Best APY Crypto Staking Exchanges in 2025: Where to Earn the Highest Rewards

By expert

In 2025, staking crypto has evolved from a niche practice into a major strategy for earning passive income. But the key question remains: which exchange offers the best APY (Annual Percentage Yield) for staking crypto? With dozens of platforms claiming competitive rates, finding the right one requires careful comparison.

This guide explores the top crypto staking exchanges of 2025, highlighting their APY rates for major coins like Ethereum (ETH), Polkadot (DOT), Cardano (ADA), and more. You’ll also learn how to choose the right platform, calculate your potential earnings, and stay safe while staking.

📌 Featured Snippet Outline

- What is APY in crypto staking?

- Top staking exchanges and their 2025 APY rates

- How to choose a staking platform

- Real earnings examples (ETH, DOT, ADA)

- FAQs on staking safety, APY variation, and more

🔍 What is Crypto Staking and APY?

Crypto staking allows you to lock your digital assets in a blockchain network to support its security and operations. In return, you receive staking rewards, which are typically expressed as APY.

APY represents the total expected return in a year, including compounding interest. For example, if you stake 10 ETH at a 5% APY, you’ll earn approximately 0.5 ETH annually.

For more personalized estimates, use our Crypto Staking Calculator to forecast your passive income potential.

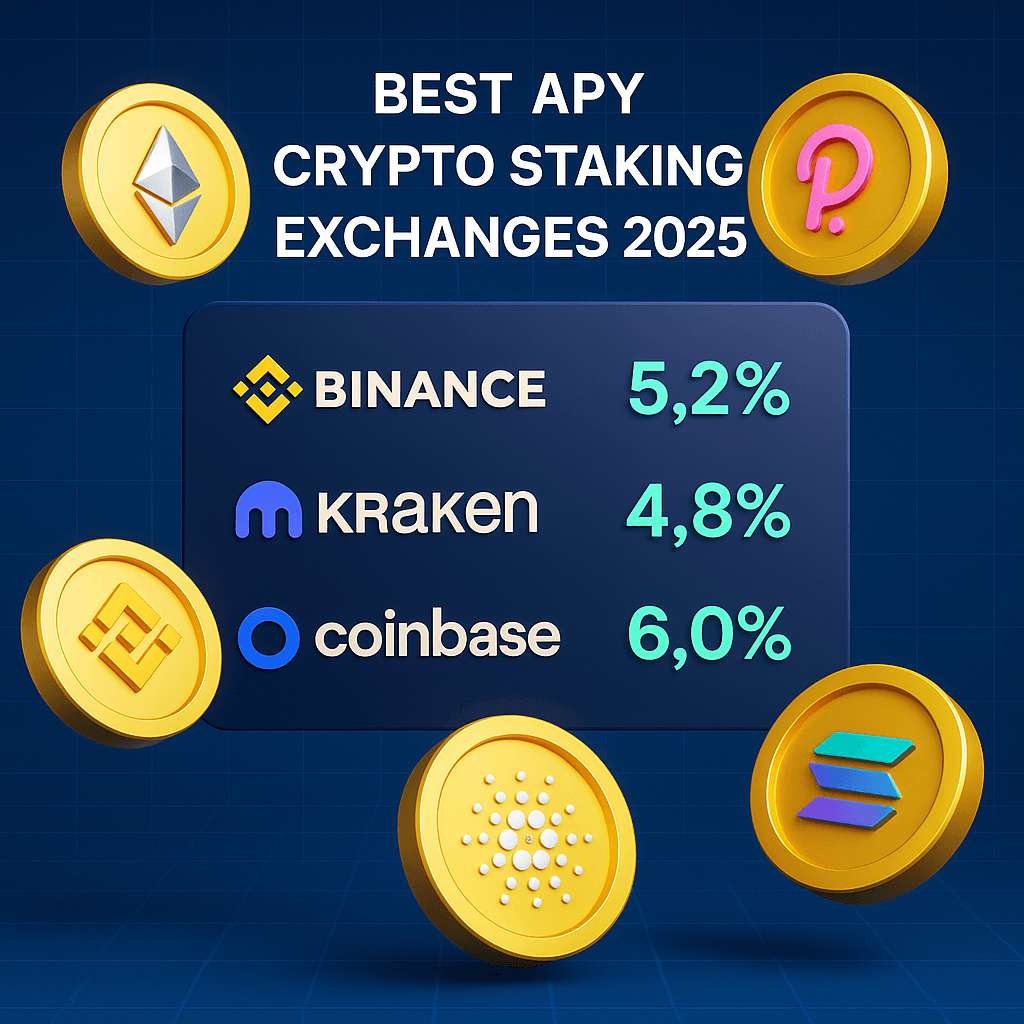

🥇 Best Crypto Staking Exchanges in 2025 (With Highest APY)

