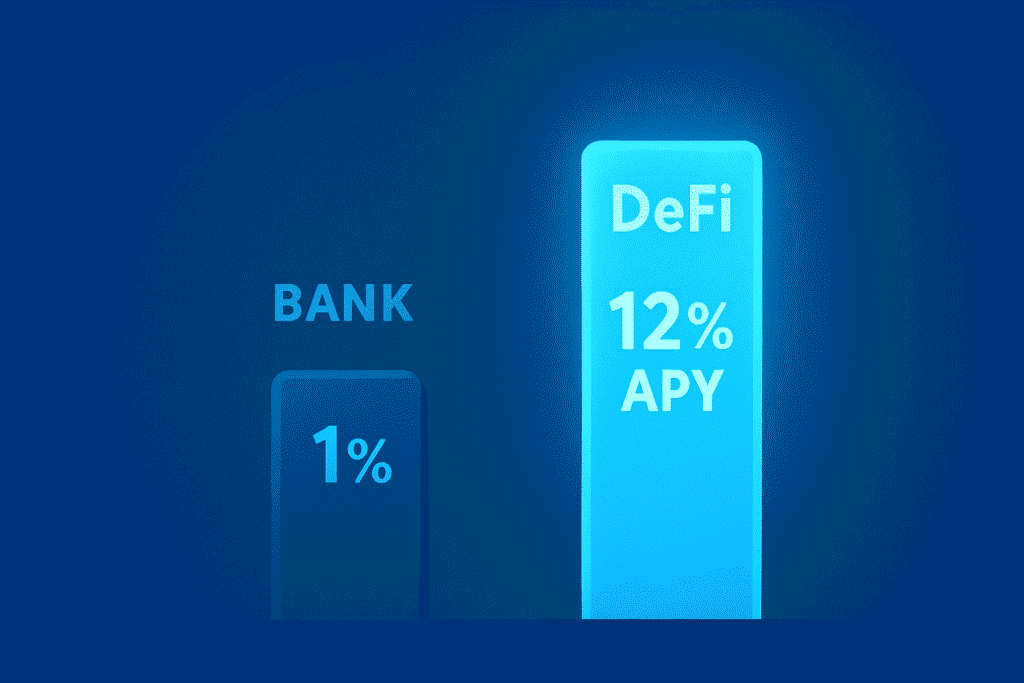

Higher Returns Compared to Traditional Finance

Top DeFi protocols offer 5%–15% APY, sometimes even higher for liquidity provision or restaking pools. It’s far better than savings accounts or bonds.

Decentralized Control and Governance Participation

Staking often grants voting power. You can influence proposals, upgrades, and treasury decisions — becoming part of the ecosystem’s future.

Support for Financial Inclusion and Innovation

DeFi breaks barriers for global participation. Anyone with internet access can stake — no banks, no borders, no discrimination.

DeFi staking is more than a profit tool — it’s a step toward financial empowerment and digital ownership.

Greater Returns than Traditional Banking

Imagine a typical savings account in the U.S. offering 0.5% to 1% APY. Compare that to DeFi staking platforms where yields range from 5% to 20% APY — and sometimes beyond.

That’s why many investors are turning to the highest APY DeFi staking in 2025 as a realistic alternative to bank savings or even stock dividends.

For instance, staking ETH on Lido can earn around 4%–5%, while newer restaking protocols like EigenLayer or Pendle offer enhanced rewards through yield compounding. Even stablecoin pools on Curve or Aave generate consistent returns with lower volatility.

The key difference is ownership and compounding. In DeFi, you control your private keys, your assets never leave your wallet (except smart contract lock-ins), and you can restake your rewards for exponential growth.

Traditional banks earn profit from your deposits — but in DeFi, you are the bank.

While volatility and smart contract risks exist, the potential upside in DeFi staking far outweighs traditional banking yields, especially for investors comfortable managing wallets and understanding basic blockchain security.

In short, DeFi staking lets you put your crypto to work — and the numbers speak for themselves.

Risks to Consider Before Staking on DeFi Platforms (2025)

DeFi staking may offer higher APYs than traditional exchanges, but it’s not without its risks. Understanding these before locking in your assets can help you protect your crypto and make smarter staking decisions.

Smart Contract Risks

Every DeFi platform relies on smart contracts — pieces of code that automatically execute transactions. If these contain bugs or vulnerabilities, hackers can exploit them to drain funds. Even well-known protocols like Curve and Balancer have faced exploits due to overlooked code errors.

Platform Risks

Not all DeFi projects are built equally. Some may lack proper audits or have weak security practices. Always verify that the protocol has been audited by reputable firms (like CertiK or Quantstamp) before staking.

Liquidity Risks

In DeFi, liquidity isn’t guaranteed. If too many users withdraw their tokens or if market volatility spikes, it can become difficult to exit your position without losses — especially on smaller DEX-based staking pools.

Governance Risks

Many DeFi protocols allow token holders to vote on changes. While decentralized governance sounds ideal, it can be hijacked by whales or insiders who manipulate decisions in their favor, impacting rewards or system stability.

Rug Pull Risks

“Rug pulls” occur when anonymous developers abandon a project after collecting user funds. To avoid this, stick to well-established platforms with verifiable teams and open-source code.

Private Key Risks

When you stake through a non-custodial DeFi platform, you control your wallet. Losing your private keys means losing access to your funds — permanently. Always back them up securely.

Regulatory Risks

U.S. regulators are paying closer attention to DeFi protocols. Sudden enforcement actions could impact token prices or restrict access for American users. Choose platforms that comply with U.S. laws or have transparent operational frameworks.

Oracle Risks

DeFi relies on oracles — data feeds connecting real-world prices to smart contracts. If an oracle is compromised, it can trigger false data and result in mass liquidations or incorrect reward payouts.

Reward Volatility

Unlike fixed APYs on centralized platforms, DeFi staking rewards fluctuate with network demand and token inflation. A 20% APY today could drop to 5% within weeks — so monitor your rewards regularly.

