Honest Reviews of the Most Popular Crypto Trading Apps 2025

Follow Us on Social Media

Honest Reviews of the Most Popular Crypto Trading Apps 2025

Introduction to Crypto Trading Apps

The cryptocurrency world continues to evolve rapidly in 2025. With over 500 million active crypto users globally, digital assets have gone far beyond just being speculative investments. Today, crypto is used for payments, savings, staking, and even earning passive income.

At the heart of this growth are crypto trading apps — platforms that allow anyone, from beginners to seasoned investors, to buy, sell, stake, and manage crypto assets right from their smartphones or computers.

However, with over 300+ trading platforms available worldwide, it can be overwhelming to choose the right one. Users now demand not just convenience, but also security, low fees, and regulatory compliance.

This blog aims to give you honest reviews of the top crypto trading apps in 2025, based on the latest features, real user feedback, and updated regulations — helping you make smart decisions with your money.

Top Crypto Trading Apps of 2025

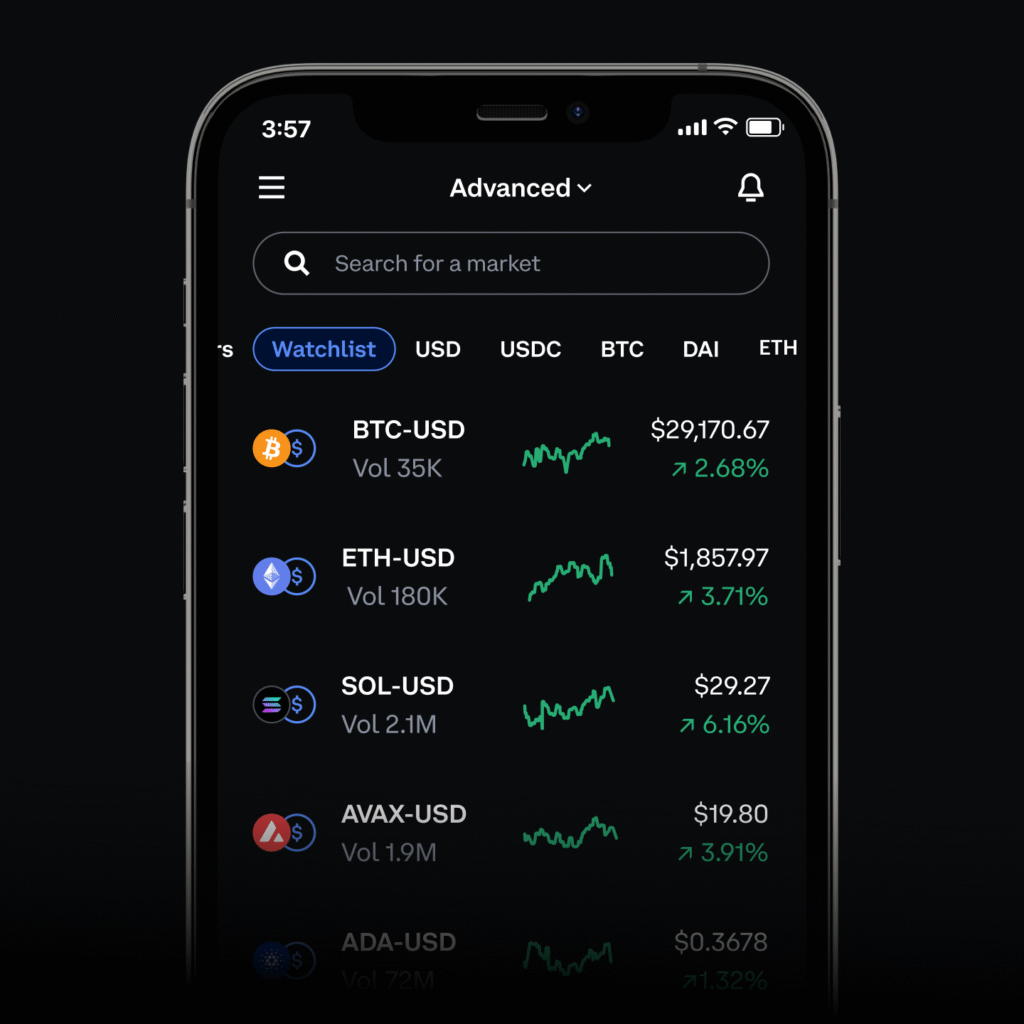

1. Coinbase Advanced (U.S. & Global)

- Overview: As one of the most trusted exchanges in the U.S., Coinbase serves over 98 million verified users. Its Advanced version is designed for users who want more sophisticated trading tools.

