Michael Egorov: Curve’s Mysterious DeFi Founder

Introduction to a Silent Giant

In the ever-loud, fast-tweeting, meme-filled world of crypto, Michael Egorov stands out by doing something radical—staying silent. While most crypto founders flood X (formerly Twitter) with updates, hot takes, and token hype, Egorov operates in stealth mode. No drama. No showmanship. Just pure code and protocol.

And yet, this enigmatic figure is the brain behind Curve Finance, one of the most foundational and trusted decentralized finance (DeFi) protocols in the world. The platform facilitates billions in stablecoin swaps monthly, offers highly efficient automated market making (AMM), and powers a significant portion of the DeFi ecosystem.

But despite all that, most people still ask: Who is Michael Egorov? Why is he so elusive, and how did he quietly build one of the most important platforms in decentralized finance?

Let’s break it down, step by step.

From Physics to Finance: Egorov’s Origin Story

Egorov’s journey didn’t start with crypto. It began with physics.

Born in Russia, Michael studied at the prestigious Moscow Institute of Physics and Technology, where he earned a Ph.D. in theoretical physics. This wasn’t casual math—we’re talking hardcore academic stuff: quantum mechanics, complex systems, and algorithmic modeling.

Later, he moved to the United States, where he transitioned into a niche intersection of cryptography and computer science. This is where he got introduced to the concept of decentralization—not as a libertarian dream but as a technical challenge.

“Math isn’t political—it’s structural,” Egorov once said in an obscure interview. That says a lot about how he sees the world.

His fascination with how systems can run autonomously using algorithms laid the groundwork for what would later become Curve.

Before Curve: Egorov’s First Tech Startups

Before Curve took off, Egorov had already dipped his toes into the startup scene. He co-founded NuCypher, a cryptographic infrastructure startup focused on data privacy and secure communication for decentralized networks.

NuCypher was one of the earliest projects to explore proxy re-encryption—a way to securely share encrypted data without revealing the key. Think of it as a privacy layer for the internet.

While NuCypher gained early attention and raised funding, it didn’t quite capture mass adoption. But it taught Egorov a valuable lesson:

- Great tech needs clear utility.

- Innovation must solve real problems, not just academic ones.

And so, Egorov moved on—to something even bigger.

The Birth of Curve Finance

In 2019–2020, DeFi was exploding. But swapping stablecoins (like USDC, DAI, and USDT) was inefficient. The early automated market makers (AMMs) like Uniswap were great for volatile assets, but they caused too much slippage when trading tokens with similar values.

Egorov saw an opportunity.

He asked a simple question: “What if an AMM existed specifically for stablecoins, with reduced slippage and better capital efficiency?”

Boom. Enter Curve Finance.

Launched in early 2020, Curve was an AMM optimized for stablecoins and similarly priced assets. It was a game-changer from day one.