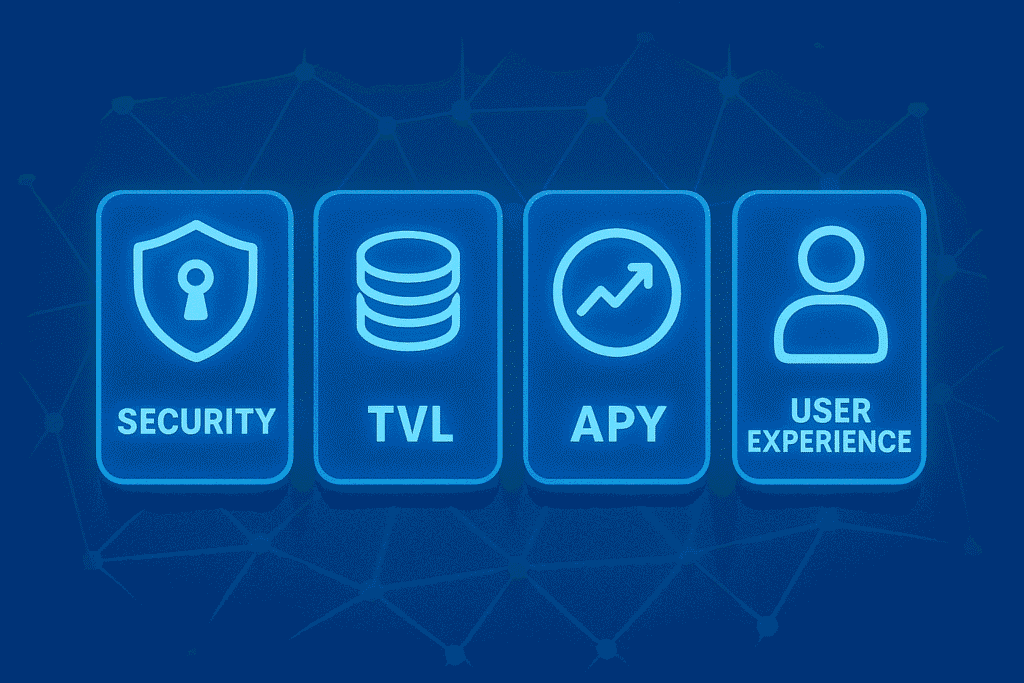

How We Ranked the Best DeFi Platforms (2025)

At CryptoTrendd, our goal is to highlight DeFi platforms that balance high yield potential with strong security and transparency. To help readers make smarter staking decisions, we ranked each platform based on a mix of technical, financial, and user-centric factors.

Security and Trustworthiness

The first and most important factor. We prioritized protocols that have undergone independent smart contract audits and have a solid track record of no major exploits or breaches.

Total Value Locked (TVL)

TVL reflects how much confidence the market has in a platform. The higher the TVL, the more liquidity and trust the protocol has from users.

User Experience

From wallet integration to dashboard clarity, we considered how simple it is for both beginners and advanced users to stake and track rewards.

Features and Services

Platforms offering extra features — like liquid staking, auto-compounding, or cross-chain support — scored higher in versatility.

Fees and Costs

Transparent fee structures were essential. We favored platforms that minimize gas costs and avoid hidden withdrawal fees.

Yield or Rewards

We analyzed average and peak APYs for key assets (ETH, SOL, DOT, and stablecoins) to ensure realistic expectations.

Decentralization and Governance

True DeFi should be community-driven. We gave preference to platforms with active DAO governance and open participation.

Compatibility and Ecosystem

Finally, platforms with multi-chain compatibility and integrations with wallets like MetaMask, Ledger, or Coinbase Wallet ranked higher for accessibility.

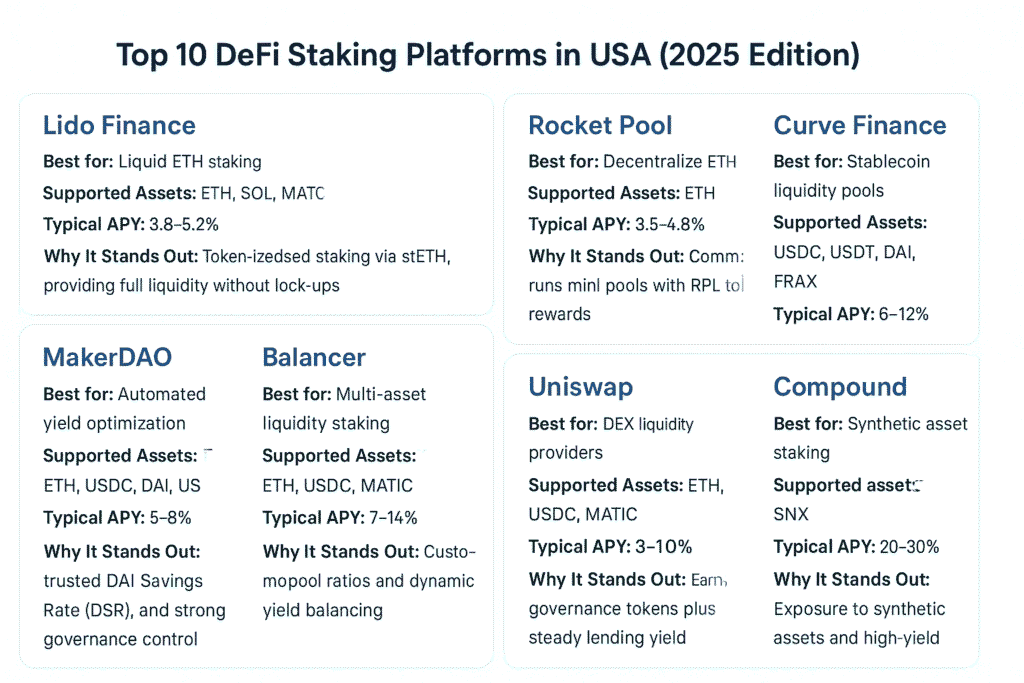

Top 10 DeFi Staking Platforms in USA (2025 Edition)

The DeFi ecosystem has evolved rapidly in the past few years, and 2025 is shaping up to be the most competitive year yet for decentralized staking. Below, we’ve ranked the Top 10 DeFi Staking Platforms in the USA (2025 Edition) — chosen based on security, total value locked (TVL), rewards, governance, and accessibility for U.S. users.

