Highest Paying Staking Exchanges Right Now (May 2025)

By Abhishek Chandravanshi

In 2025, staking crypto is no longer a niche concept. It’s a mainstream way for investors to earn passive income, especially in a market that rewards long-term holding. But where you stake matters—returns can vary widely from one exchange to another.

Whether you’re holding ETH, DOT, SOL, or stablecoins, choosing the highest paying staking exchanges can significantly boost your portfolio. Let’s break down the best platforms offering top APYs right now and how you can make the most of them.

💡 New to staking? Check out our Crypto Staking Calculator to estimate your earnings in seconds.

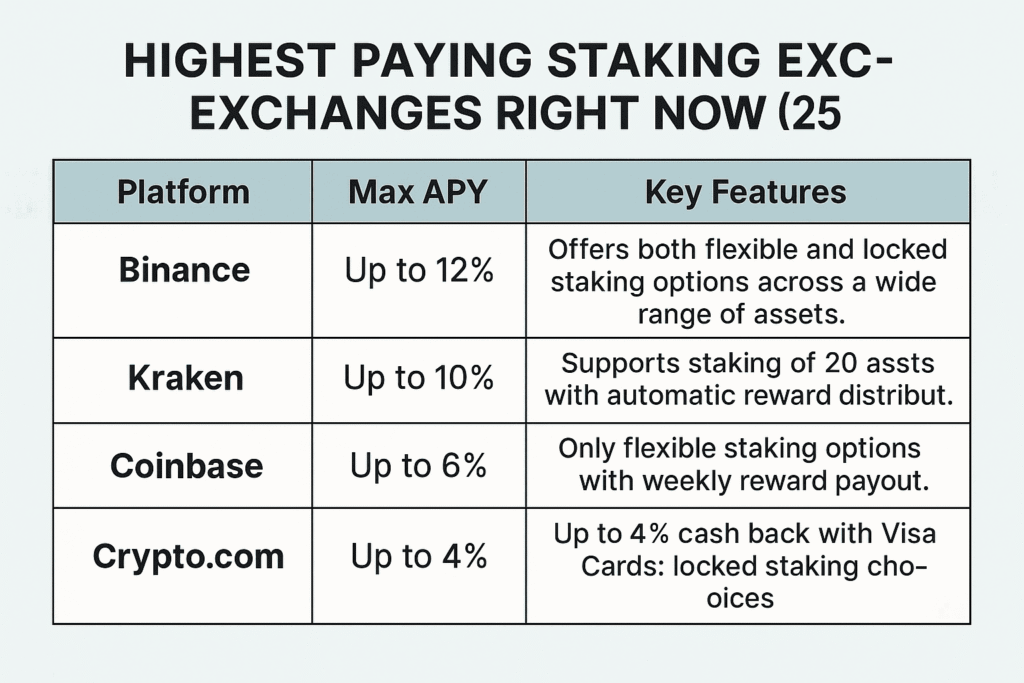

As of May 2025, the highest paying staking exchanges include Binance (up to 12%), Kraken (up to 10%), and Coinbase (up to 6%). These platforms offer flexible and locked staking with varying reward frequencies and crypto asset support.

What Makes a “High-Paying” Staking Exchange?

Before diving into the rankings, here’s what we considered:

- Annual Percentage Yield (APY): The higher, the better.

- Asset Support: ETH, DOT, SOL, ADA, ATOM, and stablecoins like USDT.

- Staking Types: Flexible vs. locked.

- Payout Frequency: Daily, weekly, or monthly.

- Security & Reputation: Regulated and trusted platforms.

1. Binance – Best Overall for High APYs

Max APY: Up to 12%

Supported Assets: ETH, DOT, ADA, SOL, USDT, BNB, and more

Staking Type: Flexible & Locked

Reward Frequency: Daily

Binance continues to dominate the staking space in May 2025. With dozens of assets available for both locked and flexible staking, it offers some of the highest APYs in the industry.

Their Simple Earn feature now includes ETH restaking options and dual investment staking products. Users can customize lock-up periods to boost rewards.

👉 Explore current Binance Staking Rates

Pros:

- Best APY range across many assets

- Frequent promotions with boosted returns

- Reliable and secure infrastructure

Cons:

- Locked staking may restrict withdrawals

- Geographic restrictions in some regions

2. Kraken – Best for U.S. Crypto Stakers

Max APY: Up to 10%

Supported Assets: ETH, ADA, DOT, SOL, FLOW, XTZ

Staking Type: On-chain & off-chain

Reward Frequency: Weekly

Kraken is a favorite for U.S. users looking for compliant, easy-to-understand staking. In May 2025, its ETH staking product offers 6–8% APY, and newer options like ATOM and KAVA are earning up to 10%.

Kraken also supports restaking via its ETH2.0 validator pool, giving users a share in the consensus layer rewards without having to run a node.