- Key Features:

- Advanced candlestick charts

- Staking on ETH, ADA, SOL, and more (up to 7.5% APY)

- Instant bank withdrawals and USD FDIC insurance

- User Experience:

- Clean, beginner-friendly interface

- Great for U.S. residents but comes with higher trading fees (0.5%) compared to others.

2. Kraken Pro (Global & U.S.)

- Overview: Known for its rock-solid security, Kraken has earned the trust of traders globally, including in the U.S., Europe, and Japan.

- Key Features:

- Spot, futures, and margin trading

- High-yield staking on assets like DOT, ETH, and ATOM

- Advanced security protocols and Proof-of-Reserves audits

- User Experience:

- Great for experienced traders

- Slight learning curve for beginners, but excellent customer service.

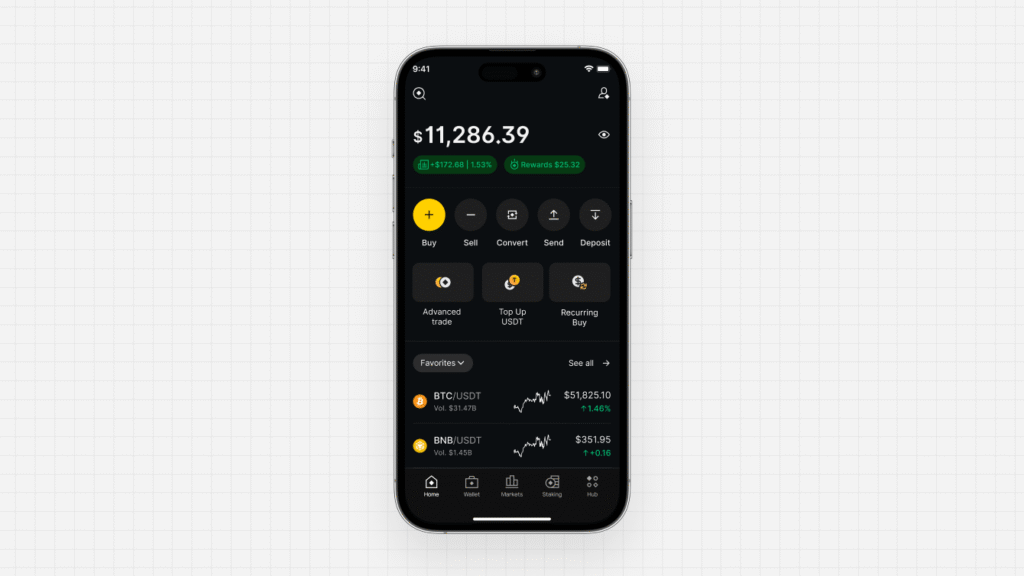

3. Binance Global (Excluding U.S.)

- Overview: With over 200 million global users, Binance remains the largest crypto exchange — offering a huge range of tokens and trading features.

- Key Features:

- Lowest fees (0.05% spot trading fee)

- 600+ cryptocurrencies

- Launchpads for early token investments and staking services

- User Experience:

- Highly versatile for pros

- Some concerns about regulatory issues in certain regions like Europe and Africa.