(If you’re just getting started with staking, you might also like our guide on Best Crypto Staking Platforms for U.S. Users 2025.)

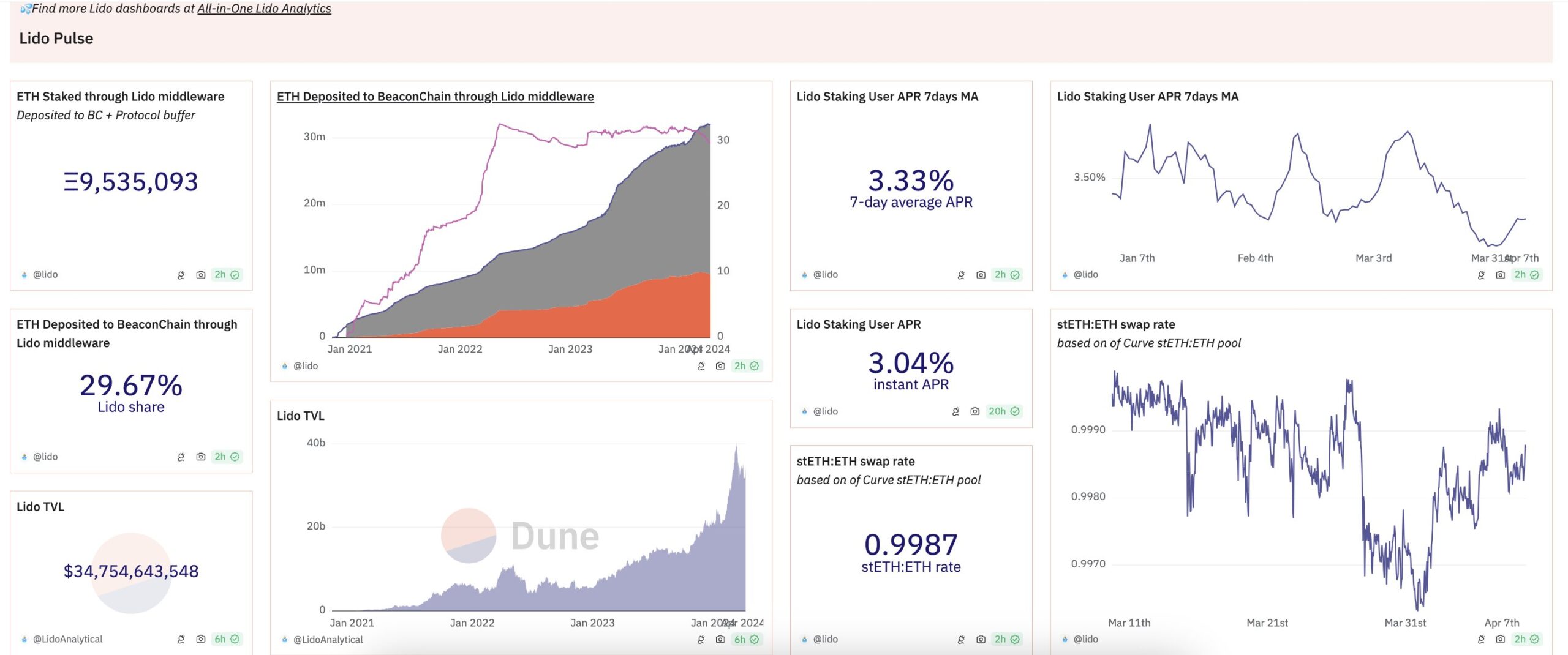

Lido Finance – Best for Liquid ETH Staking

Official Website – Lido Finance

Lido remains the go-to DeFi platform for staking Ethereum in 2025. Its liquid staking model lets users stake ETH and receive stETH, a tokenized version of their staked balance that can be traded or used in DeFi protocols like Aave or Curve.

- Supported assets: ETH, SOL, MATIC, DOT

- Typical APY (2025): 3.8–5.2%

- Why it stands out: Lido eliminates lock-up periods and gives full liquidity to stakers.

- U.S. accessibility: Available via non-custodial wallets like MetaMask.

📘 Explore more on how staking rewards compare between platforms in our Binance vs Kraken Staking Rewards (2025) breakdown.