👉 Read: Kraken vs Coinbase: Best Staking APY for U.S. Users

Pros:

- Fully regulated for U.S. customers

- Excellent transparency on staking rewards

- Easy unstaking process (on-chain only)

Cons:

- Limited number of staking assets

- Slightly lower rewards on flexible plans

3. Coinbase – Best for Beginners

Max APY: Up to 6%

Supported Assets: ETH, ALGO, XTZ, ATOM, USDC

Staking Type: Flexible

Reward Frequency: Weekly

Coinbase is a solid choice for newcomers. While it doesn’t offer the highest APY, it prioritizes user-friendliness and clarity. ETH staking on Coinbase currently yields around 5%, while ALGO and ATOM can reach 6%.

Their recent integration of ETH Liquid Staking Tokens (LSTs) is a big win, letting users trade their staked ETH while still earning yield.

Pros:

- Ideal for first-time stakers

- Strong reputation and security

- Flexible staking—no lock-in required

Cons:

- Lower yields than competitors

- Limited asset support

4. Crypto.com – Best Cashback + Staking Combo

Max APY: Up to 4%

Supported Assets: CRO, ETH, USDC, BTC

Staking Type: Locked

Reward Frequency: Daily

Crypto.com’s staking model is tightly linked with its Visa card ecosystem. Users who lock up CRO get enhanced staking APYs plus up to 4% cashback on spending.

Their DeFi Earn section offers even higher rates but comes with additional smart contract risks.

Pros:

- Combo of yield + card cashback

- Clean UI with daily earnings

- Lots of promotions

Cons:

- CRO dependency for best rates

- Limited DeFi understanding needed for advanced yields

5. Lido (via Exchanges) – Best for Liquid Staking

Max APY: 3.8% – 6% (varies by exchange)

Assets: ETH, SOL, MATIC

Reward Frequency: Daily

Lido is a decentralized staking protocol, but it’s now offered through major exchanges like Kraken, Binance, and Bitfinex.

You stake ETH and receive stETH, a liquid token you can use in DeFi apps. It’s ideal for users who want to stake and stay liquid.

Pros:

- No lock-up

- Fully decentralized

- Supports DeFi integrations

Cons:

- May diverge from ETH value (price risk)

- Requires a basic DeFi understanding

Comparison Table: May 2025 Highest Staking APYs

| Exchange | Max APY | Notable Feature |

|---|---|---|

| Binance | 12% | Locked staking + ETH restaking |

| Kraken | 10% | U.S. friendly, ETH 2.0 validator pool |

| Coinbase | 6% | Flexible, beginner-friendly |

| Crypto.com | 4% | Cashback + staking combo |

| Lido (via CEX) | 6% | Liquid staking tokens like stETH |

How to Choose the Right Staking Platform

Choosing the right exchange isn’t just about APY. Consider the following:

- Regulatory Status – Is it available in your region?

- Custody Risk – Does the exchange hold your crypto?

- Unstaking Time – Some assets take days or weeks to withdraw.

- Hidden Fees – Some platforms charge fees before distributing rewards.

- Advanced Options – Look for ETH restaking, DeFi integrations, or boosted products.

Strategies to Maximize Staking Rewards

If you’re serious about staking, here are a few smart strategies:

- Split Your Assets – Use both flexible and locked products.

- Take Advantage of Promotions – Platforms like Binance frequently offer boosted APYs.

- Reinvest Rewards – Compound staking can accelerate your gains.

- Use LSTs in DeFi – stETH or rETH can be deposited into lending protocols for extra yield.

- Track Your Returns – Use tools like our Staking Calculator for estimates.

FAQs: Highest Paying Staking Exchanges

Q1. What is the best crypto exchange for staking in 2025?

A: Binance currently offers the highest APYs (up to 12%) and supports the most staking assets, making it the top choice.

Q2. Is staking crypto safe on exchanges?

A: Reputable exchanges like Kraken, Coinbase, and Binance offer secure staking services, but there’s always some risk. Consider custodial risks and lock-up periods.

Q3. Can I stake stablecoins in 2025?

A: Yes, USDT and USDC staking is supported on Binance, Crypto.com, and some DeFi platforms, often with 3–8% APY.

Q4. What’s the difference between locked and flexible staking?

A: Locked staking offers higher returns but ties up your funds, while flexible staking lets you withdraw anytime but with lower APYs.

Q5. Does staking affect my crypto taxes?

A: Yes, staking rewards are considered taxable income in most countries. Learn more from our Crypto Tax Guide for Staking.

Conclusion: Where Should You Stake in May 2025?

If you want the highest paying staking exchange right now, Binance is the clear leader. But Kraken and Coinbase offer strong alternatives, especially for users in the U.S. or those new to staking.

Looking to stake ETH? Use Lido or Kraken for the best liquidity and yield options. For a mix of utility and yield, Crypto.com delivers with its card-staking hybrid.

.

What’s your go-to platform for staking crypto in 2025, and why?Let us know in comment box!

4 Comments