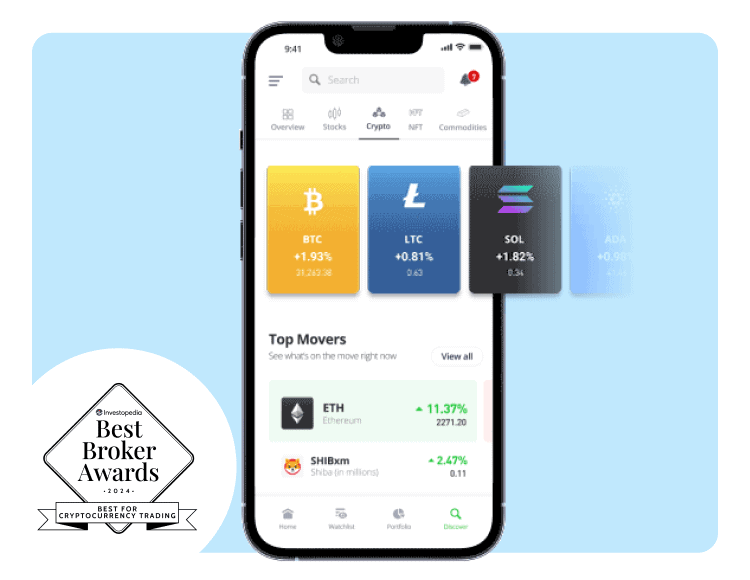

4. Robinhood Crypto (U.S. Focused)

- Overview: Originally a stock trading platform, Robinhood now has a growing crypto offering designed for simplicity.

- Key Features:

- Zero commission trading

- Supports around 35 popular cryptocurrencies

- Easy integration with stock and ETF trading

- User Experience:

- Ultra beginner-friendly

- Lacks advanced features like staking and futures.

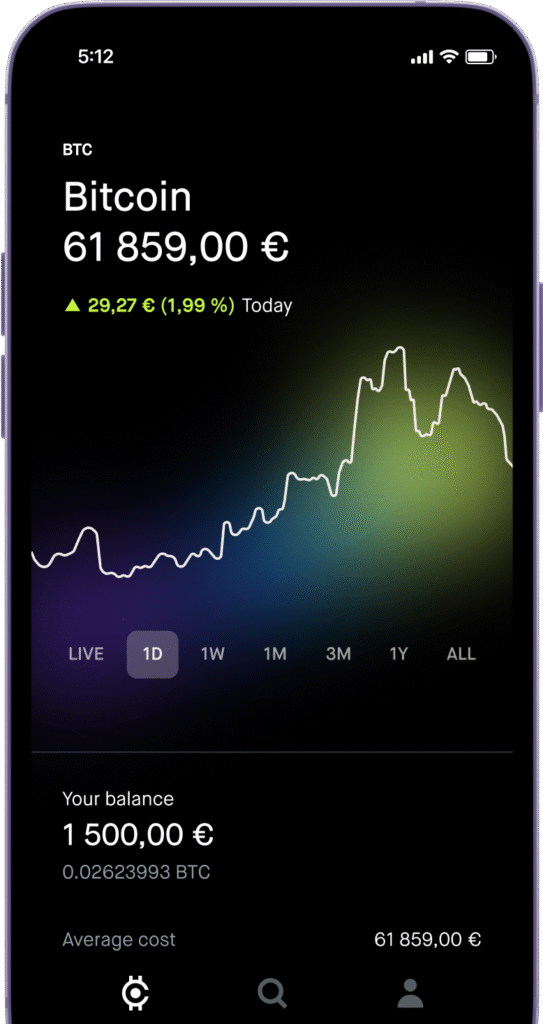

5. eToro (Global & U.S.)

- Overview: A unique platform combining crypto, stocks, ETFs, and social trading — perfect for those who prefer a diversified portfolio.

- Key Features:

- Copy trading — mirror trades of successful investors

- Over 100 cryptocurrencies, staking options, and fiat deposit support

- User-friendly wallet for withdrawals

- User Experience:

- Ideal for beginners and intermediate users

- Higher spreads (~1%) compared to other crypto-focused apps.

If You Want to trade crypto on Revolut X ? , Check Out this Article – How to Buy Crypto on the Revolut X App (2025 Guide – With Real Tips & Experiences)

✍️ My Personal Experience with Crypto Apps

Over the past four years, I’ve actively used several crypto trading platforms, and I’ve noticed that no app is perfect for everything. Each has its strengths and flaws depending on what you’re looking for.

- Kraken Pro has been my go-to for security. I’ve personally never faced a downtime or security breach with them. Their interface might not be the flashiest, but it’s rock solid for serious trading.

- For simplicity, I’ve tried Robinhood Crypto. It’s super easy for quick buys, but I quickly got frustrated when I realized I couldn’t withdraw my crypto to a private wallet (a major downside if you care about self-custody).

- Binance was unbeatable when I needed variety. From staking exotic tokens to participating in launchpads, I found opportunities I couldn’t get elsewhere. However, the constant regulatory drama (especially being an Indian user trying to access global Binance) was a headache.