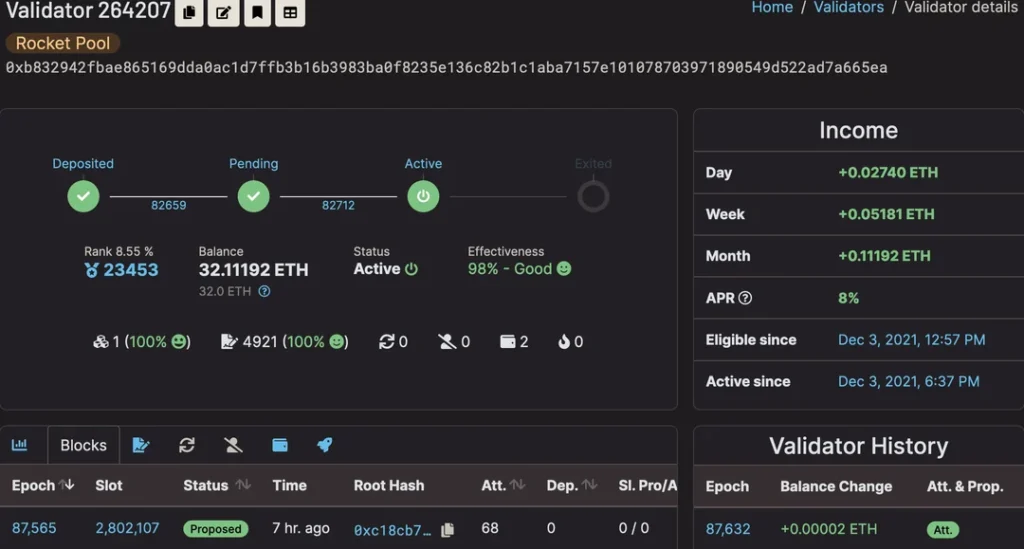

Rocket Pool – Best Decentralized ETH Staking Option

Official Website – Rocket Pool

Rocket Pool focuses on decentralized Ethereum staking and allows anyone to run a mini-pool node with just 8 ETH (instead of 32 ETH on solo staking).

- Supported assets: ETH

- Typical APY: 3.5–4.5%

- Why it stands out: It’s one of the most decentralized and community-run staking networks for Ethereum.

- Extra edge: Users earn both staking rewards and RPL incentives.

💡 You can compare how Rocket Pool’s yields stack up against centralized platforms in our Highest Paying Staking Exchanges Right Now (May 2025) guide.

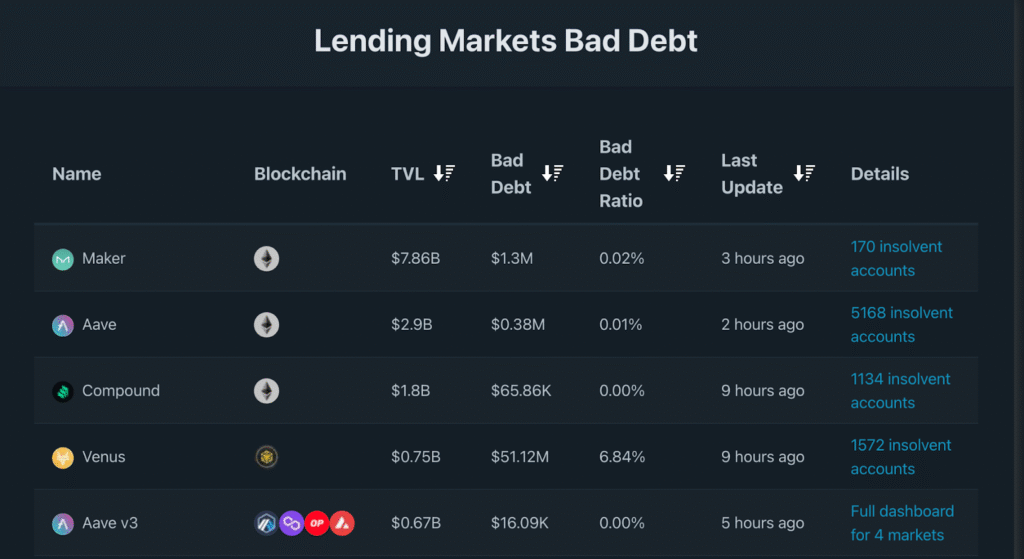

Aave – Best for Lending + Staking Flexibility

Official Website – Aave

Aave isn’t a traditional staking-only platform — it’s a DeFi lending protocol that also allows users to stake AAVE tokens for security rewards and yield.

- Supported assets: AAVE, ETH, USDC, DAI, and others

- Typical APY: 5–7% (varies by asset and liquidity)

- Why it stands out: Combines lending, borrowing, and staking in one interface.

- Security: Audited by top blockchain firms, with insurance-backed reserves.

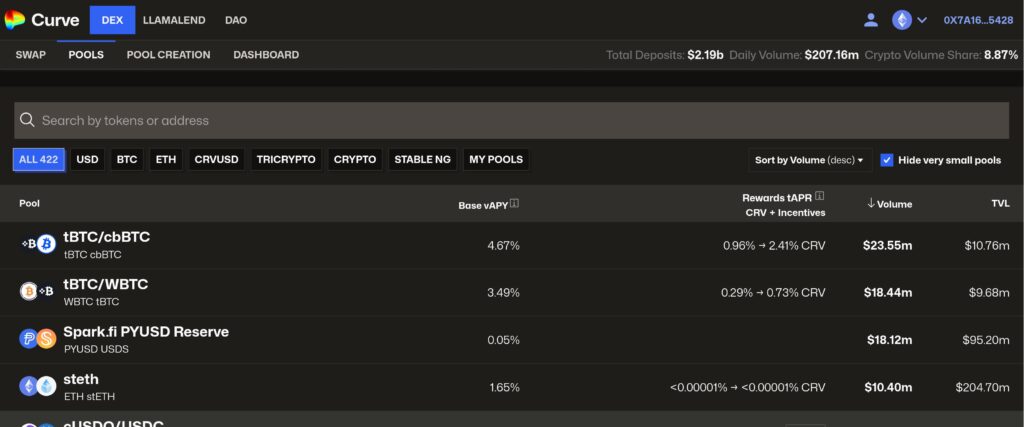

Curve Finance – Best for Stablecoin Staking

Official Website – Curve Finance

Curve is one of the largest DEXs for stablecoin liquidity pools. It allows users to earn trading fees and staking rewards by providing liquidity to pools like USDT/USDC/DAI.

- Supported assets: USDC, USDT, DAI, FRAX

- Typical APY: 6–12% (depending on pool activity)

- Why it stands out: Lower volatility with steady yield.

- Bonus: Users can stake CRV tokens for boosted governance rewards.

🔍 Want to stake stablecoins safely? Check out our full guide: Best Stablecoins to Stake Safely in U.S..

MakerDAO – Best for DAI Savings and Governance

Official Website – MakerDAO

MakerDAO, the issuer of DAI, allows users to lock up assets in vaults and earn through the DAI Savings Rate (DSR).