Below is a comparison of the top-performing staking platforms based on APY and trust:

| Exchange | ETH APY | DOT APY | ADA APY | Stablecoins APY |

|---|---|---|---|---|

| Coinbase | 6.0% | 8.5% | 5.1% | 4.5% (USDC) |

| Kraken | 4.8% | 9.0% | 4.6% | 6.0% (USDT) |

| Binance | 5.2% | 10.2% | 4.9% | 7.0% (USDT/USDC) |

| OKX | 5.5% | 9.8% | 5.0% | 6.5% |

| Bybit | 5.8% | 10.0% | 5.2% | 7.5% (USDC) |

Want real-time rates? Check our Live Crypto Staking APY Rates page, updated daily.

🧠 How to Choose the Best Crypto Staking Platform

Choosing the best staking exchange isn’t just about the highest APY. You also need to consider:

1. Staking Type

- Flexible staking allows withdrawals at any time but offers slightly lower APY.

- Fixed staking locks funds for a period (7–120 days) and typically yields higher rewards.

2. Security & Trust

Prioritize exchanges with a long track record, strong liquidity, and regulated operations. Coinbase, for example, is regulated in the U.S., while Kraken is known for its strong security policies.

3. Supported Coins

Some platforms support more than just ETH or DOT. If you’re diversifying, look for exchanges that allow staking of SOL, ATOM, MATIC, and stablecoins.

4. Fees and Minimums

Always review the fee structure and the minimum staking amount required. Lower entry points are ideal for new users.

For deeper analysis, visit: Is Staking Crypto on Exchanges Safe?

💸 Real Earning Examples Using Staking APY

Let’s say you want to stake in 2025 — here’s what you could earn:

- 5 ETH at 6.0% APY (Coinbase) → Earn 0.30 ETH/year ($900 at $3,000 ETH)

- 1,000 DOT at 10.2% APY (Binance) → Earn 102 DOT/year (~$850 at $8.5 DOT)

- $5,000 USDT at 7.0% APY (Binance) → Earn $350/year

Use our staking calculator to adjust for your specific amounts, lock durations, and compounding periods.

⚠️ Is It Safe to Stake on Exchanges in 2025?

Security is a top concern when staking on centralized platforms. While Coinbase, Kraken, and Binance are generally trusted, no exchange is immune to risk. Here’s how to protect yourself:

- ✅ Enable two-factor authentication

- ✅ Use hardware wallets when possible

- ✅ Avoid staking all your assets in one place

- ✅ Monitor withdrawal options and staking terms

Exchanges may change their reward rates or halt withdrawals during volatile periods — always read the fine print.

🔥 Why APY Rates Change in Crypto

Staking APYs are not fixed. They vary based on:

- Network inflation rates

- Validator performance

- Lock duration and total staked supply

- Exchange fees and commissions

That’s why it’s smart to track live data on our Live Staking Rates dashboard — updated daily for all major coins and platforms.

🙋 Frequently Asked Questions (FAQs)

1. Which crypto exchange has the best APY for staking in 2025?

Currently, Binance offers some of the highest APYs, especially for Polkadot (10.2%) and USDT (7.0%).

2. Is 10% APY good for staking crypto?

Yes, any APY above 7% is considered excellent. Rates above 10% are typically tied to longer lock-up periods or newer tokens.

3. What’s better: staking ETH or DOT?

Staking DOT generally offers higher APYs (9–10%) compared to ETH (4.5–6.5%). However, ETH has stronger long-term fundamentals.

4. Can I stake stablecoins like USDT or USDC?

Yes. Many exchanges offer 6%–8% APY on stablecoins, making them a great low-risk option for passive income.

5. What’s the safest way to stake crypto?

Use regulated exchanges, stick to top coins (ETH, DOT, ADA), and split your assets across platforms. Always review APY terms and liquidity policies.

🧾 Final Thoughts

With crypto staking becoming more mainstream in 2025, platforms are racing to offer the best APYs and flexible staking options. Whether you’re staking Ethereum, Polkadot, or stablecoins, choosing the right exchange is crucial for maximizing your yield while minimizing risk.

Compare rates, assess security, and plan your staking strategy carefully.

🔗 Explore Live APY Rates Now

📈 Estimate Your Earnings with Our Staking Calculator

“Which crypto staking platform are you planning to use in 2025 to earn the highest rewards? Share your thoughts in the comments!”

2 Comments