Official Website – Curve Finance

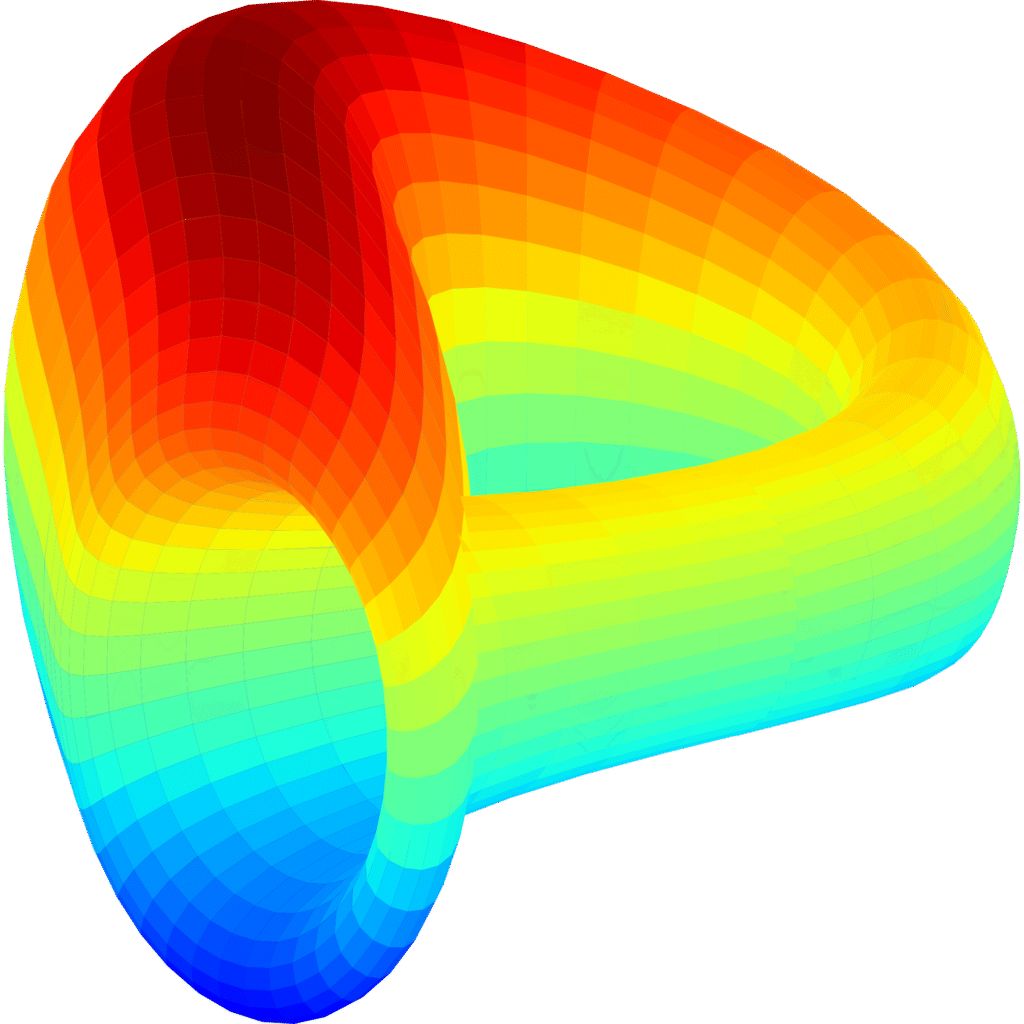

The Math Behind Curve

Most AMMs, like Uniswap, use a constant product formula (x*y=k). While this works well for volatile assets, it’s inefficient for assets meant to hold the same value (like stablecoins).

Egorov applied a custom bonding curve that flattens around the equilibrium price. This significantly reduces slippage and makes stablecoin swaps nearly fee-less at scale.

Think of Curve like a tightrope walker balancing two buckets of water—every small movement is adjusted precisely to keep equilibrium.

This mathematical brilliance helped Curve become the liquidity layer for DeFi. It wasn’t flashy, but it was brilliant.

Governance Moves: Egorov’s CRV Controversy

With growth came governance. In August 2020, Curve launched its governance token—CRV—alongside a decentralized autonomous organization (DAO).

Sounds fair, right? But here’s where it got spicy.

Egorov quietly minted CRV tokens to himself and retained a massive share of voting power via veCRV (vote-escrowed CRV)—a locking mechanism that boosts governance rights based on how long you lock your tokens.

Critics accused him of centralization in disguise.

Even though the DAO was technically live, Egorov’s vote weight meant he could override proposals and changes.

Some called it a power grab. Others said it was a necessary move to stabilize early governance.

Either way, it added to his mystique—and controversy.

👉 Bryan Pellegrino Biography: From Gaming Geek to LayerZero Crypto Visionary 2025

Egorov’s Low-Profile Leadership Style

Unlike DeFi rockstars like Andre Cronje or Do Kwon (before the fall), Egorov is painfully quiet.

- Rare interviews

- Almost no tweets

- Virtually invisible at conferences

But his GitHub commits speak volumes. His leadership style is builder-first, not brand-first.

Many respect him for this. While the rest of crypto obsesses over influencers and hype cycles, Egorov is in the lab, tweaking code and math models.