- eToro surprised me with its copy trading feature. Watching how top traders managed their portfolios helped me learn faster than reading a dozen YouTube tutorials.

- Coinbase is probably the safest choice for beginners. I’ve onboarded a couple of friends who are completely new to crypto, and they found Coinbase intuitive and easy to trust.

🚩 My Honest Opinion (No Sugarcoating)

🔥 If I had to pick…

- Best for security: Kraken — I sleep better knowing my assets are there.

- Best for lowest fees: Binance — but be aware of potential regulatory headaches.

- Best for simplicity: Coinbase — especially great for beginners.

- Best for passive income & learning: eToro — copy trading is a game-changer for newbies.

- Best for quick, small trades (with limits): Robinhood — but don’t expect full ownership.

🚫 What I Avoid:

- Any platform that doesn’t allow withdrawals to a private wallet. If you don’t own the keys, you don’t own the coins.

- Apps with poor customer support — in crypto, time is money, and waiting days for account recovery is not acceptable.

🗣️ Quotes from Trusted Sources (2025)

🔵 Coinbase

“Our mission remains the same in 2025: To increase economic freedom in the world by making crypto safe and easy to use. We are committed to regulatory compliance, security, and offering U.S. customers the most trusted trading experience.”

— Brian Armstrong, CEO of Coinbase (Source: Coinbase Blog, January 2025)

“With Coinbase Advanced, we aim to provide both retail and professional traders with deeper liquidity, faster execution, and better staking rewards — while staying fully compliant with U.S. regulations.”

— Official Coinbase Product Update, March 2025

🟦 Kraken

“Security is not just a feature — it’s our foundation. In 2025, Kraken continues to lead the industry with our real-time Proof-of-Reserves audits and 95% cold wallet storage policy.”

— Dave Ripley, CEO of Kraken (Kraken Transparency Report, 2025)

“Our focus is to empower users globally with secure access to crypto markets, staking, and derivatives, backed by world-class customer support.”

— Kraken Annual Report, April 2025

🟨 Binance

“Despite regulatory hurdles, Binance remains committed to compliance while providing users with the lowest fees, the most assets, and innovative products like Launchpool and Dual Investment.”

— Richard Teng, CEO of Binance Global (Binance AMA, February 2025)

“Binance invests heavily in user protection, including our $1 billion SAFU (Secure Asset Fund for Users) and advanced anti-fraud systems. Security and transparency are at the core of our operations.”

— Binance Security Update, January 2025

🟩 eToro

“Copy trading remains one of the most powerful tools for democratizing finance. In 2025, we continue enhancing transparency, allowing users to see every trade their copied investors make — in real time.”

— Yoni Assia, CEO of eToro (eToro Press Release, March 2025)

“Our goal is to make crypto and stock investing accessible to everyone, not just professionals. With the rise of AI-driven strategies, we’re focused on combining social trading with cutting-edge technology.”

— eToro Blog, 2025

🟥 Robinhood Crypto

“Our priority for Robinhood Crypto is simplicity — commission-free trading, easy access, and now, expanded crypto transfers to external wallets for most assets.”

— Robinhood Crypto Announcement, February 2025

“We’ve heard our customers loud and clear: crypto withdrawals are essential. In 2025, we’ve expanded this feature to nearly all supported assets.”

— Robinhood Blog, January 2025

Want to Reviews River Financial App , Check Out Here – River Financial Review 2025: Why Bitcoin Maximalists Prefer It Over Coinbase & Others

🌐 Industry Experts & Analysts

“Regulatory compliance isn’t optional in 2025 — it’s the price of doing business. Platforms like Coinbase and Kraken are thriving because they embraced compliance early, while others scramble to catch up.”

— Laura Shin, Crypto Journalist & Host of Unchained Podcast

“Crypto users in 2025 demand transparency. Platforms offering Proof-of-Reserves, clear fee structures, and robust customer service are winning trust in a skeptical market.”

— Messari 2025 Crypto Trends Report

🔥 Real User Stories & Reviews in 2025

✔️ Success Story – Passive Income via Kraken (USA)

Name: Mark, 32, Seattle

Story:

“I started staking Polkadot (DOT) on Kraken back in 2022. With DOT giving around 12% APY at the time, I was making passive income that covered my Netflix and phone bill. Even in 2025, Kraken has kept its staking rates competitive, and the peace of mind from their security is worth the slightly higher trading fees.”