- Supported assets: ETH, WBTC, USDC, and more

- Typical APY: 5–8% via DSR

- Why it stands out: Stable yield through DAI, which is one of the most trusted decentralized stablecoins.

- Governance: Holders of MKR influence protocol upgrades and interest rates.

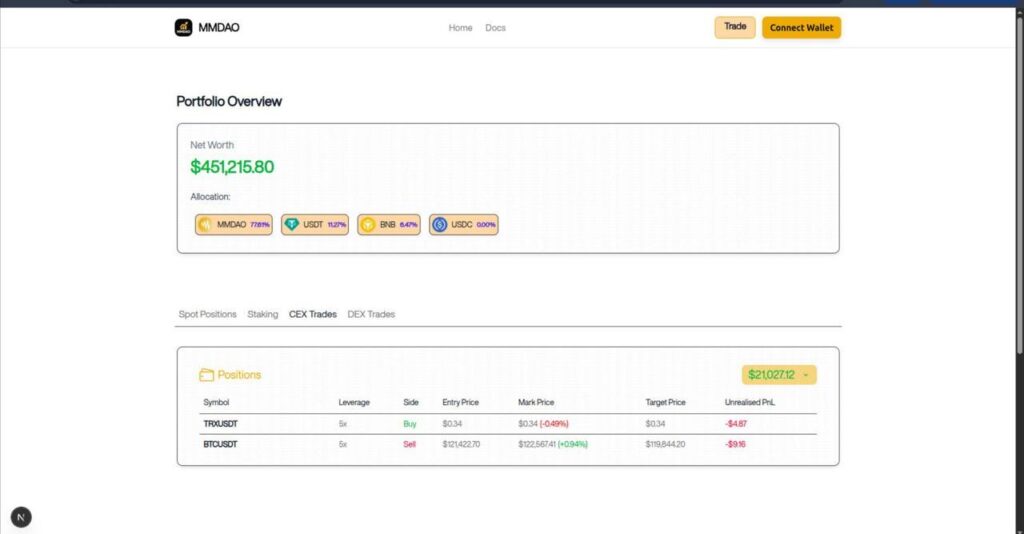

Balancer – Best for Multi-Asset Liquidity Staking

Official Website – Balancer

Balancer lets users create custom liquidity pools with up to 8 tokens, balancing them automatically to maintain ratio and yield.

- Supported assets: ETH, DAI, USDC, MATIC, etc.

- Typical APY: 7–14% depending on pool configuration

- Why it stands out: Flexible pool design and high-volume rewards.

Yearn Finance – Best for Automated Yield Optimization

Official Website – Yearn Finance

Yearn Finance (YFI) helps users automatically move funds between top DeFi protocols to chase the highest yields.

- Supported assets: ETH, USDC, DAI, USDT, and others

- Typical APY: 5–15%

- Why it stands out: Fully automated strategies; ideal for passive investors.

- Caution: Returns vary as strategies change dynamically.

Uniswap Staking – Best for DEX Liquidity Providers

Official Website – Uniswap Staking

While primarily a DEX, Uniswap lets users stake liquidity tokens to earn trading fees.

- Supported assets: ETH, USDC, MATIC, etc.

- Typical APY: 3–10%, depending on volume

- Why it stands out: Deep liquidity, no central authority.

- Downside: Impermanent loss if token prices diverge.

📘 To learn how staking on decentralized DEXs compares to centralized ones, read our post: Pros and Cons of Staking on Centralized Exchanges.

Compound – Best for Lending Rewards + Governance

Official Website – Compond

Compound pioneered decentralized lending and offers COMP token rewards for users who supply liquidity to the protocol.

- Supported assets: ETH, DAI, USDC, and others

- Typical APY: 4–6% (plus COMP rewards)

- Why it stands out: Transparent governance and consistent yields.

Synthetix – Best for Derivative Staking Rewards

Official Website – Synthetix

Synthetix enables staking of SNX tokens to mint synthetic assets that track real-world assets (like USD, BTC, or gold).

- Supported assets: SNX

- Typical APY: 20–30% (but with higher volatility)

- Why it stands out: Exposure to synthetic assets plus high staking returns.

- Risk factor: Complex mechanics; best for advanced users.

⚖️ Quick Comparison: Best DeFi Staking Platforms (USA 2025)

Top Audited & Secure DeFi Platforms in 2025

In 2025, security and transparency have become the most critical factors for DeFi investors. As the market matures, users are focusing less on risky double-digit APYs and more on audited, reliable protocols that can safeguard their funds from hacks or exploits.

Here are the top audited and most trusted DeFi platforms in 2025 that combine yield potential with battle-tested security:

Lido Finance

- One of the most popular liquid staking protocols for Ethereum, Solana, and Polygon.

- Backed by multiple smart contract audits from Quantstamp and Sigma Prime.

- Offers liquid staking tokens like Lido and Rocket Pool, letting users stake ETH while keeping assets liquid.

- DAO-governed and fully transparent with on-chain performance reports.

Rocket Pool

- A decentralized alternative to Lido with community-run node operators.

- Undergoes consistent audits by Sigma Prime and Trail of Bits.

- Known for its innovative rETH token, which maintains a 1:1 peg with staked ETH.

- Highly favored among users seeking decentralization and non-custodial staking.

Aave

- A pioneer in decentralized lending and staking with over $10B TVL.

- Conducts regular audits and live bug bounty programs to ensure safety.

- Supports ETH, USDC, and stablecoin staking with flexible yield options.

- User-friendly interface makes it ideal for both beginners and institutions.

MakerDAO

- The protocol behind DAI, the world’s most trusted decentralized stablecoin.

- Maintains strict on-chain governance and transparent audit processes.

- Often cited as one of the safest options for conservative stakers.

- A top choice for users exploring the safest stablecoins to stake.

Curve Finance

- Specializes in low-risk stablecoin and wrapped token pools.

- Employs multi-signature wallets and time-locked updates to enhance protection.