In a world full of noise, he’s the silent architect.

Curve’s Expanding Ecosystem

Over the years, Curve has evolved from a single-product DEX to a full-fledged DeFi ecosystem:

- Tricrypto Pools – Pools with ETH, BTC, and Stablecoins

- Layer 2 Integrations – Including Arbitrum, Optimism, and zkSync

- Curve Wars – Protocols like Convex Finance and Yearn Finance competing for CRV votes

This “war” was all about governance power. More CRV voting power = more rewards directed to your pool.

Curve turned DeFi governance into a competitive game, with yield bribes, veTokenomics, and strategic alliances.

Egorov’s Influence on DeFi’s Governance Models

One of Curve’s biggest contributions to DeFi wasn’t just tech—it was governance design.

The veCRV model (vote escrow) introduced:

- Long-term token locking

- Increased voting power

- Incentivized alignment with the protocol

This model was so effective, it inspired dozens of forks and adaptations:

- Balancer veBAL

- Frax veFXS

- Solidly (by Andre Cronje)

Egorov quietly created a template for decentralized coordination, blending math and incentives in powerful new ways.

Criticism and Scandals

Despite his genius, Egorov has faced heat.

In mid-2023, reports surfaced that he borrowed large sums using CRV as collateral. When CRV’s price dropped, liquidation fears rippled across DeFi. If his loans were liquidated, it could crash the price of CRV, potentially destabilizing Curve itself.

The community panicked. Critics slammed him for reckless behavior.

He eventually repaid portions of the loan, but the episode shook trust.

It was a reminder: no matter how brilliant the code, founder behavior still matters.

Egorov vs the Market: Curve’s Survival Through Bear Cycles

Curve’s resilience during brutal bear markets is no accident. Unlike speculative projects that burn fast and fade, Curve thrives on real utility.

Even during market crashes, stablecoin trading never stops. Curve’s value proposition—efficient, low-cost swaps—remains strong.

That’s why Curve has consistently maintained billions in Total Value Locked (TVL) through multiple market downturns.

The secret? A boring but battle-tested protocol that just keeps working.

The Future Vision of Curve (and Egorov)

Looking ahead, Curve isn’t slowing down. Its roadmap includes:

- crvUSD: A native stablecoin with automated self-liquidation mechanics

- Deeper Layer 2 integrations

- More AMM innovation (especially for volatile pairs)

As for Egorov?

It’s hard to say. He could stay behind the curtain, focusing on code—or he could reemerge with a new vision. Either way, his influence is baked into the DNA of DeFi.

Conclusion: Legacy of a DeFi Architect

Michael Egorov isn’t your typical crypto founder. No million-dollar NFT profile pic. No flashy events. No hype.

But he built Curve Finance, one of the most efficient and widely used protocols in DeFi. His contributions to governance, math-based AMMs, and vote-escrow economics are foundational.

He’s not trying to be a hero. He’s just solving hard problems, one equation at a time.

And in DeFi, that’s what truly changes the game.

FAQs About Michael Egorov & Curve

1. Who is Michael Egorov?

Michael Egorov is a Russian-born physicist, cryptographer, and the founder of Curve Finance. He previously co-founded NuCypher and is known for his deep expertise in mathematics and low-profile leadership.

2. What makes Curve different from Uniswap?

Curve uses a custom algorithm optimized for assets with similar prices (like stablecoins), offering lower slippage and better capital efficiency than Uniswap’s constant product model.

3. Why is Egorov’s governance role controversial?

Egorov retained a large amount of veCRV voting power, giving him significant control over Curve’s DAO. Critics argue this undermines decentralization.

4. What was the CRV liquidation scare?

In 2023, Egorov borrowed stablecoins using CRV as collateral. A sharp drop in CRV’s price risked liquidation, which could have destabilized the protocol.

5. What is crvUSD and why does it matter?

crvUSD is Curve’s upcoming stablecoin. It introduces a novel “self-liquidating” mechanism that automates liquidation, reducing systemic risk.

Please don’t forget to leave a review.