✔️ Struggles with Robinhood’s Limitations (USA)

Name: Aisha, 27, New York

Story:

“I loved Robinhood when I started—no fees, clean interface. But when I tried to move my crypto to a hardware wallet, I realized I couldn’t with several coins. It felt like I didn’t fully own my assets. I eventually switched to Coinbase for better control over my crypto.”

✔️ Regulatory Frustrations with Binance (UK)

Name: Sophie, 29, Manchester

Story:

“I was happy with Binance for two years because of the low fees. But then came the notice—Binance was limiting some services in the UK. My staking rewards froze temporarily, and I had to scramble to move funds. Now I keep my main holdings on Kraken and use Binance only for certain altcoins.”

✔️ Learning Crypto Through Copy Trading (India)

Name: Rahul, 25, Mumbai

Story:

“I was overwhelmed when I first looked at charts and candlesticks. eToro’s copy trading feature let me mirror experienced traders. I started with $500 and learned more by watching their strategies than any YouTube video could teach me. I eventually started making my own trades confidently.”

✔️ Binance Customer Support Nightmare (Australia)

Name: Ethan, 35, Sydney

Story:

“Binance is a beast for trading, but when my account was frozen due to a KYC error, I couldn’t get it resolved for 10 days. Their support was slow. I didn’t lose funds, but the stress was real. Now, I diversify my funds across Binance and Kraken.”

Top Honest Reviews From Different Countries

🇺🇸 United States

- “Kraken feels like Fort Knox. I’ve traded on multiple platforms, but Kraken’s security and uptime are unmatched.” – James, California

- “Robinhood’s crypto is okay for small trades but feels restrictive once you want to stake or buy lesser-known coins.” – Lily, New York

🇬🇧 United Kingdom

- “eToro is perfect for me. I don’t have the time to research everything, so copy trading helps a lot.” – Arjun, London

- “Binance is unbeatable in terms of fees and options, but the uncertainty around regulations here makes me nervous.” – Sophie, Manchester

🇯🇵 Japan

- “Kraken’s Japanese language support is a lifesaver. Plus, their staking returns are among the highest I’ve seen.” – Hiroshi, Tokyo

🇦🇺 Australia

- “Coinbase works well but is pricey. I switched to Binance for lower fees and better coin variety.” – Ethan, Sydney

🌍 Global Users

- Users worldwide praise Binance’s variety and low fees but frequently mention concerns over sudden service restrictions due to regulations in countries like Nigeria, the Netherlands, and parts of South America.

Comparative Analysis of Features

⭐ User Interface & Experience

- Beginner-Friendly: Robinhood, Coinbase — Simple UI, fewer distractions, intuitive.

- Advanced Trading: Kraken Pro, Binance — Offer depth with order books, leverage, futures, and APIs.

- All-in-One Investing: eToro — Mix crypto with stocks and ETFs.

🔐 Security Measures

- Kraken: Cold storage, regular penetration tests, 2FA, biometrics, and real-time Proof of Reserves.

- Coinbase: FDIC insurance for USD, SOC2-compliant security, and high-end encryption.

- Binance: Strong security, but some questions around regulatory compliance in multiple countries.

- Robinhood: Basic security — 2FA and encryption but lacks crypto withdrawal options in some regions.

- eToro: Highly regulated in Europe and the U.S., robust security but funds are held custodially.

💸 Fees Comparison

| App | Spot Fee | Futures | Staking | Fiat Support |

|---|---|---|---|---|

| Coinbase | 0.5% | ❌ | ✅ | USD |

| Kraken Pro | 0.26% | ✅ | ✅ | USD, EUR, JPY |

| Binance | 0.05% | ✅ | ✅ | 30+ currencies |

| Robinhood | 0%* | ❌ | ❌ (Limited) | USD |

| eToro | 1% (spread) | ❌ | ✅ | USD, EUR |

*Note: Robinhood’s 0% comes with hidden costs via wider spreads.

How to Choose Safely in 2025

Choosing the right crypto trading app isn’t just about the lowest fees. Here are key things to consider:

✅ Check Regulatory Compliance

- If you’re in the U.S., Binance is not available — stick to Coinbase, Kraken, or Robinhood.

- UK and EU users should check for recent updates, especially for Binance and newer platforms.