- Regularly audited and remains a go-to platform for stablecoin liquidity providers.

Balancer

- A DeFi liquidity and staking protocol that combines AMM flexibility with deep liquidity.

- Uses real-time on-chain monitoring and audited codebases to prevent vulnerabilities.

- Favored by experienced users who value both customization and safety.

These platforms have proven that security and yield can coexist in DeFi. From the best ETH restaking platforms like Lido and Rocket Pool to stablecoin-oriented options like MakerDAO and Curve, each represents a new standard of safety-first staking.

Before staking, always verify whether the platform has undergone recent independent audits and offers transparent governance. In DeFi, trust is earned not through marketing — but through verifiable code.

Comparing DeFi vs Centralized Exchange Staking

As staking becomes mainstream in 2025, crypto investors often face one key decision — should they stake through DeFi platforms or centralized exchanges (CEXs)? Both allow you to earn passive income, but the experience, control, and risk level differ significantly.

Ownership and Control

With DeFi staking, you’re in full control. You connect your wallet directly to a decentralized protocol — no middleman, no custody risk. You own your private keys and can unstake whenever protocol rules allow.

In contrast, CEX staking requires you to deposit tokens with an exchange like Coinbase or Kraken. While convenient, your assets sit under the exchange’s custody, meaning you must trust their systems and management.

Security and Transparency

DeFi staking runs on smart contracts — automated, open-source programs visible on the blockchain. Many top protocols such as Lido, Aave, and MakerDAO undergo regular audits, making them among the most secure DeFi staking options. However, bugs or unaudited contracts still pose risks.

CEX staking feels safer to beginners due to its polished interface, but it’s not immune to issues like account freezes or exchange hacks. To understand the nuances, see our guide on the pros and cons of centralized staking.

Rewards and Flexibility

Generally, DeFi platforms offer higher yields because there’s no intermediary taking a cut. Platforms like Lido and Rocket Pool often provide some of the best APYs in 2025. CEX staking, however, offers easier entry — no need for wallet connections or blockchain knowledge. You can compare yields in our guide to the best APY staking exchanges.

Final Takeaway

If you prefer control, transparency, and higher returns, DeFi staking wins. But for simplicity and support, centralized exchanges remain a comfortable starting point. Many investors balance both — using DeFi for growth and exchanges for convenience.

Best Wallets for DeFi Staking in the USA (2025 Edition)

When it comes to DeFi staking, your wallet is more than just a storage tool — it’s your personal gateway to the decentralized ecosystem. The right wallet not only keeps your crypto secure but also connects you seamlessly to the top DeFi protocols across Ethereum, Polygon, Solana, and more. In 2025, U.S. investors have access to several reliable, user-friendly, and secure DeFi wallets built for staking and yield farming.

MetaMask

The go-to wallet for DeFi users. MetaMask supports Ethereum and most EVM-compatible chains, making it perfect for connecting with platforms like Lido, Aave, and Rocket Pool. It’s browser-based, easy to use, and integrates directly with DeFi dashboards.

Trust Wallet

Backed by Binance, Trust Wallet is one of the most versatile mobile wallets for staking and earning. It supports multiple assets and provides in-app access to liquid staking tokens like Lido and Rocket Pool.

Ledger Nano X / S Plus

For investors who prioritize security, hardware wallets like Ledger are essential. You can connect them with apps like MetaMask to stake safely on DeFi protocols without exposing your private keys online.

Coinbase Wallet

Not to be confused with the exchange, Coinbase Wallet gives you self-custody access to the DeFi ecosystem. It connects easily to the best ETH restaking platforms and supports a wide range of DeFi assets.

Rabby Wallet

A newer entrant built for DeFi power users. Rabby auto-detects chains and supports faster, safer confirmations when connecting to multiple platforms.

In short, the best DeFi staking wallets in 2025 balance security, compatibility, and ease of use. Whether you’re staking ETH, stablecoins, or yield-bearing tokens, always verify integrations and enable multi-factor protection before connecting to any dApp.

How to Start DeFi Staking in the USA (Step-by-Step Guide)

Starting with DeFi staking in the U.S. might sound technical at first, but it’s actually straightforward once you understand the basics. Whether you’re looking to earn from Ethereum, stablecoins, or multi-chain assets, here’s a simple step-by-step guide to get started confidently and safely in 2025.

Choose a DeFi Protocol

Start by selecting a reliable DeFi staking platform that matches your goals. Top choices like Lido, Aave, and Rocket Pool offer varying yields and risk levels. For Ethereum holders, explore the best ETH restaking platforms, while conservative investors might prefer the safest stablecoins to stake such as USDC or DAI. Always verify that the protocol is audited and has a strong track record.

Set Up a Crypto Wallet

Next, choose a compatible DeFi wallet such as MetaMask, Trust Wallet, or Ledger. Your wallet allows you to connect directly to decentralized platforms while keeping your private keys secure. If you need help choosing one, check out the section on Best Wallets for DeFi Staking in the USA (2025 Edition).

Buy and Transfer Crypto Tokens

Purchase the crypto you plan to stake — like ETH, DOT, or MATIC — from a trusted exchange. Once bought, transfer tokens to your wallet. Always double-check the network (e.g., Ethereum, BNB Chain, Polygon) before sending.

Connect Wallet to Staking Platform

Visit your chosen DeFi platform’s official website and click “Connect Wallet.” Approve the connection in your wallet app. Be cautious of phishing websites; always confirm the URL is authentic before connecting.

Stake Your Tokens

Enter the amount you want to stake and confirm the transaction. Your tokens will then be locked in a smart contract, earning you staking rewards automatically.

Track Rewards and Manage Staking

Use dashboards like DeFiLlama or Zapper to monitor your staking performance. You can also reinvest or claim rewards periodically to compound your earnings — similar to how traditional interest grows over time.

Be Aware of Risks

DeFi staking isn’t risk-free. Smart contract bugs, platform hacks, and reward volatility can impact your returns. Review the Risks to Consider Before Staking section and our post on pros and cons of centralized staking to stay informed.

U.S. Regulatory Updates & Legal Landscape for DeFi Stakers

The DeFi staking landscape in the USA has been evolving rapidly, with regulators paying closer attention to how decentralized finance operates. In 2025, the legal framework around DeFi staking is clearer than ever, offering more confidence to U.S.-based crypto investors while still demanding due diligence and compliance.

Clearer Regulations for Crypto Staking

Recent developments have brought much-needed clarity to how staking income is taxed and classified. The IRS now treats staking rewards as taxable income at the time of receipt, similar to mining. However, state-level interpretations vary, and some jurisdictions are exploring crypto-friendly rules to attract innovation. The SEC has also drawn a clearer line between centralized staking programs and decentralized protocols, easing pressure on non-custodial DeFi platforms.

DeFi Tokens and Liquid Staking Not Securities

One of the biggest updates in 2025 came when regulators signaled that liquid staking tokens (LSTs) like stETH or rETH may not qualify as securities if they operate under decentralized, non-custodial models. This distinction protects DeFi users from the compliance burden faced by centralized exchanges and promotes liquid staking innovation across the U.S.

Multiple Agencies Oversee DeFi

Unlike traditional finance, DeFi operates under a multi-agency oversight model. The SEC, CFTC, FinCEN, and IRS all play roles in shaping compliance. For instance, the CFTC focuses on derivatives-based DeFi projects, while FinCEN enforces anti-money laundering (AML) standards for DeFi protocols that interact with fiat.

Legislative Acts and Regulatory Collaboration

Congress and federal agencies are now working together to create a comprehensive crypto framework. Proposed bills like the Financial Innovation and Technology for the 21st Century Act (FIT21) and the Digital Commodity Exchange Act (DCEA) aim to define digital assets more clearly. This growing collaboration marks a positive shift toward balanced DeFi regulation, enabling innovation while maintaining investor protection.

Common DeFi Staking Mistakes to Avoid

While DeFi staking offers excellent opportunities for passive income, many investors—especially newcomers—often make avoidable mistakes that can lead to significant losses. Understanding these pitfalls can help you protect your crypto and maximize long-term rewards.

Lack of Research and Due Diligence

One of the most common errors is staking on platforms without proper research. Always verify audits, liquidity, and community trust before locking your tokens. Use reputable sources like CryptoTrendd’s Best DeFi Staking Platforms in USA 2025 for verified options.

Chasing Hype and FOMO

High advertised APYs can be tempting, but projects promising unrealistic returns often collapse or turn out to be scams. Focus on sustainable yields backed by genuine network activity rather than hype.

Ignoring Security Measures

Never stake directly from an exchange wallet or unverified dApp. Always use a hardware wallet or trusted options listed in Best Wallets for DeFi Staking in the USA (2025 Edition) to maintain full control of your funds.

Not Understanding Lockup Periods

Some DeFi protocols require you to lock your tokens for weeks or months. Before staking, check whether early withdrawals are allowed or if there’s a penalty.

Failing to Diversify

Avoid putting all your crypto into one protocol or token. Diversify across multiple DeFi platforms to reduce risk exposure.

Overlooking Smart Contract Risks

Even top DeFi platforms carry contract vulnerabilities. Review audit reports before staking and prefer audited DeFi protocols featured in Top Audited & Secure DeFi Platforms in 2025.

Other Mistakes

Not researching validators, ignoring network fees, skipping exit strategies, or investing in fake tokens are all red flags. Always verify token contracts on Etherscan or BSCScan, track your rewards regularly, and stay updated with U.S. DeFi regulations to avoid surprises.

Tax Rules and Legal Considerations for U.S. DeFi Stakers

As DeFi staking continues to gain traction in the United States, understanding the tax and legal implications is essential for investors looking to stay compliant and avoid surprises during tax season.

Staking Rewards as Taxable Income

According to the IRS, all staking rewards are considered taxable income at the time they’re received, based on the fair market value (FMV) in USD. Whether you stake through DeFi protocols or centralized exchanges, these rewards must be reported as ordinary income. Later, when you sell or swap the staked tokens, you’ll also incur capital gains tax on any price appreciation. You can learn more about this in IRS Rules for Crypto Staking Income (Explained Simply).

DeFi vs. Centralized Staking Tax Differences

When using DeFi platforms, you remain in control of your wallet and private keys, but you also carry the full burden of record-keeping and reporting. In contrast, centralized exchanges like Coinbase or Kraken may provide 1099 forms to simplify filing.

Tracking and Reporting Tools

Tools like Koinly, CoinTracker, or Accointing can automatically sync with your wallet to calculate staking income and capital gains. Keeping detailed transaction logs is critical for minimizing audit risks and ensuring transparency.

Legal Landscape and Future Updates

With evolving U.S. regulations, DeFi stakers should monitor updates highlighted in U.S. Regulatory Updates & Legal Landscape for DeFi Stakers. Staying informed helps ensure compliance as Congress and agencies like the SEC, CFTC, and IRS refine their stance on DeFi taxation and reporting requirements.

DeFi Trends for 2025 and Future Predictions in America (2025–2030 Outlook)

The DeFi ecosystem in the U.S. is entering a new era of maturity, innovation, and institutional participation. Between 2025 and 2030, investors can expect decentralized finance to expand beyond yield farming and staking—bridging real-world use cases, artificial intelligence, and global compliance standards.

Real-World Asset Tokenization

One of the biggest DeFi trends in 2025 is the tokenization of real-world assets (RWA) such as real estate, treasury bonds, and commodities. Platforms like MakerDAO and Ondo Finance are pioneering tokenized U.S. Treasury yields, giving DeFi investors low-risk, on-chain returns comparable to traditional markets.