✅ Security Should Be Non-Negotiable

- Look for:

- 2FA (Two-Factor Authentication)

- Biometric login (fingerprint/face ID)

- Cold wallet storage

- Proof-of-Reserves reports

✅ Understand the Fee Model

- Some apps (like Binance) have transparent, ultra-low fees.

- Others (Robinhood, eToro) claim ‘zero commissions’, but compensate with wider spreads — effectively hidden costs.

✅ Consider Your Trading Goals

- Long-term holders: Prioritize staking features (Kraken, Coinbase).

- Active traders: Need advanced tools, leverage, and fast execution (Kraken Pro, Binance).

- Beginner or casual investors: Go for simplicity (Robinhood, eToro).

Future Trends in Crypto Trading Apps (2025 & Beyond)

🔮 AI-Powered Tools

- Platforms like eToro and Kraken are integrating AI-based trading signals, portfolio optimizers, and predictive models to help users make smarter decisions.

🔗 On-Chain Transparency

- Expect more exchanges to offer live proof-of-reserves, allowing users to verify if their assets are fully backed in real-time.

📜 Stricter Regulations

- Governments in the U.S., Europe, and India are tightening crypto laws. Apps are adapting with ID verification, tax reporting tools, and KYC upgrades.

🌐 Rise of Social Trading

- Copy trading is booming. eToro’s success has inspired new apps like CopyCrypto and TradeTogether, focusing purely on social strategies.

💳 Integration with DeFi

- Some centralized apps (CEX) are now adding features to connect with DeFi protocols, bridging the gap between CeFi and DeFi for yield farming, lending, and staking.

🛑 Key Takeaway — What I’ve Learned the Hard Way

- Never keep all your crypto on one app. Exchanges can go down, get hacked, or face regulatory shutdowns.

- Always set up 2FA, strong passwords, and whitelist withdrawal addresses.

- Self-custody matters. Use exchanges for trading, not as long-term storage.

🔍 What Real People Care About in 2025

- Security: Still the #1 concern. Hacks are rare on major apps but not impossible.

- Regulations: A massive factor. Some apps work great one day and get restricted the next (e.g., Binance in the UK, Nigeria, or parts of Europe).

- Fees Transparency: Users are smarter now. People hate hidden fees through spreads (common on Robinhood or eToro).

- Customer Service: Major pain point for nearly every app when things go wrong.

⭐ Final Thoughts

Crypto trading apps in 2025 are safer, smarter, and offer more opportunities than ever before — but they come with risks. No app is perfect for everyone. Whether you value low fees, high security, or user-friendly design, the right platform depends on your goals.

🎯 My honest advice:

“Use 2-3 apps, spread your assets, trade smart, and always keep long-term holdings in a hardware wallet.”

🚀 Pro Tip: Always use hardware wallets or self-custody for large holdings. Treat exchanges like a hot wallet — for trading, not for saving.

FAQs

❓ What should I look for in a crypto trading app?

- Check for regulatory compliance, security protocols, fees, available assets, staking options, and ease of use.

❓ Are crypto trading apps safe to use?

- Yes, if you choose regulated apps with strong security like Kraken or Coinbase. But remember, the safest storage is still self-custody via hardware wallets.

❓ How do fees vary between different trading apps?

- They vary widely — from 0.05% on Binance to 1% spreads on eToro. Some apps like Robinhood hide fees within spreads.

❓ Can I trade cryptocurrencies on my mobile device?

- Absolutely. Every major crypto app in 2025 supports iOS and Android apps with full functionality.

❓ What are the risks associated with crypto trading apps?

- Risks include:

- Platform hacks

- Service outages during market crashes

- Regulatory shutdowns

- Hidden fees

- Poor customer service on some platforms

🚀 Ready to Start Your Crypto Journey?

Choosing the right crypto trading app can make all the difference. Whether you’re looking for security, low fees, staking rewards, or beginner-friendly tools, there’s an app that fits your needs.

👉 Explore. Compare. Trade Smart.

✅ Check out the official websites of Coinbase, Kraken, Binance, eToro, and Robinhood to get started.

🔒 Pro Tip: Always enable 2FA, use strong passwords, and never store large amounts of crypto on exchanges.

➡️ Start trading smarter today — and take control of your financial future.

Follow Us on Social Media

2 Comments