AI-Driven DeFi Protocols

Artificial intelligence is making DeFi smarter. AI-driven protocols now optimize staking yields, detect risks, and automate liquidity provision—reducing human error and improving returns. Expect AI integration to shape portfolio management and predictive analytics within DeFi apps.

Cross-Chain Interoperability

By 2030, DeFi will be largely chain-agnostic, thanks to cross-chain bridges and multi-chain wallets. This trend will allow users to stake and earn across ecosystems like Ethereum, Solana, and Avalanche, seamlessly connected through protocols like LayerZero and Axelar.

Decentralized Identity and Compliance

To align with evolving U.S. regulatory updates, DeFi protocols are introducing decentralized identity (DID) systems that enable user verification without sacrificing privacy. This ensures compliance with KYC/AML rules while keeping DeFi decentralized.

Security and Insurance in DeFi

With security breaches still a top concern, 2025 marks the rise of DeFi insurance protocols like Nexus Mutual and InsurAce, offering coverage against smart contract exploits and loss events.

Institutional Adoption

Finally, large institutions and funds are entering the DeFi space, exploring regulated staking, tokenized funds, and on-chain liquidity. This shift will likely transform DeFi from a niche innovation into a mainstream component of the U.S. financial system by 2030.

🌐 Future Outlook: DeFi Staking in America (2025–2030)

By 2030, DeFi staking in the U.S. is projected to become as common as stock investing, with tokenized yields competing directly with traditional savings products. Institutional liquidity, combined with regulatory clarity, will make DeFi safer and more transparent.

As AI and automation streamline risk management, users will be able to earn optimized returns across multiple chains with a single wallet. Meanwhile, real-world assets—like bonds and real estate—will make DeFi yields more stable and predictable.

In short, the next five years will transform DeFi from a high-risk experiment into a regulated, AI-enhanced, yield ecosystem powering the future of finance in America.

Expert Tips to Maximize DeFi Staking Rewards

DeFi staking can deliver exceptional passive income — but only if you approach it strategically. Here are expert-backed tips to help U.S. investors maximize their staking rewards while minimizing risks in 2025.

Choose the Right Assets to Stake

Select assets with strong fundamentals and high network activity, such as ETH, SOL, or DOT. Avoid newly launched or low-liquidity tokens unless backed by reputable DeFi protocols.

Pick Reliable and Secure Platforms

Always stake through audited and transparent platforms featured in Top Audited & Secure DeFi Platforms in 2025. This minimizes smart contract vulnerabilities and reduces exposure to rug pulls.

Understand Reward Distribution

Learn how often rewards are distributed (daily, weekly, or epoch-based) and how compounding works. Platforms with auto-compounding or rebase mechanisms can accelerate your returns.

Reinvest Your Rewards (Compound Earnings)

Reinvest staking rewards periodically to compound your earnings. Many top DeFi platforms now offer auto-stake features to simplify this process.

Use Staking Pools if Needed

If minimum staking amounts are high, consider staking pools. They allow smaller investors to earn consistent rewards while contributing to network security.

Stay Informed About Market and Platform Updates

Keep track of APY changes, governance updates, and token unlocks. Visit Best DeFi Staking Platforms in USA 2025 to stay updated on current rates.

Manage Risks and Avoid Hype

Diversify across multiple protocols, check lock-up periods, and avoid platforms promising unrealistic APYs. A well-balanced strategy ensures steady growth without unnecessary exposure.

Conclusion

DeFi staking in the USA has evolved into a dynamic and rewarding opportunity for both seasoned investors and crypto newcomers. As decentralized finance continues to mature, platforms are becoming more secure, transparent, and user-friendly, allowing anyone to earn passive income while supporting blockchain networks.

However, success in DeFi staking requires more than just high APYs — it demands research, diversification, and risk management. By choosing audited platforms, using secure wallets, and staying updated with U.S. regulatory changes, investors can safeguard their assets while maximizing returns.

Looking ahead to 2030, the convergence of AI automation, real-world asset tokenization, and institutional adoption will redefine how Americans engage with DeFi. For those ready to adapt and learn, DeFi staking offers not just rewards but a front-row seat to the future of decentralized finance.

👉 Explore more insights at CryptoTrendd.com.

Frequently Asked Questions

If you’re exploring decentralized finance for the first time, these FAQs cover the most common questions U.S. investors ask about DeFi staking — from safety and legality to earnings and tools.

1. What is the best DeFi staking platform for U.S. investors in 2025?

Top choices include Lido, Rocket Pool, Aave, and Balancer — known for strong security, liquidity, and consistent yields.

2. Is DeFi staking legal in the United States?

Yes. It’s legal as long as you comply with IRS reporting and avoid unregistered or risky platforms.

3. How much can I earn from DeFi staking?

Yields range from 4% to 20% APY, depending on the platform and token. Learn more in our guide on how much you can earn staking crypto.

4. What are the safest DeFi platforms right now?

Audited protocols like Aave, Lido, and Compound are considered the safest. Check our list of top audited and secure DeFi platforms for 2025.

5. What’s the difference between liquid and regular staking?

Liquid staking gives you tradeable tokens (like stETH) while earning rewards. Regular staking locks assets for higher but less flexible returns.

6. How are staking rewards taxed in the U.S.?

Rewards are treated as ordinary income when received. Learn more in IRS rules for crypto staking income.

7. Can I stake stablecoins?

Yes, stablecoins like USDC and DAI can be staked for safer, lower-risk returns — see our guide on the safest stablecoins to stake.

Follow Us On Social Media

Author Bio

Abhishek Chandravanshi is the mind behind CryptoTrendd.com — your go-to hub for insights on crypto trading apps, DeFi trends, and the stories of visionary crypto entrepreneurs shaping the future of finance.

In this piece, “Best DeFi Staking Platforms in USA 2025,” Abhishek breaks down how investors can earn smarter passive income through trusted decentralized platforms. He’s passionate about turning complex crypto strategies into simple, actionable ideas that help everyday traders stay ahead in the digital economy.

2 Comments